Claim 24 | Cover ID 1369 | Goldfinch Protocol Cover

- Claim Request: 36,692.87 USDC

- Total Cover Amount: 42,000.19 USDC

- Cover Period: 9 October 2024 until 7 January 2025

- Reported Date of Loss in Claim Submission: Unclear but forum post provided in Incident Details is dated July 2023

- Assessment Period: 2 February 2025 until 5 February 2025

Overview

On 2 February 2025, a claim was filed for the Goldfinch listing under the Protocol Cover product type.

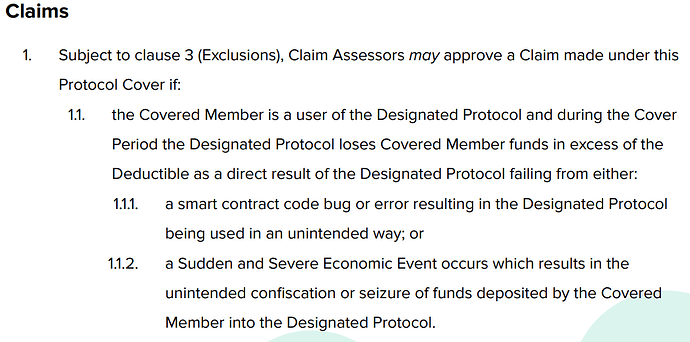

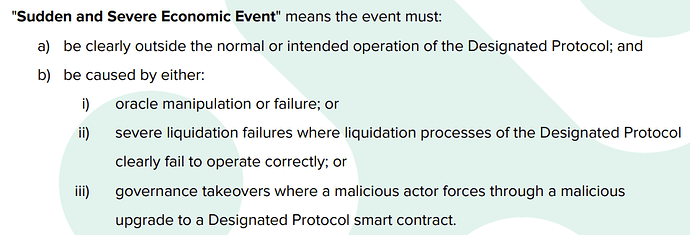

In the incident details for this claim, the claimant shared the incident details and cited Clause 1.1.2 (“a Sudden and Severe Economic Event”) but did not specify which of the three covered provisions under Clause 1.1.2 was the cause of the loss other than to state that it was not due to oracle manipulation.

Excerpt taken from the Protocol Cover wording document. See the complete Protocol Cover wording for the full terms and conditions.

Excerpt taken from the Protocol Cover wording document. See the complete Protocol Cover wording for the full terms and conditions.

Incident Details

The following details were provided in the claim submission, which can be reviewed in the Nexus Mutual UI: Nexus Mutual.

Total loss:

36692.87$

Deposit links are provided to nexus mutual via email. Total deposit was 50000$

Update on the Tugende Kenya Facility - Goldfinch Governance Forum

One of the Sr. Pool loans is currently in default. This may impact the returns of your investment. Please see this governance post for more details. In addition, currently, monthly interest payments and principal repayments are less than the current withdrawal demand. As such, the Goldfinch Senior Pool cannot accommodate all withdrawal requests.

Incident Tugende: Tugende | Goldfinch

Cover Wording: https://api.nexusmutual.io/ipfs/QmdunFJm4A5CUW1ynM7bevsGt6UzQfw6K4ysKqvsqpjWCQ

1.1.2. a Sudden and Severe Economic Event occurs which results in the unintended confiscation or seizure of funds deposited by the Covered Member into the Designated Protocol. In addition, currently, monthly interest payments and principal repayments are less than the current withdrawal demand. As such, the Goldfinch Senior Pool cannot accommodate all withdrawal requests. (pool site) senior pool: Goldfinch

Tugende –> (Tugende | Goldfinch)

Confirmed from cover wording: 1.3. the Impacted Account has suffered a Material Loss; and 1 1.4. the Covered Member submits a Claim within the following timeframes: 1.4.1. at least 14 days after the loss event listed in clause 1.1; and 1.4.2. during the Cover Period or within 35 days of the Cover Period ending

Confirmed from cover wording: 1.4.1. at least 14 days after the loss event listed in clause 1.1

Confirmed from cover wording: No rug pull 3.7.

