Hi all,

I’ve posted some of these thoughts in Discord over time but thought I’d put them all here for discussion.

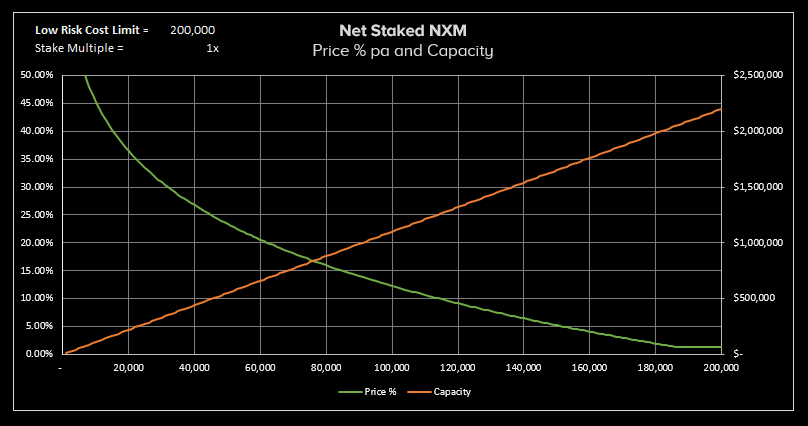

Seems like we are stuck in a bit of a rut now, not a lot of new staking coming in because rewards are low and rewards are low because not a lot of cover is being purchased because cover prices are high until there is more net staked.

I think we’ve introduced a negative feedback loop by putting in numbers that are based on future targets rather than scaling to the current situation. For example 200,000 NXM as a 1.3% PA cover cost is fine as a future target but we shouldn’t impact the highly staked contracts right now.

2 things I think we need to address:

1. Fixed numbers do not scale

Choosing a fixed number for things causes unbalanced impact to either the short-term or the long-term depending on what you are trying to achieve. Once we hit the 200k NXM target for cover to cost 1.3% PA, then what? Should the ceiling be raised once a bunch of contracts hit it? When do we decide that?

Why does an arbitrary figure of 200k NXM staked mean the contract is deemed lower risk by members vs total amount staked relative to other contracts/total capital?

Potential solution: Variable targets.

Instead of 200k NXM net staked being the lowest tier cost for cover and adjusting from there it should be a variable target based on either the capital size or the total NXM staked.

We need to auto-scale based on capital and activity in the mutual, no point doing gov proposals to catch up every 3 months causing potential friction if we don’t have to.

Same goes with the MCR re-balance, although this is temporary so might not matter as much but having the ability to ramp up/down the MCR injection depending on MCR% would allow us to burst that capital into the fund when MCR% skyrockets but also return to a steady state once MCR% is lower.

During the craziness of the pump a 1-4hr MCR made sense, now maybe a 12hr makes sense, maybe next week an 8 hour is best suited

Why not treat it like mining difficulty adjustments conceptually? If MCR % is over 200% then MCR is 4 hourly, if MCR% is 180-200% then 8 hourly, if 130-150 then 24 hourly etc etc

Then each day the timer adjusts based on that days MCR %

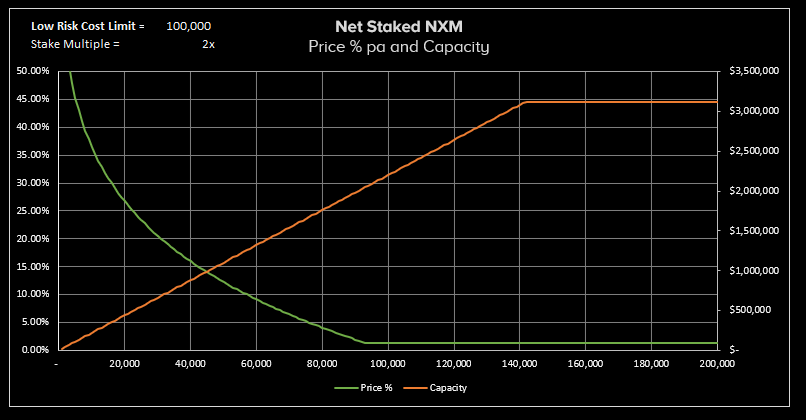

2. Net Staked NXM

This is a good idea in theory but I don’t think works as well in current format especially due to the speculative nature of most investors.

When a person unstakes for whatever reason, could be they want to re-assess in 90 days, could be they want to re-balance the proportion of stake per contract - this then removes the staking capacity which affects the price of cover. While I agree that unstaked amounts should be taken into consideration, I don’t think the entire stake should disappear from the calculation for cover as soon as the unstaking timer counts down.

If a claim comes in during the 90 day unstake period, then the stake can still be burned - so why treat it like it doesn’t exist as soon as the unstaking timer starts.

Potential Solution: Treat the unstaking process just like we used to in terms of gradual release.

If a person unstakes then that staked amount is slowly removed from the calculation against pricing over the 90 day period.

So let’s say 10000 NXM is unstaked, day 1 the net staked amount might be 9998, day 2 9996 etc until day 90 where it’s 0. The impact to the price formula for cover is then spread across the unstake period and realistically represents risk of staking being available in the event of a claims burn.

Thanks for hearing my 2c!