Pool 22 Update | September 2025

It’s been too long since I provided current and prospective Pool 22 NXM stakers with a State of the Pool (SotP) update. I’ll be moving to a bi-annual format for updates, with the next update due in March 2026.

Let’s talk about Pool 22’s performance over the last year.

4 September 2024–2025 Growth

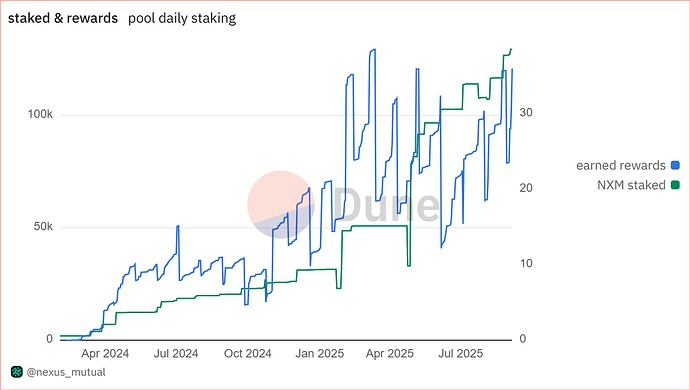

The underwriting pool has grown from 20,545.97 NXM to 129,480 NXM in delegations (+530.20%), which has expanded Pool 22’s underwriting potential significantly. The additional capital has translated to a greater portion of active cover and NXM rewards for Pool 22 stakers.

- Growth in Active Cover: $6,766,369.31 to $46,417,625.26 (+586.00%)

- Growth in NXM Rewards: 9.60 NXM/day to 30.94 NXM/day (+222.14%)

Source: Nexus Mutual Staking Pool Dune Dashboard | Pool 22

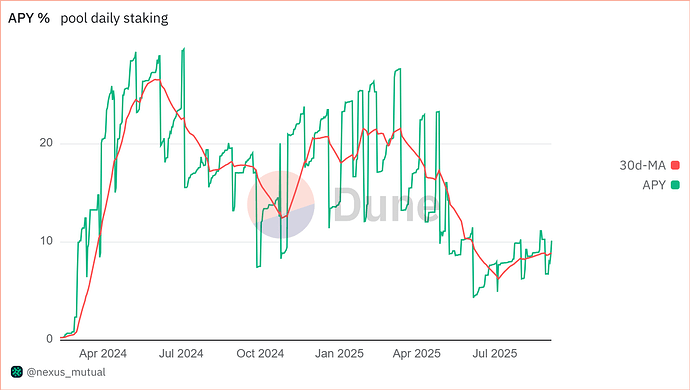

NXM delegations increased significantly from Jan to March 2024 and from April to May 2025. In both periods, NXM delegations nearly doubled before delegations started to gradually increase up to present levels. The large delegations have allowed Pool 22 to expand capacity, underwrite more cover, and generate more NXM rewards for stakers. While the pool’s present and 30-Day MA APY is not as high as it was in September 2024 (17.08%/17.81%), it has maintained a competitive APY as underwriting capital has scaled with the pool’s annualized earnings at 8.67% based on year-to-date performance.

- Present APY: 8.30%

- 30-Day MA APY: 8.82%

Source: Nexus Mutual Staking Pool Dune Dashboard | Pool 22

In the last year, underwriting capital has scaled and premiums have continued to accrue to Pool 22 NXM stakers. In the year ahead, I am committed to increasing growth in sales along with the other Nexus Mutual teams.

Arcadia Claim Payouts (August 2025)

On 15 July 2025, Arcadia Finance was exploited for $3.6M. At the time of the exploit, Nexus Mutual was underwriting $213,153.69 in active Arcadia Protocol Cover for members who suffered a loss of funds. That exposure was split between 50 ETH ($156,654) and 56,450 USDC ($56,450.21). The Arcadia Single Protocol Cover for 50 ETH was underwritten by Pool 22.

After the Arcadia claims were filed, I reviewed the claim submissions along with other claim assessors, verified the loss amounts, and validated the claims. I shared my perspective on the forum along with Hugh.

Assessors voted to approve the Arcadia claims and they were subsequently paid out to the affected members. When affected members redeemed their claims, Nexus Mutual paid out ~$250,000 to Arcadia Protocol Cover holders impacted by the exploit.

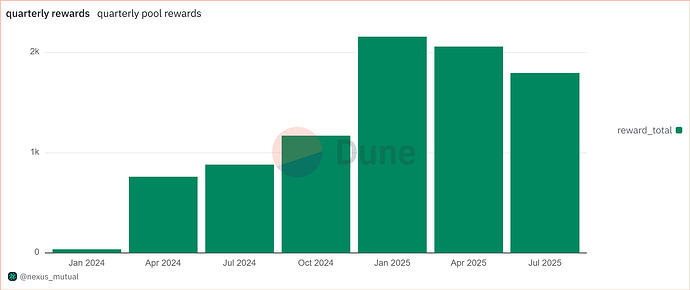

In total, 1% of the NXM in Pool 22 was burned to facilitate the Arcadia claim payment for the 50 ETH cover. This translates into a burn of 1,078.19 NXM, which can be verified on this Dune dashboard. Let’s compare the burn to the NXM rewards earned in 2024 until present day and the total NXM earned since Pool 22 launched.

