Since Mutant Marketing launched on 2 August 2021, we have worked relentlessly to create value for members. I created the foundation and infrastructure for the Nexus Community Ambassador and Nexus Embassy Programmes; worked with Ambassadors to launch our first three Nexus Embassies; started the weekly Mutant Meetup call, which I record, edit, and upload; organise, schedule, and moderate the Risk in DeFi Twitter Spaces events; write, post, and schedule the majority of the mutual’s communications across social media; engage with users on Discord, Telegram, and Twitter, while moderating the former two communities; and worked to foster strong relationships with listed DeFi protocols.

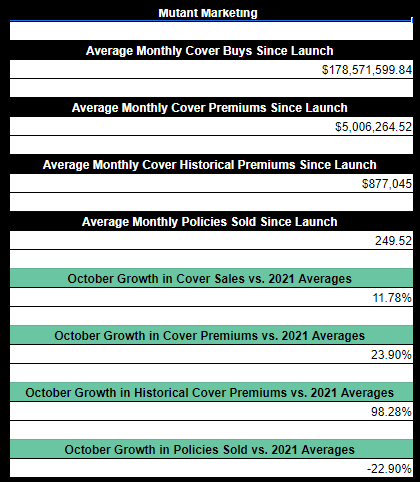

Since Mutant Marketing launched in August, the mutual has sold $535,714,799.51 and earned $15,018,793.56 in premiums.

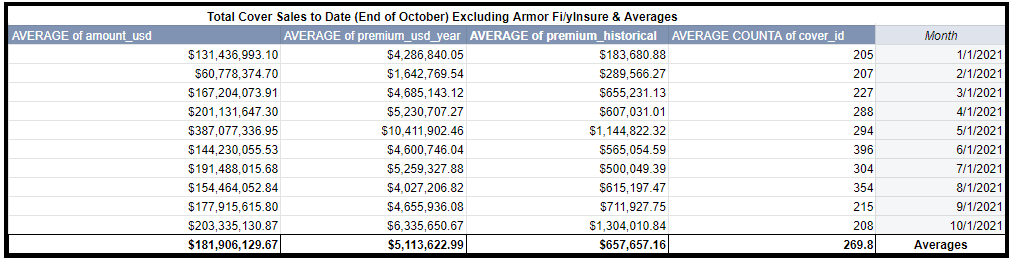

To date in 2021, Nexus Mutual sold $1,819,061,296.68 in cover policies and earned $51,136,229.93 in premiums when adjusted for the price of ETH.

By comparing October 2021 premiums, we can see a growth of 23.90% in premiums earned versus 2021 averages.

In the first quarter of Mutant Marketing operations, the mutual has sold 943 cover policies in total; 777 policies when Armor Fi and yInsure policies are excluded, and of those policies, 81 were seven-figure or greater cover sales.

There are currently 7,977 members in the mutual, which is an 8.57% increase in membership from our baseline data.

Members can review the in-depth first quarter report here; it is also linked at the end of this forum post as well. Below is an abbreviated review of Mutant Marketing’s first three months of operation.

In the Mutant Marketing Charter, we outlined our mission, objectives, and key results. Mutant Marketing’s scope is defined as:

Mutant Marketing’s sole responsibility is to convert NXM allocated for marketing initiatives into growth in cover sales and membership rates.

Every NXM token allocated to Mutant Marketing should result in a meaningful return on investment over time.

