Official News

Cover Buys: Week in Review (9/27 to 10/3)

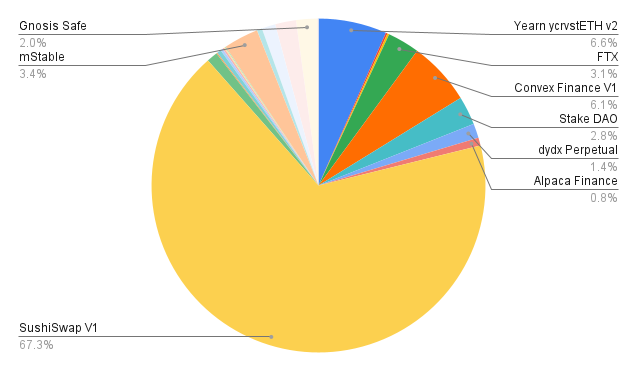

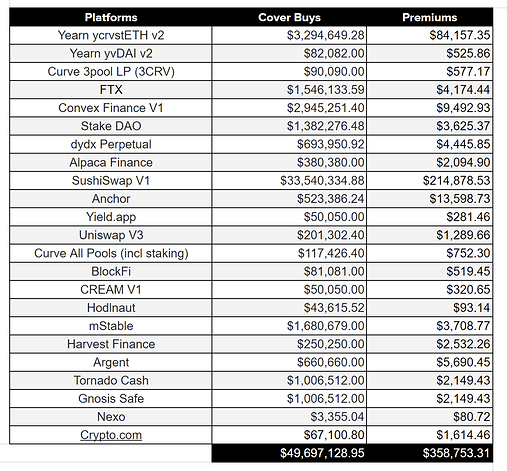

In the last week, the mutual sold $49,814,555 in cover policies and earned $358,753 in premiums. Versus last week, we sold 36.48% more in coverage and increased the weekly premiums received by 74.76% ![]()

And if you didn’t see the Cover Buy of the Week, one whale covered more than $27M in a single cover buy: https://twitter.com/NexusMutualBot/status/1443306486621425674

The mutual sold a 9,715.0 ETH Protocol Cover policy for SushiSwap V1, and $175,124 flowed into the Capital Pool with $87,562 going to Risk Assessors staked against SushiSwap V1.

It pays to be a Risk Assessor ![]()

Looking for protocols, custodians, and/or Yield Token Cover products to assess for risk?

The mutual could use more staking on the following platforms/products:

Protocols

Custodians

Yield Token Cover

Before you stake NXM against any platform/product, review the Risks and Risk Assessment sections of the docs if this is your first time staking. Feel free to use the Risk Assessment Resources section when you evaluate these platforms/products.

New Shield Mining Campaign

Goldfinch Finance (https://goldfinch.finance/) is incentivizing stakers through their new shield mining campaign. Goldfinch is a decentralized credit protocol that allows anyone to be a lender, not just banks.

USDC will be awarded to Nexus Risk Assessors at a rate of 0.25 USDC/NXM staked on a weekly basis.

https://twitter.com/NexusMutual/status/1445020095034626052

See our Discord announcement: https://discordapp.com/channels/496296560624140298/758245879189602315/894577223368073276

Website: https://goldfinch.finance/

Whitepaper: https://goldfinch.finance/goldfinch_whitepaper.pdf

Bug Bounty Program: https://immunefi.com/bounty/goldfinch/

Nexus Governance Proposal Passed

Proposal 157: Increase the capital pool allocation to stETH was passed and on 5 October the mutual increased our allocation of stETH to 30,000.

https://twitter.com/HughKarp/status/1445331234482278406

On this week’s Mutant Meetup, Hugh shared that the mutual is earning ~4 stETH per day. A big thank you to the Investment Hub for their work to make more assets in the Capital Pool productive!

Twitter Spaces: Wallet Security

This morning we hosted our first Twitter Spaces event. This is the beginning of our Risk in DeFi Series, which will include covered and non-covered risks. The mutual is committed to protecting users in DeFi, and through our Twitters Spaces Risk in DeFi Series, we can reach more users in an effort to educate DeFi users about various risks.

Hugh talked with the GridPlus+ team about the risks of self-custody and how hardware wallets can protect users.

https://twitter.com/NexusMutual/status/1445423017769717775

DPI Index

The Index Coop team have posted a proposal on the forum about investing some of the Capital Pool in DPI. The communities broad response was that DPI is a fantastic opportunity, but not the perfect fit given the current outperformance of ETH.

Be sure to read and comment on the Index Coop DPI Proposal.

Community Ambassadors

In the last two weeks, Mutant Marketing has worked with Crypt0non and Fungus to launch the first two Nexus Embassies.

Fungus is the Ambassador for the Balancer community, and in the last week, there has been a lot of activity within the Balancer community when Fungus has held Office Hours.

Fungus holds Office Hours in the Balancer Discord within the ![]() Support channel on:

Support channel on:

-

Tuesdays from 1am to 1pm EST

-

Wednesdays 2pm to 4pm EST

-

Thursdays 1am to 1pm EST

Crypt0non is the Ambassador for the Alpaca Finance community, and in the last week, Crypt0non has been highlighting risks within the Binance Smart Chain ecosystem.

Crypt0non holds Office Hours in the Alpaca Finance Discord within the ![]() Ask Anything channel on:

Ask Anything channel on:

-

Mondays from 5pm to 8pm PST

-

Thursdays from 5pm to 8pm PST

Read more about our Nexus Embassy Programme in the docs.

Using wNXM to Save on Premiums

@BraveDeFi wrote a guide on how to use the wNXM discount to your advantage when you buy cover. Members can buy wNXM at a discount, unwrap to NXM, and pay for premiums with NXM to secure more affordable cover premiums.

Save 50%+ on Nexus Mutual Cover Premiums: How to use wNXM to Your Advantage

Opportunities

-

We are searching for a skilled copywriter. Love Nexus Mutual and want to get paid to amplify the Mutual and drive more cover buys? Join us! The ideal Mutant has experience writing copy, ideally around DeFi, and has a strong understanding of Nexus Mutual and the tokenomics. Together, we’ll create content that will be shared through the DeFi space to generate greater understanding of the importance of cover, what Nexus Mutual offers and why we’re the premier destination for DeFi cover. DM me if you’re interested!

-

We are still looking for a Discord Bot aficionado. We want to create an automatic integration from our other social platforms to our Discord, to generate more community engagement. We’re also very interested in a Discord Bot that would notify members when more cover capacity is available on popular protocols. DM me if you’re interested!

-

The Fund is open for business and we’d love to hear from you if you have any ideas, potential projects and collaborations. DM me if you’re interested!