[RFC]: Deprecate Custody Cover product

Summary

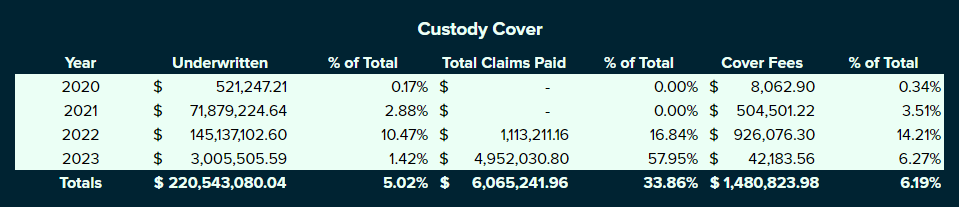

Since Custody Cover first launched in December 2020, Nexus Mutual members have sold $220m in cover, earned $1.48m in cover fees, and paid out over $6m in claims.

Given the lack of transparency and high correlation between custodians, I propose that Nexus Mutual members take action to deprecate (i.e., delist and no longer offer) the Custody Cover product.

Rationale

Below, you can find a high level overview of the historical cover sold, fees earned, and claims paid for Custody Cover products since launch.

Source: Covers Dune Dashboard, Claims Dune Dashboard

Lack of transparency, high degree of correlation

When Custody Cover was first launched, the intent was to primarily cover against custodial hacks, which were the leading contributor to custodial losses at the time this product launched. The halted withdrawals provision was included to cover other edge cases outside of exchange wallet hacks, such as losses that occur outside a custodial exchange (e.g., Nexo, BlockFi) due to DeFi exploits.

In 2021, Custody Cover sales represented 2.88% ($71.8m) of the mutual’s total cover sales for the year. The cover fees earned in 2021 were just over $504k. Adoption remained lower than expected, as the product was designed to:

… protect newcomers and…provid[e] custody cover and protection for those entering the space…to encourage more widespread adoption and support DeFi onboarding.

In 2022, Custody Cover demand saw more than a two-fold increase to $145m in annual sales, which brought in $926k in cover fees. In 2022, the greatest demand was for Yield app ($64m), FTX ($25.4m), and Nexo ($22.1m).

A significant uptick in Custody Cover sales occurred after the Three Arrows collapse, spurred on by the implosion of the Terra ecosystem. These two loss events had a high degree of correlation to various custodians that primarily offered yield products. These loss events were major contributing factors to the subsequent Celsius and Hodlnaut insolvencies (i.e., halted withdrawal events). After Celsius and Hodlnaut announced they were halting withdrawals, it came to light that many custodians had the same counterparties. This high degree of correlation was not anticipated, so the risk presented by the Custody Cover offering was more significant than previously thought. With the pricing limitations in the Nexus Mutual V1 protocol, members were unable to adequately adjust pricing to reflect this increased exposure to risk.

Since then, many other custodians have announced the end of yield product offerings and/or halted withdrawals. To date, the mutual has paid out Custody Cover claims for Hodlnaut, FTX, and BlockFi.

To date, members have paid $6,065,241.96 in Custody Cover claims–33.86% of all claims paid–while cover fees earned only represent 6.19% of total cover fees earned.

Risk vs. reward

Because any given custodian’s off chain liabilities are not known and the proof of reserve audits have come into question, members lack adequate information to assess risk relating to custodial failures.

In the past, we’ve seen the largest cover buys for a custodian when public information suggests insolvency is looming. Given past trends, I do not believe the future rewards are worth the future custodial risks, especially given the heightened regulatory actions taken by various government agencies around the world.

Since Custody Cover launched in late 2020, covering custodial risk has cost more in payouts than cover fees earned. Members lack enough information to adequately price and assess risk for custodians.

I welcome other members’ thoughts on the prospect of deprecating Custody Cover.

For more information, you can read about Custody Cover in the Nexus Mutual documentation.

Specification

If members were to support sunsetting Custody Cover after an NMPIP is posted and a successful on-chain vote, Custody Cover would be deprecated by:

-

Setting the

isDeprecateflag to true on all existing listings under Custody Cover -

Removing Custody Cover references and associated listings from the Nexus Mutual UI