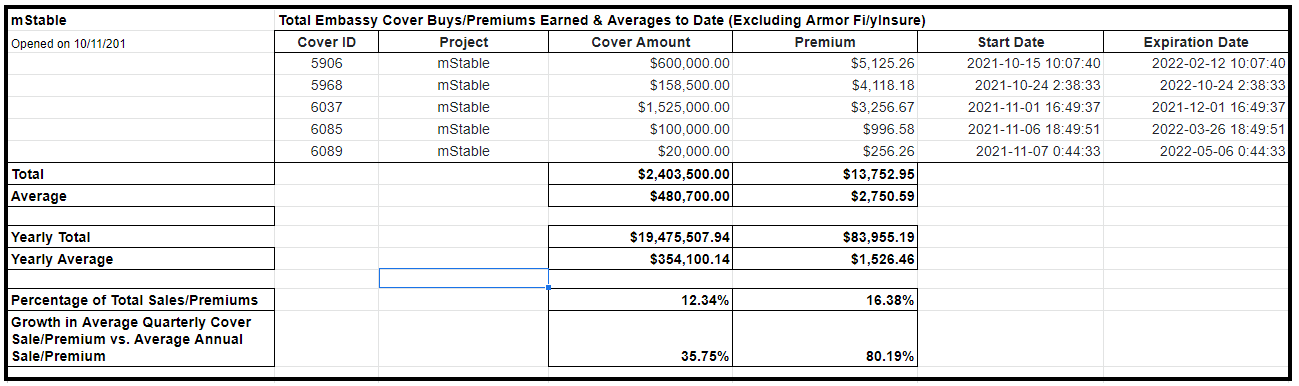

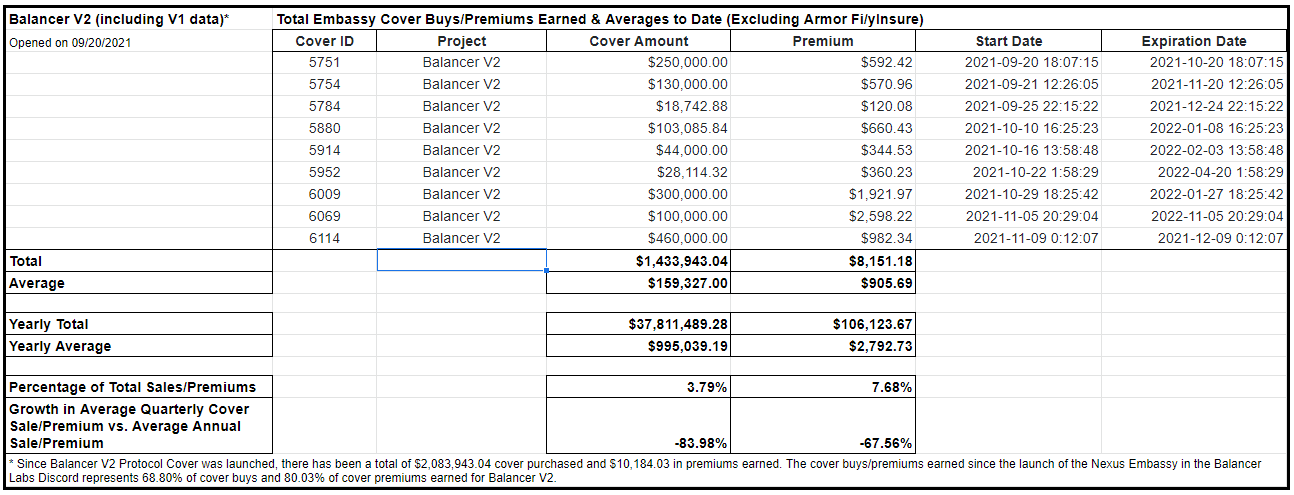

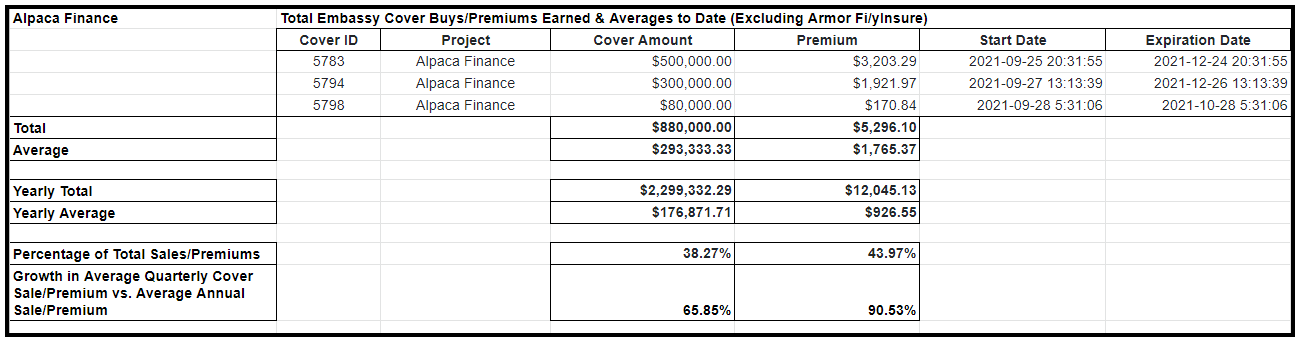

Our Nexus Embassy Programme has delivered significant value to the mutual in fewer than eight weeks of operation. In total, the mutual has sold $4,717,443.04 in cover policies and earned $27,200.23 in premiums since the Nexus Embassies were established.

We are working to deliver on our promise to convert each NXM spent into growth in both sales and membership.

In the next quarter, we will look for Nexus Mutants to help fill roles within our hub, namely:

- Nexus Community Ambassadors (2-3)

- Copywriters (1-2)

- Community Support (2)

Below, I’ll review our objective and key results, as outlined in our Marketing Strategy.

Overview of Objective and Key Results

Nexus Mutants can find the baseline data in the Mutant Marketing Charter and the objective/key results in the Marketing Strategy shared with members before the launch of our hub.

The Objectives and Key Results (OKR) methodology is the leading goal management approach in the world. It is used by companies like Google, Uber, Apple, Dropbox, and thousands of others to help teams align and stay focused on what matters most to the organization. By design, teams and individuals are encouraged to set very aggressive, “stretch” goals for each time period. The idea behind this is that it forces people to think in a much more innovative way to deliver outsized results. As such, many people consider a 70% attainment rate of a goal within an OKR framework to be satisfactory. Anything above that is considered to be a strong performance.

When we built the Marketing strategy, we deployed the OKR framework and, as such, put in exceedingly aggressive goals, knowing there would be a very high chance that we would not reach 100%. We believed the trade-off in terms of relentless focus on the results that we felt would matter most to the community would be a worthwhile trade-off. We believe it was.

