Introduction

This report summarises kpk’s activities and achievements in June 2025, with a focus on the management and diversification of NXM token holdings.

Financial Results:

-

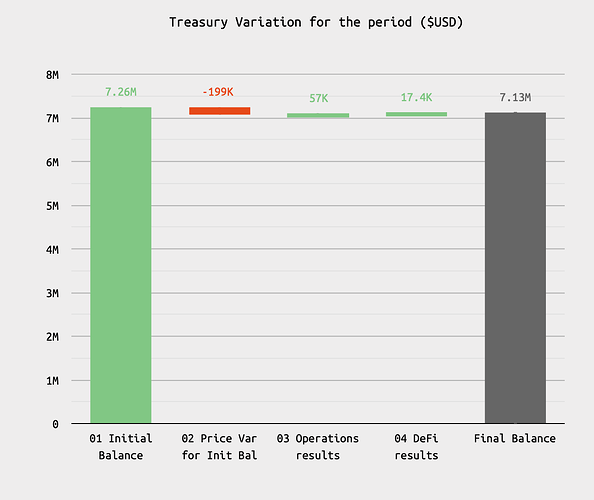

Treasury Balance: $7.13M (on June 30th), down slightly from $7.25M in May, due to market fluctuations. See the Treasury Variation chart below.

-

Protocol Fee Revenue to Treasury: Operational income increased to $57K in June, up from $28.3K in May, driven by increased protocol activity.

-

DeFi Allocation: 49.5%, up from 48.9% in May, primarily due to strategic changes in allocations, as detailed under Treasury Operations.

-

DeFi Revenue: $17.4K, a decrease from $27.0K in May, primarily driven by decreased yield in NXM staking pool positions. This is reflected in the DeFi results entry in the Treasury Variation chart.**

-

Full treasury breakdown is available on the Nexus Mutual dashboard at the kpk website.

Treasury Operations:

-

Migrated ~100.5K aEthUSDC from Aave v3 to sGHO, which offers a higher yield (~8.05% APR compared to 3.4% APR), with a similar risk profile.

-

Deposited ~60K in incoming USDC/ETH from protocol fee revenue into sGHO to enhance returns.

-

As a part of an expansion into new investment strategies to optimize treasury performance, new kpk permissions have been created and successfully tested on Balancer v3, Aura, Fluid, Morpho, Aave v3 and Cowswap.

NXM Tokenomics:

-

Within the total circulating supply, the NXM composition relative to wNXM has decreased by 2.73% compared to May '25.

-

Within the total circulating supply, the NXM composition relative to wNXM has decreased by 2.73% compared to May '25.

NXM Price:

-

In June, the NXM spot price remained closely below BV - 2% range and continued to trade below its Book Value (“BV”), with the discount ranging from a maximum of 4% to a minimum of 2.7%.

Next Steps:

- Implementing a TWAP-based exit strategy to systematically convert ETH liquid staking tokens (LSTs) into stablecoins, capturing ETH price upside and stabilising treasury value.

- Once new kpk permissions are live, migrate low-yield or idle USDC from protocol revenue into higher-yielding opportunities to meet budget requirements.

- Stake idle NXM tokens across multiple Nexus Mutual staking pools to earn additional treasury income and diversify risk.

- Actively monitor the wNXM price, and Uniswap LP position, to support the ongoing diversification process and financial objectives.