- 2025 NXM Earnings: 6,005.69 NXM

- 2025 Burn: 1,078.19 NXM

- 2025 Loss Ratio: 17.95%

- 2024 NXM Earnings: 2,852.019 NXM

- 2024 Burn: 0 NXM

- 2024 Loss Ratio: 0%

- Total NXM Earnings: 8,857.71 NXM

- Overall NXM Burn: 1,078.19 NXM

- Overall Loss Ratio: 12.17%

Source: Nexus Mutual Staking Pool Dune Dashboard | Pool 22

Even after paying the 50 ETH Arcadia claim, Pool 22 stakers are still profitable, with a net APY of 7.11% over the last year after adjusting the annualized earnings (8.67% APY) by a 17.95% reduction in yield.

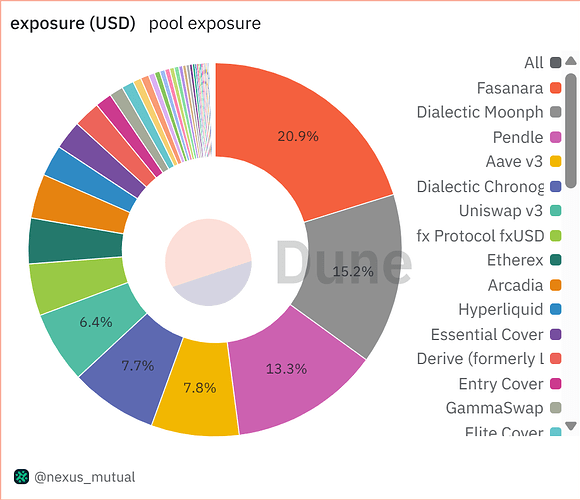

Current Exposure

Source: Nexus Mutual Staking Pool Dune Dashboard | Pool 22

| Listing | Total Exposure (USD) | Exposure (USDC) | Exposure (ETH) | Exposure (cbBTC) |