Objective: Nexus is the blue-chip cover provider

Key Results

KR #1: Increase the number of annual Cover Policies Sold from 4,107 (YTD) to 9,000. [4,893 annual cover policies / 1,224 policies per quarter]

KR #2: Activate 10 influential DeFi thinkers/builders who are members, have influence, and provide further credibility to the protocol.

KR #3: Grow the number of seven figure cover buys from 350 within a six-month period (350 between Dec 21, 2020, to May 21, 2021) to an additional 440 cover buys within a six-month period, or a growth of 125% from existing levels.

Status of Key Results

Key Result #1

Our stated goal is to reach 4,893 cover sales within one year’s time. If we break that out into quarterly goals, then we need to achieve 1,224 cover sales per quarter.

To measure our success here, we can use the baseline data from the Charter, which is 5,099 cover policies sold. As of 2 November 2021, the mutual sold 6,042 cover policies. Given that, we have sold 943 cover policies and reached 77.04% of our goal.

If we review the cover policies sold by Nexus Mutual, excluding Armor Fi policies, the mutual has sold 777 policies from the beginning of August until the end of October. Given that, we have reached 63.48% of our stated goal.

The Nexus Embassy Programme was central to our KR #1 strategy, and this will be covered in more detail in the Proof of Work section of the report.

Key Result #2

After careful review, we determined that the Get Out of Your Shell Campaign wasn’t the best use of our time and resources. Instead, we have shifted our focus to overhauling the Nexus Mutual website and using budget funding to launch limited advertising campaigns in cryptonative markets. This will be covered in more detail in the Focus for Next Quarter section of the report.

