The Investment Committee team presents its November 2024 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

Monthly Change

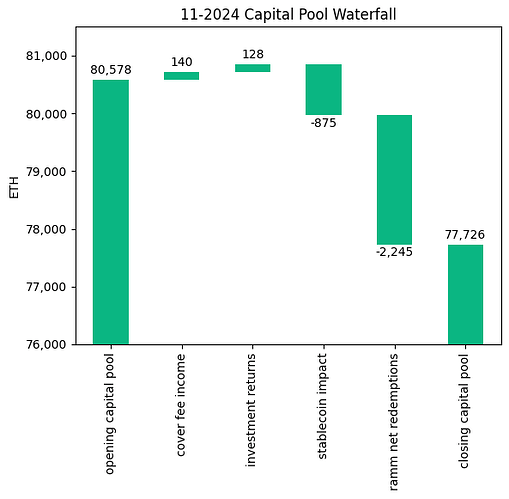

The Capital Pool has reduced by 3.54% in ETH terms this month. The largest impact was again from withdrawals via the RAMM within 2.2k total redemptions. There has been a substantial negative FX impact as a result of the stablecoin holdings due to the increase in ETH price, as well as very good results from Cover Fees and Investment holdings.

The various impacts on the capital pool are summarised in the waterfall chart below.

The cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

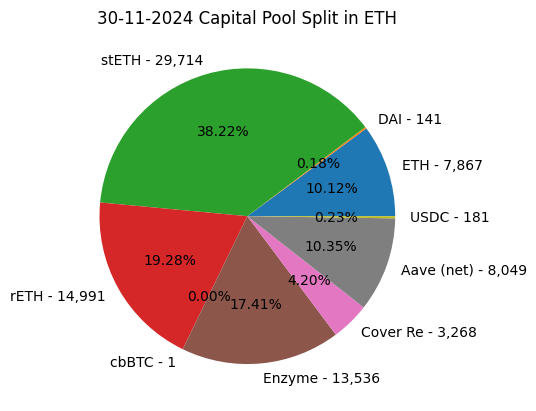

End of Month Pool Split

The split of the Capital Pool at the end of November ‘24 in ETH terms is as follows.

The largest largest portion of cover buys in November were again denominated in USDC. We have also seen first cover bought denominated in cbBTC.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

Aave USDC Loan

On November 7th, the Advisory Board repaid 236.7k USDC from the Aave loan, bringing the outstanding debt balance at the time down from 5.31m to 5.07m USDC

State of the Investments

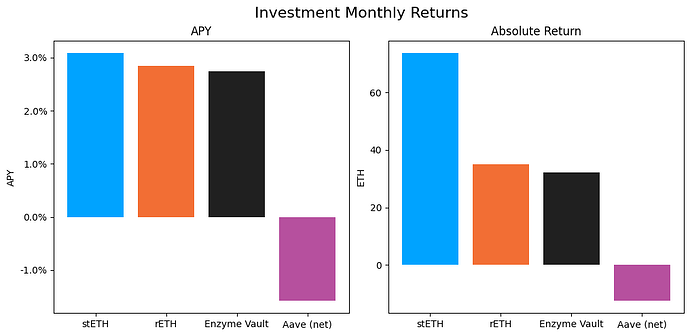

In the last month, the Mutual earned 128.4 ETH on its investments, overall, as broken down below.

stETH Monthly Return: 73.703

stETH Monthly APY: 3.085%

rETH Monthly Return: 35.006

rETH Monthly APY: 2.845%

Enzyme Vault Monthly Return: 32.133

Enzyme Vault Monthly APY: 2.748%

Enzyme Vault includes Kiln, EtherFi and Chorus One/Stakewise V3 investments

aEthWETH Return: 15.208

aEthWETH APY: 1.954%

debtUSDC Return: -27.697

debtUSDC APY: 17.561%

Aave Net Return: -12.489

Aave Net APY: -1.579%

Total ETH Earned: 128.352

Total Monthly APY: 1.963%

Based on average Capital Pool amount over the monthly period

All returns after fees

The active staking investments yielded between 2.7% and 3.1% APY, reflecting the lower but healthy ETH staking yields…

The Aave USDC debt position, collateralised by ETH, produced a net APY of -1.58%.

The Capital Pool overall earned 1.96% APY based on the average Capital Pool value over the course of the month.

Investment Committee Priorities

- We are working with Enzyme and Chainlink to incorporate the unclaimed Kiln rewards into the NXMTY oracle; this update is still pending, as per the last update.