|---|---|---|---|---|

| Fasanara | 9,685,609.97 | 9,681,817.80 | 0 | 0 |

| Dialectic Moonphase | 7,078,235.55 | 0 | 1,639.74 | 0 |

| Pendle | 6,177,341.84 | 6,174,923.24 | 0 | 0 |

| Aave v3 | 3,616,991.24 | 1,800,493.73 | 266.79 | 5.98 |

| Dialectic Chronograph | 3,587,110.40 | 3,585,705.96 | 0 | 0 |

| Uniswap v3 | 2,960,954.88 | 331,971.46 | 609 | 0 |

| fx Protocol fxUSD Depeg | 2,122,451.36 | 2,121,620.36 | 0 | 0 |

| Etherex | 1,860,776.13 | 1,860,047.59 | 0 | 0 |

| Arcadia | 1,802,160.69 | 1,103,699.40 | 161.71 | 0 |

| Hyperliquid | 1,262,299.70 | 1,261,805.47 | 0 | 0 |

| Essential Cover | 1,168,114.71 | 257,814.85 | 210.86 | 0 |

| Derive (formerly Lyra) | 1,075,393.90 | 0 | 0 | 9.68 |

| Entry Cover | 648,603.85 | 31,936.36 | 142.85 | 0 |

| GammaSwap | 538,764.21 | 120,000.00 | 97 | 0 |

| Elite Cover | 465,986.71 | 275,384.06 | 44.13 | 0 |

| Blue Chip Morpho Vaults | 306,477.95 | 306,357.96 | 0 | 0 |

| vfat | 303,680.07 | 298,814.69 | 1.1 | 0 |

| Instadapp Fluid | 221,253.47 | 221,166.84 | 0 | 0 |

| Treehouse ETH Depeg | 189,933.58 | 0 | 44 | 0 |

| Toros Finance | 172,666.89 | 0 | 40 | 0 |

| Inverse Finance FiRM | 163,063.84 | 163,000.00 | 0 | 0 |

| Inverse DOLA Depeg | 155,060.71 | 155,000.00 | 0 | 0 |

| Frax frxUSD Depeg | 152,059.54 | 152,000.00 | 0 | 0 |

| Velodrome | 126,244.45 | 81,362.36 | 10.39 | 0 |

| Aerodrome | 103,074.91 | 103,034.56 | 0 | 0 |

| Spark Lending v1 | 102,002.97 | 0 | 23.63 | 0 |

| Super OETH Depeg | 83,311.77 | 0 | 19.3 | 0 |

| Revert Finance | 62,024.28 | 62,000.00 | 0 | 0 |

| ExtraFi | 35,013.71 | 35,000.00 | 0 | 0 |

| 40 Acres | 30,011.75 | 30,000.00 | 0 | 0 |

| Ether.fi Liquid Market-Neutral USD Vault | 26,010.18 | 26,000.00 | 0 | 0 |

| Beefy v2 | 24,709.67 | 24,700.00 | 0 | 0 |

| Superform | 21,008.23 | 21,000.00 | 0 | 0 |

| Sky Protocol | 18,130.02 | 0 | 4.2 | 0 |

| Contango | 17,266.69 | 0 | 4 | 0 |

| EigenLayer v1 | 14,690.54 | 0 | 3.4 | 0 |

| Aave Umbrella Slashing Cover | 10,204.00 | 10,200.00 | 0 | 0 |

| Dolomite | 7,903.09 | 7,900.00 | 0 | 0 |

| Safe | 5,591.61 | 5,000.00 | 0 | 0.01 |

| Tokemak | 5,001.96 | 5,000.00 | 0 | 0 |

| PoolTogether | 4,316.67 | 0 | 1 | 0 |

| Ether.fi Liquid ETH Vault | 3,473.47 | 0 | 0.8 | 0 |

| YO | 2,544.06 | 0 | 0.59 | 0 |

| Moonwell | 100.04 | 100 | 0 | 0 |

Over the last year, a majority of Pool 22’s NXM rewards have come from underwriting Fund Portfolio Cover listings and the Mutual’s most popular Protocol Cover listings (e.g., Aave v3, Hyperliquid, Pendle, Derive, etc.). At present, Pool 22’s exposure is largely across Fasanara and the two Dialectic listings, all three of which are diversified by nature since each listing underwrites multiple protocols. The largest exposure by individual protocol largely comes from Pendle, Aave v3, Uniswap v3, Etherex, Arcadia, and Hyperliquid.

If a loss event were to occur on any of the protocols Pool 22 underwrites and claims were paid, 50% of the liability would be paid out from Pool 22 via NXM burns and the other 50% socialised across all NXM holders, so any impact from a claim payout would be 50% of the shown exposure for a given listing. For every 1 NXM staked, 2 NXM of capacity is opened. When cover buyers pay their premium, 100% of the premium flows into the Capital Pool and 50% of the value is minted as NXM and streamed to stakers over the cover’s duration.

Overall, the pool’s underwriting portfolio remains diversified across a variety of protocols. Since Pool 22’s underwriting capital has grown, diversification has improved and staking weights (i.e., the amount of NXM staked against a given listing) on average are in the 3–8% range. Only the most battle-tested and diversified listings have a staking weight above 10%. Those that do earn outsized rewards for Pool 22 NXM stakers.

Every week, I conduct due diligence for new listings, read DeFi governance forums for updates, and review Euler and Morpho markets to understand the risk landscape in onchain markets. When a DeFi protocol is exploited, I analyse the attack onchain, read available analysis and post-mortem reports, and expand my existing DeFi hacks database. Even if a protocol is not listed on Nexus Mutual, I track onchain exploits to understand the current risk trends. All of this informs the model I use to price risk for new and existing listings.

Closing Thoughts

When I first launched Pool 22 in February 2024, I deposited 2,000 NXM of my own funds and began underwriting listings. My goal was simple: I wanted every pricing and product decision I made as Head of Product & Risk to be backed by my own capital. Launching Pool 22 was the best decision I’ve made since I first joined Nexus Mutual in 2021.

It changed the way I view risk and how I approach our core product (the Nexus Mutual protocol and frontend) and our cover product offerings (i.e., Fund Portfolio Cover, Protocol Cover, Nexus Mutual Cover, etc.). I’ve been able to use all of the data I’ve collected over the years on DeFi hacks to create a pricing model I use for Pool 22 and allows the Mutual to provide industry-leading rates for the coverage we offer.

A big thank you to any member who has delegated their NXM to Pool 22. Together, we are protecting DeFi users (from funds to everyday users) and enjoying an above-average APY on NXM, an ETH-backed asset. Even with the Arcadia claim payouts, the claim-adjusted APY (7.11%) over the last year is among the highest ETH-based yields available, especially when NXM book value growth is taken into account (+3.35% from 4 September 2024–2025).

Over the next year, I’ll work alongside my colleagues to drive cover sales, further expand our product offerings, attract additional underwriting capital, and add more functionality to the core Nexus Mutual protocol. There are quite a few existing proposals that will go up for vote soon, all of which I’ll be supporting. If any NXM stakers who delegate to my pool have thoughts about the current NMPIPs that will go up for vote in the next week, please reach out to me on the forum.

I’ll post another update in March 2026. Until then, you can keep track of Pool 22’s performance using the following resources: