Introduction

Nexus Mutual has been discussing holding DAI to pay potential claims and allocating 30% of the mutual funds to USD based assets as early as October 2020. Then in December 2020, Nexus Mutual mentioned allocating 75%-100% to lower risk yield bearing instruments. Connecting these concepts together, I think Nexus Mutual would benefit greatly from holding a diversified portfolio of productive USD stable coin assets via a single ERC-20 token like the Stable Yield Index.

Stable Yield Index

Stable Yield Index (SYI) is a diversified USD stable coin money market fund optimised for risk adjusted returns. In DeFi the best yielding products can change frequently and keeping up is time consuming. By holding SYI, users gain passive exposure to the best risk adjusted returns on ethereum as capital is periodically redistributed within a portfolio to capture returns for holders

With built-in compounding, all the income generated from the underlying holdings is invested to generate further returns which is reflected in the price of the SYI ERC-20 token. SYI will be the first, widely trade-able money management product in defi that offers holders the benefits of a diversified stable coin portfolio for the price of a single trade. Investors seeking to enter/exit large positions can do so by purchasing/selling the underlying assets and then minting/redeeming the SYI token via the TokenSet website.

By automating stable coin portfolio management, SYI saves investors time needed to manage a defi fund, reduces the gas cost of maintaining/rebalancing multiple positions and compounds returns for holders via a passive buy and hold strategy.

Features

There are many appealing qualities and distinguishing features creating a compelling investment thesis. SYI is the only money product that offers risk adjusted returns, while capturing the upside of future innovation within the Ethereum ecosystem. Some of the key benefits are detailed below:

- Broad diversification

- Risk adjusted returns

- Liquid market for traders (when launched)

- Sustainable methodology independent of market cycles

- Evolves with the innovation of Ethereum ecosystem

- Re-invested interest payments that compound NAV over time

- Can be used as collateral

- Time efficient

- Gas efficient

Expected Returns

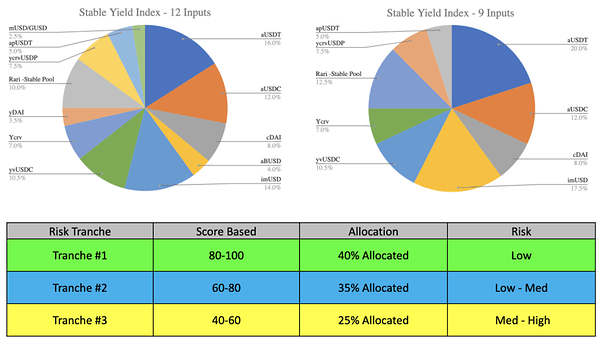

SYI is anticipated to generate 18-20% expected ROI based on current market conditions per annum before any compounding benefits and making any allowance for steaming fees. The image below presents two potential variations of SYI whereby either three or four assets are allocated across each of the three risk tranches. The 4 assets per risk tranche generates 19.65%, whilst the three assets per risk tranche generates 19.87% before compounding and fees. The low variance in the returns reflects the ability to diversify funds, reducing idiosyncratic risk whilst delivery consistent returns. This highlights the robustness of the strategy and ability to manage liquidity within the underlying asset positions over time during periods of rebalancing.

Specification

SYI allocates capital across three distinct risk tranches, with 40% being allocated to the lowest risk category. To determine the risk score of a particular stable coin holding we consider parameters:

- Total Value Locked

- Durations the product has been established

- Any built in risk protection, like DAO backstops

- Complexity eg: Number of protocols interacting creating potential points of failure

- Risk of impermanent loss

- Audits

- Liquidity

The above qualitative assessment is converted into a risk score and then reviewed to adjust the level of return each position is generating in the market to give an overall risk-adjusted-return analysis. From this assets are selected for inclusion in their respective risk tranche and capital is allocated accordingly. There is a tiered diversification within each risk tranche, whereby the lowest risk asset within the tranche receives the largest allocation. This is reflected in the pie charts above with each holding being weighted differently. The net result is to create a product that is weighted towards the least risky asset, in the lowest risk tranche, reducing the overall risk of SYI.

SYI is built on TokenSets V2 and the price of SYI will track the increasing Net Asset Value (NAV) of the underlying components over time and will be supported by an arbitrage bot similar to other Index Coop products.

Author

Index Coop contributor Matthew Graham aka ![]() Fire

Fire ![]() on discord. I lead the Treasury Working Group at Index Coop and am currently engaged in discussions with various DAO treasuries about SYI. There has been strong interest to date and we are progressing SYI towards launch over the coming months.

on discord. I lead the Treasury Working Group at Index Coop and am currently engaged in discussions with various DAO treasuries about SYI. There has been strong interest to date and we are progressing SYI towards launch over the coming months.