Confirmed from cover wording: No oracle manipulation. 3.5. any events or losses resulting from movements in the market price of assets used in, or relied upon, by the Designated Protocol except for any losses caused by asset price movements where the price movement meets the denition of oracle manipulation under clause 1.1.2 (Sudden and Severe Economic Event). https://www.coingecko.com/de/munze/fidu (from approx 1 $ to 0.3$)

Assessment

Members who stake NXM and act as claim assessors can discuss the claim submission in this thread. The claimant and other members can also participate in this discussion.

Learn more about Claim Assessment in the Nexus Mutual documentation.

4 Likes

The event he’s linking to is from 2023. The loan matured in 2023 as well.

He also smudged out all of the dates on all of the transactions so we can’t confirm anything.

He also did not buy coverage until 10/9/2024 6:11 AM. He’ll have to provide more details to prove his deposit, and when the loan went from being restructured to a lower payout to no payout at all for him.

By the way, I can’t provide links or images. Would it be possible to have that turned on for my account?

6 Likes

I’ve updated your trust level, so you should be able to include images and links now.

Thanks for your review, @Zarathustra

I’ll share my personal review on Monday, as well.

3 Likes

After reviewing the claim submission, I wanted to provide my personal assessment of this claim request.

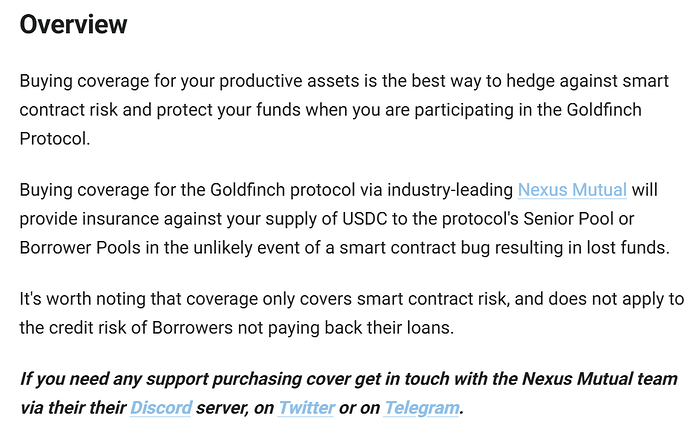

The loss is question is related to a loan default on Goldfinch Finance, not due to any smart contract hacks or any of the other covered events outlined in the Protocol Cover wording.

The Goldfinch Finance docs also highlighted that Goldfinch Protocol Cover did not protect against creditor default.

Ultimately, the above is the reason why I have determined this is not a valid claim.

The other contributing factors:

- The reported loss occurred before the cover was purchased

- Onchain proof of loss was not provided

- The screenshots provided of the deposit transactions had the dates blurred out, so assessors could not confirm the deposits dates. However, the transaction links were sent in an email provided to the Nexus Mutual team. Failing to provide all claim assessors with the same information impedes assessors’ ability to validate a claim submission.

4 Likes

He resubmitted with some more details. I checked with the Goldfinch team, and the senior pool is not in default currently. Some borrowers are in default and some others are in the process of renegotiating the length of their loans. Currently, users can still withdraw. Maybe, out in the future this pool defaults on us, and we have to cover it. But, nothing has happened yet that we need to cover for him. Currently, the APR is just lower than initially expected. Besides, he bought the policy after the Tugende Kenya Facility defaulted.

He’s going to have to buy another policy to cover the default if it happens. We might want to rotate stakes off of Goldfinch in case this gets worse.

6 Likes

Based on my reading of the cover wording, defaults wouldn’t be covered. That has nothing to do with the protocol. That’s credit risk and the Goldfinch team has even highlighted in their docs that credit risk is not covered. I included a screenshot of this statement in their docs above.

Protocol Cover does not protect against credit risk for uncollateralized loans. It protects against:

- A smart contract hack

- Oracle failure/manipulation

- Severe liquidation failure, which wouldn’t apply as there is no collateral to liquidate; and

- Governance takeovers

There is no additional capacity available for Goldfinch in any event, as the only pool manager staking against it has unstaked.

You are correct, though. Users can still withdraw up to the amount of available liquidity. Utilized capital for loans cannot be withdrawn. The particular loan in question is in default, as the borrower hasn’t paid it back, but the overall senior pool is fine from a smart contract perspective and there is still liquidity available for withdrawals as loans are paid back.

4 Likes

Claim 25 is another submission, but it is the same Cover ID as Claim 24. The claim details are the same for both Claim 24 and 25, yes.

4 Likes