The DAO Community team presents Nexus Mutual DAO’s Q4 2023 Insights report, where we share data and analyses from the Nexus Mutual DAO Dune dashboards and highlight exciting developments from the last quarter.

Overview

In the final quarter of 2023, the Mutual sold more than $58.3m in cover, further solidifying its position as DeFi’s leading risk marketplace.

Q4 2023 Cover Sales & Investment Earnings Breakdown

Cover Sales

In Q4 2023, we saw steady quarter-over-quarter cover sales, which showed a ~12% sales growth. Nexus Mutual members purchased over $58.3m of coverage. The Mutual earned more than $209.9k in cover fees in Q4, which is on par with cover sales in Q3.

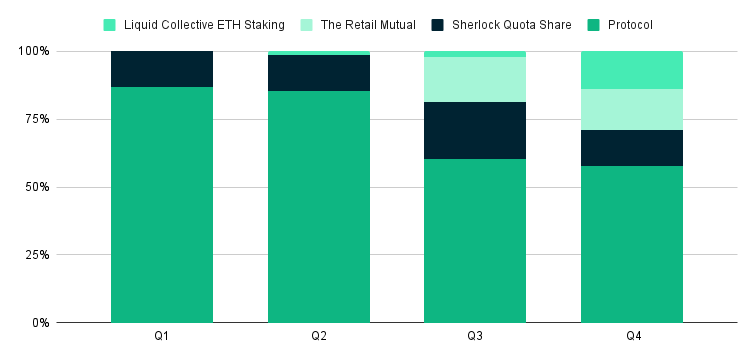

Quarterly distribution of product sales as a percentage of total cover sales throughout 2023.

We continued to see continued risk diversification across the Mutual’s product offerings in Q4 2023.

- Protocol Cover’s Evolving Role: In Q4, Protocol Cover accounted for 48% of the total cover fees. This shift further diversifies our risk exposure and reduces our reliance on Protocol Cover sales as we broaden product offerings.

- Consistent Growth with Sherlock: Sherlock has grown as a leader within our ecosystem since we first partnered in 2022. Their consistent cover buys and existing distribution channel has contributed to our cover sales throughout 2023. They’re the perfect example of an underwriter with top tier risk expertise that already has a distribution network who can benefit from added underwriting capital and capacity. Sherlock’s auditing services combined with the Mutual’s deep Capital Pool has been a recipe for success.

- Liquid Collective’s Impact: In Q4, Liquid Collective’s TVL increased by an incredible 96.5%! Since 2022, we’ve worked with Liquid Collective to provide LsETH holders with native ETH Slashing Cover through the Liquid Collective Slashing Coverage Program. Protection against slashing events is crucial for the institutions staking their ETH with Liquid Collective, and our coverage has scaled with their growth in TVL. We continue to partner and protect with industry-leaders like Liquid Collective against ETH slashing events.

- Expansion into Real-World Risk with The Retail Mutual: Through Unity Cover’s partnership with The Retail Mutual, our members are able to underwrite real-world risks. This partnership has been instrumental in bridging on-chain underwriting capital into traditional risk markets. While many DeFi protocols are looking to tokenise RWAs on chain, we’re working to underwrite coverage in the real world with crypto-native capital. As we share later in this report, our partnership with Cover Re in 2024 will allow members to underwrite a broader array of real-world risks and create massive potential for growth in cover sales and cover fees.

Investment Earnings

Capital Pool investments earned members 487 ETH ($1,248,534) in Q4 2023. These earnings were bolstered by the Q3 investment in RocketPool ETH (rETH) and ETH staking through Kiln. Currently, Nexus Mutual’s Capital Pool holds 54,603.64 staked ETH, which continues to generate yield for members. The staked ETH holdings diversify our exposure to any one liquid staking provider and allows the Mutual to mitigate the potential impact of a slashing event.

Of note: Nearly 55% of the Capital Pool is generating yield through staked ETH investment allocations. To learn more about the Mutual’s investment strategy, read the Investment Committee’s Investment Philosophy and review the Investments section in the documentation.

