Introduction

This report summarises karpatkey’s activities and achievements in January 2025, with our focus on selling and diversification of NXM Token.

Financial Results:

-

Treasury Balance: $8.47M, down from $9.08M in December, mainly due to NXM price variation. This is depicted by the Price Var for Init Bal in the below Treasury Variation chart.

-

Protocol Fee Revenue to Treasury: Operations results (also shown in the Treasury Variation chart below) decreased to $74.1K from $122K in December.

-

Operating Expense: To fund the 2025 Q1 budget, $155K was withdrawn from the Nexus Avatar Safe in aEthUSDC and WNXM.

-

DeFi Allocation: 45.8%, up from 43.7% in December, mostly driven by additional positions in Aave v3 and Uniswap v3 as detailed below.

-

DeFi Revenue: $25.7K, down from $28.3K in December. This is depicted by the DeFi results entry in the below Treasury Variation chart.

-

Full treasury breakdown is available on the Nexus Mutual dashboard at the karpatkey website.

Treasury Operations:

-

Positioned two Limit orders one at 1.8% discount to Book Value and other at 1.2% discount to Book value to capture WNXM selling to WETH.

-

44.8K USDC that had accrued from protocol fees was deposited into the Aave V3 core market.

-

Strategically, exited one of the LP Position in Uniswap v3 that resulted in WNXM sold for WETH at 0.02263 after accruing trading fees, equivalent to 0.17% discount to Book Value and well within 2% mandate.

Asset Invested Withdrawn Diffs Total Fee WNXM 1027.90 213.44 -814.46 17.66 WETH 2.50 20.39 17.89 0.44 -

As NXM Book Value seemed to increase in January, a new LP position was created with increased lower and upper bound to capture the fees while WNXM price remained in the range.

-

As a part of an expanded universe of strategies, new Zodiac permissions have been created and successfully tested on Spark, EtherFi, Aave v3, Uniswap v3, and CowSwap.

-

Inline with karpatkey’s risk management best practices, on-chain monitoring alerts have been configured for the EtherFi staking contract and major weETH liquidity pools.

NXM Tokenomics:

-

The current circulating supply of NXM stands at 3.07M, down by 5% compared to Dec '24.

-

Out of the total circulating NXM, NXM composition increased by 1.96%, while WNXM composition decreased in Jan '25.

-

The NXM Holders composition remained unchanged, while NXM in staking pools increased by 1.89% compared to Dec '24.

-

The WNXM Holders composition decreased by 3.02%, whereas WNXM in Liquidity Pools grew by 1.05% to nearly 3x compared to Dec '24.

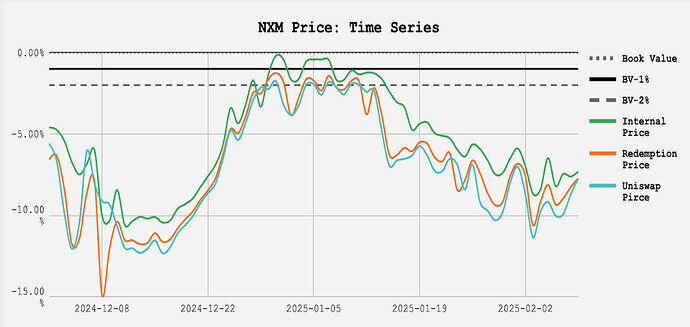

NXM Price:

-

In January, the NXM spot price consistently traded below its Book Value (“BV”), reaching a maximum discount of 10.2% and a minimum discount of 0.179%. One limit order placed at a 0.18% discount to BV was partially filled.

-

Due to the significant divergence between the NXM spot price and BV, both Uniswap concentrated liquidity positions moved out of range, resulting in temporary impermanent loss. Given that these LP positions are strategically deployed for the long term, they are expected to return to active bins and resume generating trading fees once the NXM price converges closer to BV.

-

karpatkey team will continue to closely monitor the NXM spot price and execute WNXM sales when the price moves between BV and BV-2% through either:

- Limit Orders.

- Liquidity Provision strategies.

Next Steps:

- Deploy the new permissions payload on Nexus Treasury Avatar Safe.

- Swap the incoming cbBTC as a part of Protocol Fee Revenue and allocate to yield-generating strategies.

- Once the new permissions are added, allocate the Treasury to additional venues such as Rocketpool (rETH), Etherfi (weETH), Spark (sDAI/sUSDS), Balancer (v2/v3 LP pools), Aura, and Aave v3 Prime Market.

- Actively monitor the NXM price to continue the diversification process.