The Investment Committee team presents its August 2025 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

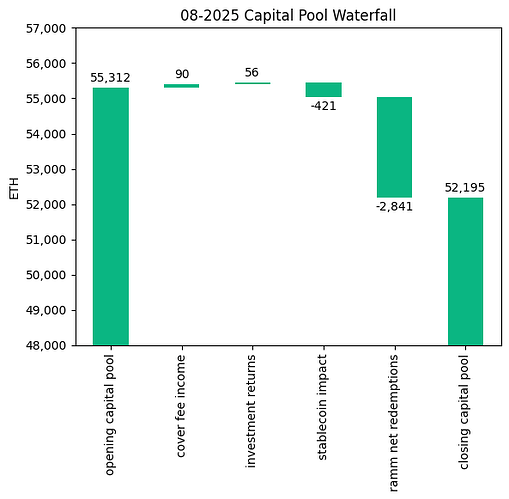

Monthly Change - ETH value

The Capital Pool decreased by 5.63% in ETH terms this month, dropping from 55.3k to 52.2k ETH. Withdrawals through the RAMM, totaling 2.8k redemptions, remained the primary factor. The 19% increase in ETH price over the last month created a negative FX impact on our stablecoin holdings. However, Cover Fees and Investment holdings made positive contributions to the pool’s value.

The various impacts on the capital pool are summarised in the waterfall chart below.

The cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

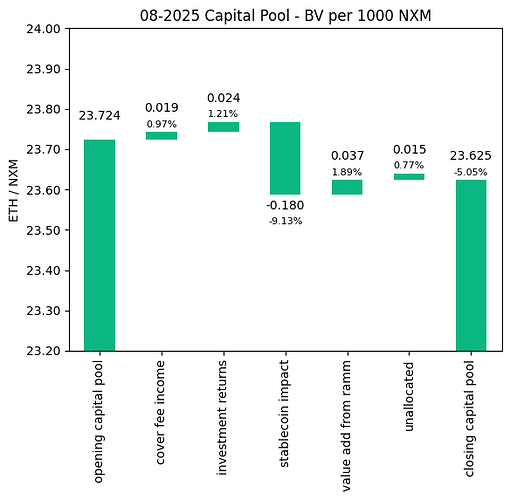

Monthly Change in NXM Book Value

The Capital Pool’s ETH/NXM value decreased from 0.02372 to 0.02363, a 5.05% annualised decline for the month. This reduction primarily stemmed from the negative FX impact on stablecoin holdings, though value added through RAMM, Cover Fees, and Investment returns partially offset this decline.

The various impacts on the capital pool are summarised in the waterfall chart below.

→ Members can track protocol’s revenue on the Financials Dune Dashboard.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

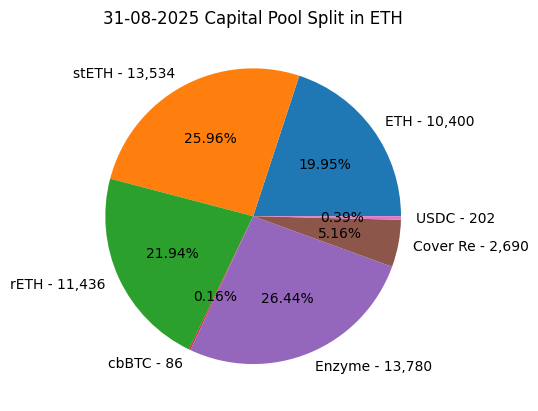

End of Month Pool Split

The split of the Capital Pool at the end of August ‘25 in ETH terms is as follows.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

rETH Divestment

On August 16th, the Advisory Board swapped 1077 rETH to 1227 ETH as per the Divestment Framework.

Stakewise/Chorus One

In early July, the Investment Committee were made aware by the Avantgarde team that there were proposed contract updates related to our position in Stakewise V3/Chorus One. Out of an abundance of caution, the position was placed into the withdrawal queue on July 17th and the withdrawal back to the Enzyme vault of 5,165.8 WETH was completed on August 4.

Aave USDC Loan

On August 26th, the Advisory Board took two key actions regarding the Aave loan: first repaying 339.9k USDC, which reduced the outstanding debt from 2.0m to 1.7m USDC, then fully closing the position by using 371.3 ETH of collateral to repay the remaining debt (as per NMPIP 245). This allowed 4,167.7 ETH to be transferred back to the Capital Pool, completely closing the Mutual’s Aave position.

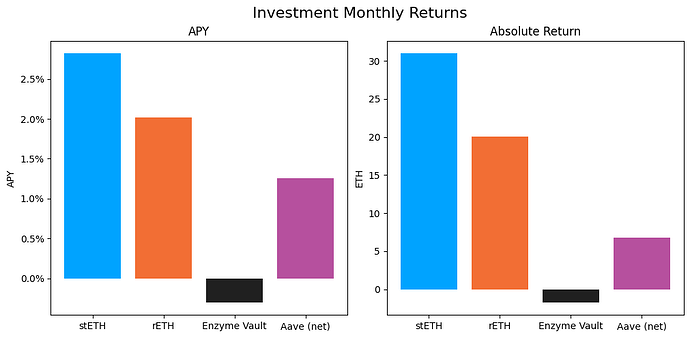

State of the Investments

In the last month, the Mutual earned 56.1 ETH on its investments, overall, as broken down below.

stETH Monthly Return: 30.976

stETH Monthly APY: 2.82%

rETH Monthly Return: 20.048

rETH Monthly APY: 2.021%

Enzyme Vault Monthly Return: -1.751

Enzyme Vault Monthly APY: -0.303%

Enzyme Vault includes EtherFi investments

aEthWETH Return: 6.837

aEthWETH APY: 1.263%

debtUSDC Return: -0.05

debtUSDC APY: 0.113%

Aave Net Return: 6.787

Aave Net APY: 1.254%

Total ETH Earned: 56.06

Total Monthly APY: 1.259%

Based on average Capital Pool amount over the monthly period

All returns after fees

Active staking investments yielded between -0.3% and 2.8% APY, showing healthy ETH staking returns despite market conditions. The negative returns in the Enzyme vault were a result of slight volatility in the eETH/ETH price. The Aave USDC debt position, using ETH as collateral, produced a net APY of 1.25%. Overall, based on the average Capital Pool value for the month, investments returned 1.3% APY.

Investment Committee Priorities

- Forthcoming proposal on how to reallocate the idle WETH in the Enzyme vault.