Introduction

The Ease team has been contributing within the Nexus Mutual ecosystem since 2021, and they manage Staking Pool 3 and Staking Pool 4.

The Ease team completed this questionnaire, which members can review to learn more about the Ease team, their staking pools, how they manage their pools, and how they’re building on top of the Nexus Mutual V2 protocol.

Can you introduce yourself for members who may not be familiar with Ease?

Ease has been in DeFi since early 2021. Founded under the name Armor by blockchain security expert, Robert Forster and a digital money veteran from the Digicash days, Harry Kikstra. We have always strived to be innovators in the DeFi coverage and security sectors. We started with the first pay-as-you-go cover system, arCore, that streamlined the UX for Nexus Mutual coverage. Then, further innovating with arShields, that wrapped tokens directly with Nexus Mutual coverage. We have since expanded into a 0-premium risk-sharing cover model, Ease Uninsurance. With a focus on blue-chip DeFi protocols, and a set-and-forget model, users have paid 0% in its 14 months since launch.

With this extensive coverage and security expertise, we transfer much of these views and know-how into our Nexus Mutual V2 pool management. We had already been actively managing NXM stakers through our arNXM system since early Nexus Mutual V1 days. Our arNXM system has made us the largest single staker of NXM for underwriting cover.

Can you describe the strategy for your staking pools in one or two sentences?

With v2, Ease created a Risk Rubric that we use to divide all sufficiently scoring protocols into AAA or AA risk pools. We look at a variety of metrics, including time-weighted TVL, the scope of audits, use of oracles and many more. The full rubric can be found here.

How frequently do you review and reassess the pricing and capacity parameters for the cover products you underwrite?

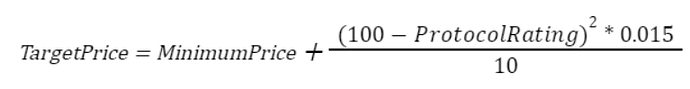

Pricing follows a formula that is dependent on the risk rating of the product.

Capacity is determined by product demand, which we measure through cover buys. Ratings and capacity are revisited every month, or as needed, in the case of an adverse event. Any notable updates are posted to our blog.

As a pool manager, what is your approach to adding new products to your pools, whether it’s a completely new cover product or a new listing for an existing product?

We update our risk ratings monthly. So if a score changes for a protocol that bumps them above the required thresholds, they will be added into our staking pools and users will be notified via our blog and other socials. The same can be said for the opposite. If an event occurs that lowers a score below the threshold, a product can be removed from the pool.

Regarding new products, Time-weighted TVL carries a large weight in our rubric. So, if the new cover product is also a new protocol to DeFi, it’s unlikely that it will be covered by us immediately. This is to mitigate risk for our stakers, and ensure that only the most “battle-tested” protocols receive our AAA rating. Our goal is to focus on protocols that are not likely to be hacked. Maximizing reward, while minimizing risk to our stakers.

Do you have any plans to develop an application or distribution network that utilizes your staking pools?

We already do! For users that do not wish to deal with a staking NFT or lockup periods for their NXM, we have our arNXM system that handles that for the user. With over 100,000 NXM in our staking NFTs, we are currently the largest single provider of underwriting capital in v2. The documentation here provides information on tranche distribution, total leverage used, NXM allocated per staking pool, and more.

How and with what frequency will you provide updates to the NXM stakers that delegate to your pools?

We do monthly updates to our protocol ratings! Noticeable changes will be posted via our blog.

How can prospective and/or current NXM stakers communicate with you?

You can use our Discord, forums, Telegram to reach out to our team. Or you can reach out to me directly on Discord, (Christachio#9533) or Telegram, (@Christachio). I am the lead for our Nexus Mutual staking pools and Ease Risk Rubric.

Any other thoughts that you’d like to share?

DeFi is a community centered experience, and Ease values that. If anyone has more questions or comments on our rubric or staking systems, do not hesitate to reach out via our forum or socials!