The Investment Hub team presents its March 2024 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

Monthly Change

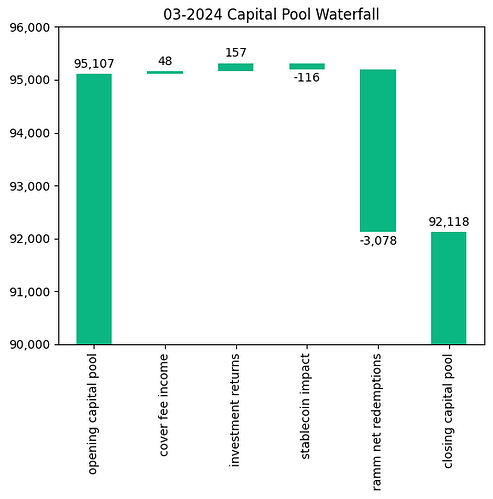

The Capital Pool has reduced by 3.1% in ETH terms this month, largely as a result of withdrawals via the RAMM.

The various impacts on the capital pool are summarised in the waterfall chart below.

Note that the cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

End of Month Pool Split

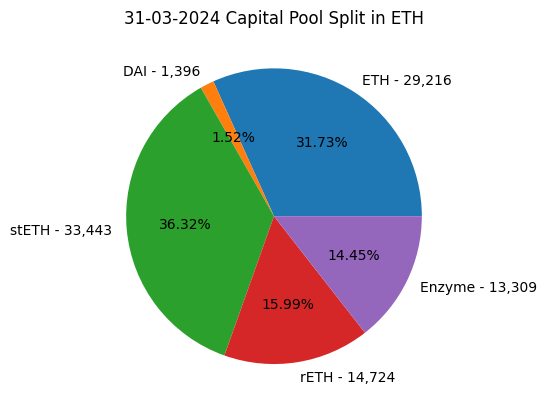

The split of the Capital Pool at the end of March ‘24 in ETH terms is as follows.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

→ Note the difference of ~30 ETH between the sum of the pie chart above and the closing value in the waterfall chart above is mostly explained by the Dune Dashboard source not currently capturing the Kiln rewards, with the remainder a result of exchange rate timing differences.

State of the Investments

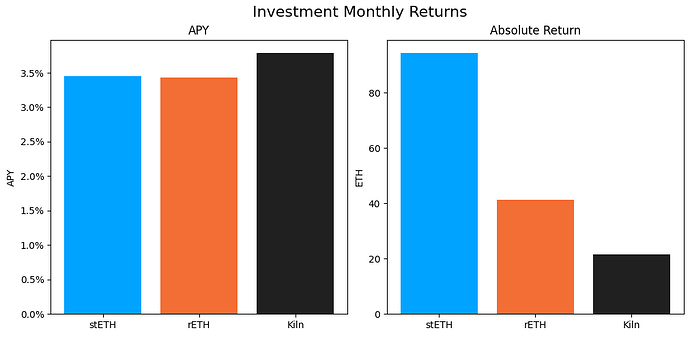

In the last month, the Mutual earned 157.2 ETH on its investments, overall, as broken down below.

stETH Monthly APY: 3.448%

stETH Monthly Return: 94.35

rETH Monthly APY: 3.429%

rETH Monthly Return: 41.311

Enzyme Monthly APY: 1.816%; Kiln Portion Monthly APY: 3.786%

Kiln Monthly Return: 21.571

Total ETH Earned: 157.231

All returns after fees

The active investments yielded between 3.4% and 3.8% APY. The capital pool overall earned 2.0% APY based on the average Capital Pool value over the course of the month.

Investment Committee Priorities

-

We are in discussions with Enzyme to update the terms of our arrangement and exploring opportunities for the idle portion of ETH in the vault. Expecting to provide an update imminently.

-

Creating a plan for divesting out of investment assets over the course of the year as more ETH is required for the RAMM redemptions and the upcoming Cover Re investment.

-

Working on visibility in the community - starting with this newsletter.

-

DAO Treasury - speaking to a variety of potential service providers.