First Quarter (Q1) 2024 Insights | Nexus Mutual DAO

The DAO Community team presents Nexus Mutual DAO’s Q1 2024 Insights report, where we share data and analyses from the Nexus Mutual DAO Dune dashboards and highlight exciting developments from the last quarter.

Overview

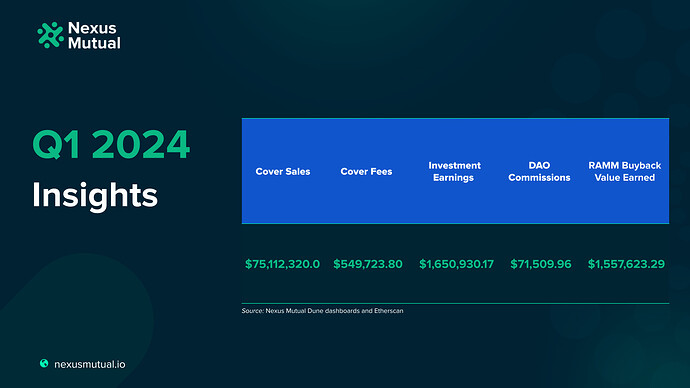

In the first quarter of 2024, the Mutual sold more than $75.1m in cover, an increase of ~29% from Q4 2023.

Q1 2024 Cover Sales & Investment Earnings Breakdown

Cover Sales

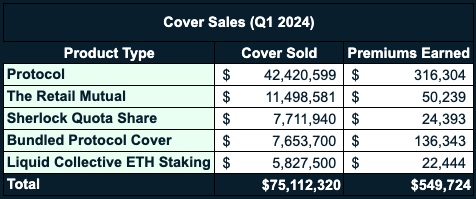

In Q1 2024, we saw steady growth in quarter-over-quarter cover sales, with a ~29% increase in sales. Nexus Mutual members purchased over $75.11m of coverage. The Mutual earned more than $549.7k in cover fees in Q1, a 162% increase from Q4 2023.

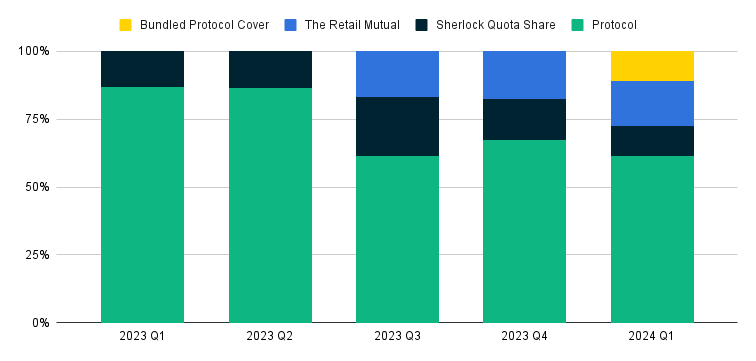

Quarterly distribution of product sales as a percentage of total cover sales throughout 2023 and 2024.

We observed continued diversification across the Mutual’s product offerings in Q1 2024, including the introduction of a new product and revenue source: the Bundled Protocol Cover.

-

Growth in Protocol Cover Sales: As DeFi yield climbed in Q1 2024, we saw an uptick in demand for Protocol Cover. Through Protocol Cover sales, members earned a total of ~ $317k in cover fees in Q1 2024 (57.54% of total cover fees earned in Q1).

-

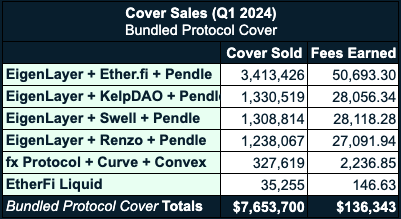

Successful Launch of Bundled Protocol Cover: After Bundled Protocol Cover launched in March, members purchased a total of over $7.6m worth of cover in Q1, which generated more than $136k in cover fees in the last two weeks of Q1. Learn more about Bundled Protocol Cover later in this report.

-

OpenCover Sells the Mutual’s Cover on L2s: OpenCover, a distribution platform built on top of Nexus Mutual, continues to increase access to Protocol Cover on L2s such as Base, Arbitrum and Optimism. Through OpenCover, DeFi users can purchase Protocol Cover on L2s without joining the Mutual or going through KYC. In Q1 2024, $2,994,371 worth of cover was sold through OpenCover.

-

Continued Partnership with Liquid Collective: First launched in 2022, the Mutual’s Slashing Coverage Program with Liquid Collective has protected institutional stakers against slashing risks. Through the partnership, the Mutual sold more than $5.8m worth of cover in the first quarter of 2024.

-

Underwriting Real-World Risk with The Retail Mutual: In July 2023, we began our partnership with The Retail Mutual. Since then, they have purchased cover on a monthly basis. In Q1 2024, The Retail Mutual has purchased over $3.9m worth of cover.

Investment Earnings

In Q1 2024, the Mutual’s productive Capital Pool holdings generated $1,650,930 in investment earnings. Currently, Nexus Mutual’s Capital Pool holds over 55k of staked ETH, which makes up ~60% of the Mutual’s holdings. Based on the blended staking yields across the Lido, RocketPool, and Kiln staked ETH holdings, the Mutual is earning 3.30% APR on staked ETH in the pool.