DAO Commissions

As an incentive for other teams to distribute Nexus Mutual coverage, third-party teams can earn a commission when they offer Nexus Mutual coverage to users through a dedicated frontend. This functionality was made possible when Nexus Mutual V2 launched. Since March 2023, the commissions from cover purchased through the official Nexus Mutual UI has generated over $116k for the DAO Treasury. In Q4, the DAO earned $20,208.34 through commissions on cover buys.

Tokenomics Retrospective

In November, members celebrated a significant milestone after NMPIP-209 was approved. NMPIP-209 ratified the tokenomics upgrade, which replaced the Bonding Curve with the Ratcheting AMM (RAMM) and removed the Minimum Capital Requirement Floor (MCR Floor). The vote was overwhelmingly approved by members, with voting power exceeding 1.18m NXM cast in favor of NMPIP-209.

The success of this project is a testament to effective community-driven decision-making within our community.

Value-Add for Members

As BraveNewDeFi highlights in this recap from a Community Call in December, the Tokenomics project has four main goals:

To give a status update for each of these goals, we can make the following remarks:

1. The price of NXM and the open market price have been brought together again ![]()

This data is tracked at the RAMM Dune Dashboards created by the DAO R&D team in real-time.

2. More than 2.2m NXM have been redeemed by members ![]()

We have provided a summary and breakdown of the redeemers in the latest issue of The Hedge.

3. Growth remains Nexus Mutual teams’ top priority ![]()

Growth remains our top priority in 2024, as elaborated in the Q1 & Q2 Roadmap for 2024.

4. NXM holders gained more than $5.4m in value from the RAMM ![]()

![]()

We expect more value accrual, as our community enters the next era of decentralised risk sharing.

Notes and Resources

If you want to learn more about the Tokenomics project and the RAMM, take a look at the resources below. In case you have any further questions, don’t hesitate to reach out to us and our community by simply replying to this post or on the Nexus Mutual Discord.

- Nexus Mutual Blog

Members Vote to Upgrade Nexus Mutual Protocol’s Token Model

Members Vote to Upgrade Nexus Mutual Protocol’s Token Model - Nexus Mutual UI

NXM

NXM - Nexus Mutual Governance Forum

All Tokenomics discussions

All Tokenomics discussions - Nexus Mutual Governance

Nexus Mutual Protocol Improvement Proposal (NMPIP) 209

Nexus Mutual Protocol Improvement Proposal (NMPIP) 209 - RAMM Whitepaper

The Ratcheting AMM (“RAMM”) for Nexus Mutual by Reinis Melbardis, Anatol Prisacaru, Miljan Milidrag

The Ratcheting AMM (“RAMM”) for Nexus Mutual by Reinis Melbardis, Anatol Prisacaru, Miljan Milidrag - Nexus Mutual Documentation

Token Model

Token Model - Nexus Mutual Dune Dashboards

Nexus Mutual Ratcheting AMM

Nexus Mutual Ratcheting AMM - Richard Chen (Community Contributor)

NXM Dashboard on Dune

NXM Dashboard on Dune

Underwriting Risk in Traditional Markets

Nexus Mutual was established to provide protection for underserved communities often overlooked by traditional insurance markets. Utilizing blockchain technology, Nexus Mutual offers a solution designed for the collective good.

In 2023, we reached a significant milestone when Mutual members began underwriting real-world risks through Unity Cover’s partnership with The Retail Mutual, a UK-based discretionary mutual representing over 5,000 independent business owners.

In November 2023, Hugh, representing Unity Cover, proposed a partnership with Cover Re, a Cayman Islands-based reinsurance company. Cover Re reinsures various business lines, including aviation, business owners, commercial multi-peril, personal and commercial auto, professional liability, and workers’ compensation. In December, members overwhelmingly voted to approve the Cover Re deal.

Cover Re is positioned to significantly grow its premium volume, yet this is contingent on securing additional capital. Conversely, Nexus Mutual has ready-to-deploy underwriting capital and is looking to expand cover sales. These strategic objectives aligned and formed the foundation of the Cover Re deal. Further details on this proposal and its logistics can be reviewed through Hugh’s presentation on one of our recent community calls.

In 2024, Nexus Mutual teams and members will continue to expand the Mutual’s product offerings as growth remains our top priority.