Key Result #3

Within the first quarter, 81 seven-figure cover policies were sold. With this key result, we set the bar high with 790 total seven-figure cover policies within six months time. To date, we have achieved 20.51% of our quarterly goal. We expect to see an improvement in these numbers when we begin the DAO Coverage Campaign.

The DAO Coverage Campaign will be one of the main features of the next quarter. The CREAM V1 exploit has created a greater sense of urgency for DAOs to re-evaluate the security of their treasury assets. Many DAOs are built on top of other money Legos like CREAM V1, and several communities have reached out with questions about coverage for underlying money Legos. This is covered in more detail in the Focus for Next Quarter section of the report linked below.

Focus for Next Quarter

KR #3: DAO Coverage Campaign

More protocols have taken steps to own their own liquidity, diversify their treasury, or increase non-operating revenues. Within DeFi, there are numerous DAO treasuries sitting idle during a period of expansion and growth. Offering KYC-free point-of-sale coverage integrations or covering a portion of TVL can also give existing DeFi protocols a competitive advantage.

Mutant Marketing will work in conjunction with the business development team to talk with DeFi DAOs about the protections that Nexus Mutual offers, the underwriting capacity the mutual can deliver, and the benefits of putting treasury assets to work. Protocols can build reserves to fund future growth and innovation.

Expanding Nexus Embassy Programme

We are looking to add another 2-3 Ambassadors and open the same number of Nexus Embassies. If you are interested in being a Nexus Community Ambassador, please read this section in the Nexus Mutual documentation and fill out this application form.

Overhaul of Nexus Mutual Website

The current website is in need of an update, and Mutant Marketing will work with the team to overhaul the site, update the copy and optimise for SEO, and refresh the look/feel of the site. We will also add a blog component to the site where we can post updates, share information with our community, and announce partnerships. Hosting these updates on a native blog will also help drive more traffic to the site.

DAO-2-DAO (D2D) Communication, Coordination

While the development team focuses on Nexus V2, Mutant Marketing will work to strengthen relationships with protocol communities throughout DeFi. While members of the mutual could pitch to DAOs on the benefits of Nexus coverage, we first begin by starting a conversation with other communities to determine their needs, how they see coverage benefiting their community, and determine how the mutual can be of service to other DAOs.

Conclusion

When Mutant Marketing was launched, we set out to deliver the greatest amount of value for the community by growing membership and demand for cover. In the first month, I spent a large share of my time building out the framework for asynchronous training and the infrastructure for the Nexus Embassy Programme. In the second month, I focussed on recruiting and training Ambassadors; I then worked with Ambassadors to launch each Nexus Embassy. October was the first month where the Nexus Embassies were fully operational.

Community engagement and support is paramount when marketing within DeFi, and I’ve spent a considerable amount of time moderating the Nexus Mutual socials, as well as responding to individual users. Since the hub launched, I started the weekly community call and began a speaker series for the mutual. This week’s Mutant Meetup call had more than 30 attendees, which is a sizable increase since we held our first call.

Twitter Spaces events have been well attended with more than 120 attendees on the first Twitter Spaces event we held in partnership with GridPlus. These events help establish the mutual as a thought leader on risk in DeFi; through these events, we can educate users and develop greater interest in the mutual.

As we begin the next quarter, our mission and objective remains unchanged. We will continue to deliver value to the Nexus Mutual community, grow our membership, and create demand for cover. Through our DAO Coverage Campaign, we hope to protect protocol treasuries to allow more DeFi treasuries to safely earn and grow their reserves.

Mutant Marketing is a small organisation, and we hope to grow in the next quarter and beyond. If you want to cover a greater portion of DeFi and work for Nexus Mutual, reach out to us in the Nexus Discord. In the next quarter, we will look for Nexus Mutants to help fill roles within our Hub, namely:

- Nexus Community Ambassadors (2-3)

- Copywriters (1-2)

- Community Support (2)

Mutant Marketing thanks the community for their support. Here’s to another quarter of growth in premiums, cover sales, and membership.