When the projected annual earnings are taken over the total Capital Pool value in ETH, the Mutual is earning 1.98% APR on the total 91,758 ETH held in the pool from investment earnings alone. To learn more about the Mutual’s investment strategy, read the Investment Committee’s Investment Philosophy and review the Investments section in the documentation.

DAO Commissions

As an incentive for others to distribute Nexus Mutual cover through third-party interfaces, teams that run a distribution service through a dedicated frontend or integrate cover buys in their user interface can earn a commission for the cover they sell.

In Q4, the DAO earned $71,509.96 worth of commissions. The DAO saw an increase of 254% in commission earnings compared with the previous quarter.

Bundled Protocol Cover

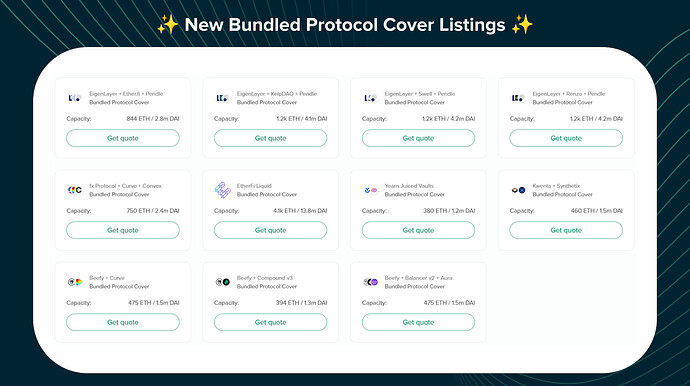

As the liquid restaking strategies grew in popularity, many members expressed interest in buying bundled covers that offered protection against smart contract risk across multiple protocols with just one (1) Cover NFT. The Product & Risk team responded, developed Bundled Protocol Cover, and launched the new product in mid-March. Bundled Protocol Cover has proven quite popular since launch and more listings will be added to the Nexus Mutual UI in Q2.

Currently, there are 11 Bundled Protocol Cover products listed on Nexus Mutual:

- EigenLayer + Ether.fi + Pendle

- EigenLayer + KelpDAO + Pendle

- EigenLayer + Swell + Pendle

- EigenLayer + Renzo + Pendle

- fx Protocol + Curve + Convex

- EtherFi Liquid

- Yearn Juiced Vaults

- Kwenta + Synthetix

- Beefy + Curve

- Beefy + Compound v3

- Beefy + Balancer v2 + Aura

Since Bundle Protocol Cover’s launch, we have seen more than $7.6m worth of cover buys, which have generated $136k in cover fees:

![]() If there’s a Bundled Protocol Cover listing you’d like to see added, reach out to us on Discord with your request for our Product & Risk Team to evaluate.

If there’s a Bundled Protocol Cover listing you’d like to see added, reach out to us on Discord with your request for our Product & Risk Team to evaluate.

Q1 Claims Update and Reimbursement News

No claims were filed and no payouts were made in Q1 2024.

Under the guidelines of NMPIP-205, the Foundation’s Legal team has been working to secure reimbursements for claims where members received reimbursement after their claim was paid. The Legal team is working with claimants who hold a bankruptcy claim for Hodlnaut, FTX, BlockFi, and Gemini to transfer their bankruptcy claim to the Mutual for an amount that matches their previous claim payment. The Legal team has also been working with the final few Euler Finance claimants who received reimbursement after their claim was paid to return their excess payment to the Mutual.

To date, these efforts have resulted in a recovery of $1.68m for Mutual members. For more information, see the update on the forum.

Focus on Growth

The Nexus Mutual Foundation and DAO teams are focused on growth, as outlined in our Q1 & Q2 2024 roadmap. To further these goals, our teams are working hard to secure more partnerships, launch new products, add new features, and to refine both the user interface and the overall member experience.

Since last quarter, the Mutual’s cover sales have grown by ~30% and cover fees have increased by 162%. The launch of Bundled Protocol Cover along with key listings like Pendle and Spark Protocol have contributed to the growth in cover sales. The Foundation and DAO teams are committed to driving growth in cover sales, not only through our existing products but also through those soon to be launched and others still in development.

Stay tuned for new product launches and to discover more opportunities to contribute to our ecosystem!

What’s Up Next

Nexus Mutual started 2024 with an impressive increase in cover sales. In Q2, we’ll launch some new cover products, focus on existing and new partnerships, and work to grow the Nexus Mutual ecosystem.

In the second quarter of the year, the DAO teams will be looking to onboard additional contributors. Currently, there’s an open role for a Social Media Marketing Manager within the DAO Community team. Keep an eye on announcements for other ways you can get involved within the DAO!

We’re also enhancing the Cover Buy interface to offer a more user-friendly cover buying experience, enabling members to request more capacity directly within the UI and receive notifications as their cover approaches expiration.

Let’s Stay Connected

![]() If you want to learn more about how to contribute within the Nexus Mutual DAO, reach out to us on Discord and the DAO Community team can find the best way to onboard you to our community.

If you want to learn more about how to contribute within the Nexus Mutual DAO, reach out to us on Discord and the DAO Community team can find the best way to onboard you to our community.

![]() Our community is most active on Discord and here on the governance forum.

Our community is most active on Discord and here on the governance forum.

We look forward to hearing more from you!

![]() If you’re building in DeFi, get in touch with us through our website.

If you’re building in DeFi, get in touch with us through our website.

![]() To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls and Covering DeFi interviews on X spaces.

To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls and Covering DeFi interviews on X spaces.