Official News

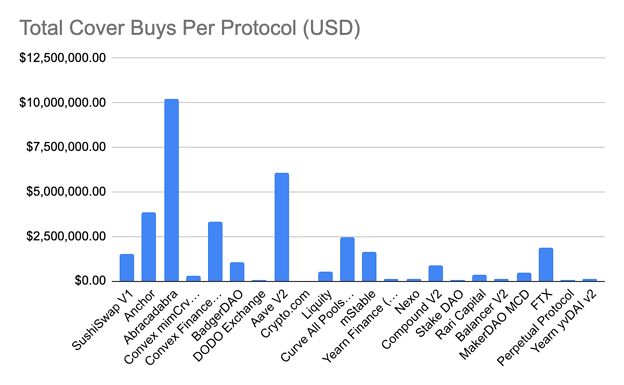

Cover Buys: Week in Review (1 Nov to 8 Nov)

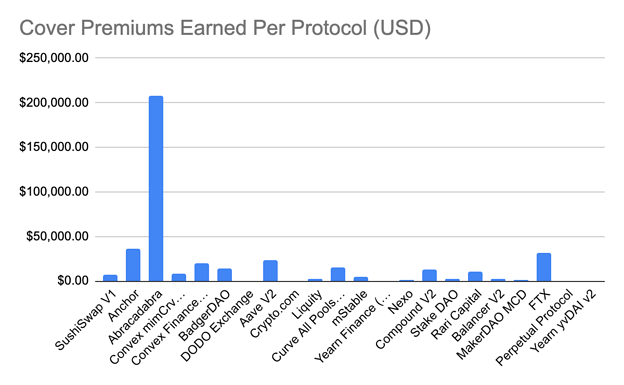

Premiums Earned: Week in Review (1 Nov to 8 Nov)

Total Cover Sold: $35,174,063

Total Premiums Earned: $403,988

IMPORTANT: Operation TM12

Members have created a proposal that the mutual should purchase wNXM from the open market because it’s selling below book value.

This is the most important proposal we have had in many months, please take the time to read this, absorb it and ask questions in Discord.

We will be voting on this proposal shortly, once it goes to governance.

https://forum.nexusmutual.io/t/proposal-operation-tm12/716/26

Weekly Mutant Meetup

Missed our call? Boo! Don’t forget, we have our weekly meetup call at 10am, every Tuesday in Discord. Lucky for you, we have a recording:

https://www.loom.com/share/f6e202760a274c78a8338867a5c20c23

BarnBridge Proposal

A member from the BarnBridge community made two proposals. The first is that we take part in a DPI/ETH Smart Alpha pool. The second is that we create a wNXM/NXM Smart Alpha pool.

These are interesting proposals that you can read more about here: [RFC]: How the Community Fund can use BarnBridge's SMART Alpha to hedge risk

Shield Mining

We have four new shield mining campaigns:

-

Abracadabra (https://abracadabra.money/) is incentivizing stakers through their new shield mining campaign. 1,466,275 $SPELL will be awarded to Nexus Risk Assessors at a rate of 6.8 SPELL/NXM staked on a weekly basis.

-

Premia Finance (https://premia.finance/) is a decentralized options market based on a pool-to-peer architecture, similar to Uniswap or SushiSwap, but for options. 15,000 $PREMIA will be awarded to Nexus Risk Assessors at a rate of 0.05 PREMIA/NXM staked on a weekly basis.

-

Convex Finance (https://www.convexfinance.com/) allows Curve.fi liquidity providers to earn trading fees and claim boosted CRV without locking CRV themselves. Liquidity providers can receive boosted CRV and liquidity mining rewards with minimal effort. $CVX will be awarded to Nexus Risk Assessors at a rate of 0.008 CVX/NXM staked per pool on a weekly basis.

-

Popsicle Finance (https://popsicle.finance/) is a multichain yield optimization platform for Liquidity Providers. Users can turn on Popsicle’s auto-pilot, relax, and boost their yield. 810 $ICE will be awarded to Nexus Risk Assessors at a rate of 0.007 ICE/NXM staked on a weekly basis.