Staking Rewards Breakdown

In Q4 2023, NXM stakers earned nearly 2,000 NXM in staking rewards. This figure is consistent with the amount of staking rewards members earned in Q3. NXM stakers allocate capital that is used to create open capacity, which allows other members to purchase cover and protect themselves against risk.

In the distribution of NXM staking rewards, 48% originated from staking pools underwriting Protocol Cover. Meanwhile, NXM stakers in Staking Pool 5 (Unity Cover) earned 20% of the rewards through The Retail Mutual Cover buys. Additionally, the Liquid Collective cover buys contributed 17% of NXM rewards to stakers in Staking Pool 5.

Learn more about NXM staking and Staking Pool Managers in the Nexus Mutual documentation.

Q4 Claims Review

In Q4 2023, Nexus Mutual members approved two (2) FTX claims for a total of $294,758.99. To date, Nexus Mutual members have paid more than $18 million in claims to people who were impacted by various loss events.

Following the guidelines of NMPIP-205, the Foundation Legal team is working to secure reimbursements for any claims that were paid where those same members received reimbursement in addition to their claim payment. This is in the context of the bankruptcy proceedings involving Hodlnaut, FTX, BlockFi and Gemini, as well as the reimbursement provided by the Euler Finance team post-claims settlement. In Q4, these efforts led to a recovery of $270k. This is in addition to the $2m of reimbursement secured directly after the Euler Finance team reimbursed users in Q2 2023. The majority of the Euler claimants returned their claim payment to the Capital Pool.

To learn more about the Mutual’s claim history, you can review the Claims History section in the documentation and the Claims Dune dashboard.

A Complete Picture of 2023

In 2023, the Mutual paid out more than $8.8m in claims to people affected by various crypto custodian halted withdrawals, including FTX, BlockFi, and Gemini. Members also paid out claims to those affected by the Euler Finance hack. In cases where claimants received a payout from the Mutual and reimbursement from either a custodian or protocol, the Mutual has pursued reimbursement. To date, nearly $2.3m has been recovered and we’re expecting further recoveries from FTX, BlockFi, and Gemini claimants.

While the cover fees earned were less than previous years due to low yields across DeFi in 2023, we continued to earn yield on Capital Pool investments, which were increased with the RocketPool and Kiln allocations in August 2023. The Ratcheting AMM (RAMM) launch also earned members ~$5.4m in 2023 through the RAMM’s price discovery mechanism. Even with the large claim payouts, the Mutual saw net Capital Pool earnings of $4,137,651.24 in 2023. The DAO Treasury earned $103,201.84 from commissions on cover buys through the official Nexus Mutual UI.

Even in 2023’s bear market, the Mutual remained profitable, increased Capital Pool investments, and expanded into new markets. We’re excited for the progress we’ll make in 2024!

What’s Up Next

Nexus Mutual concluded 2023 with significant developments that set the stage for ongoing growth. This included the introduction of the Tokenomics update and the establishment of a partnership with Cover Re to underwrite a broader range of real-world risks. Throughout this period, members consistently processed claims and managed risk by staking NXM in various staking pools.

As we enter the new year, our focus will be on revamping the DAO website to provide additional resources for members interested in engaging with Nexus Mutual Governance and in managing Staking Pools. Moreover, in response to the evolving DeFi landscape, we are excited to announce the expansion of our protocol listings. Last but certainly not least, Nexus Mutual will be enhancing its collaboration with OpenCover to facilitate efficient cover distribution via Layer-2 solutions.

Let’s Stay Connected

![]() If you want to learn more about how you can be an active contributor within the Nexus Mutual DAO, simply reply to this thread and the DAO Community team can find the best way to onboard you to our community.

If you want to learn more about how you can be an active contributor within the Nexus Mutual DAO, simply reply to this thread and the DAO Community team can find the best way to onboard you to our community.

![]() Our community is most active on Discord and on the governance forum. We look forward to seeing you there!

Our community is most active on Discord and on the governance forum. We look forward to seeing you there!

![]() If you’re building in DeFi, get in touch with us through our website.

If you’re building in DeFi, get in touch with us through our website.

![]() To get regular updates from us, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X!

To get regular updates from us, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X!