This proposal is open for voting between 14–17 March 2024

NMPIP-213: Change Pricing Parameter to Increase the PRICE_CHANGE_PER_DAY from 0.5% to 2.0%

Summary

Since Nexus Mutual V2 launched in March 2023, the dynamic pricing mechanism has been in place and all parameters have remained unchanged since V2’s launch. I and other members of the Foundation team have been monitoring the protocol’s main parameters over the last year to see if any changes are warranted. Most recently we’ve been evaluating a change to one of the dynamic pricing parameters to improve the user experience for cover buyers.

I am proposing members increase the PRICE_CHANGE_PER_DAY parameter from 0.5% to 2.0%.

Rationale

In V2, staking pool managers set the minimum price they are willing to accept for a given cover product. When a cover is bought from a staking pool, the price for the next cover buy on that particular cover product is increased within that pool. Subsequently, the price decays back down to the pool’s minimum price according to the PRICE_CHANGE_PER_DAY parameter within the Staking Products contract. Through this price change, dynamic pricing in V2 creates a continuous reverse auction process, spreads cover buys and risk across the various staking pools underwriting a given risk, and helps the Mutual and the staking pool manager(s) capture value when cover demand is high.

The downside of a slow price change means potential cover buyers have to wait, sometimes 1–2 weeks for the price to decay back down to a price they are willing to pay for cover. This means the staking pool manager is willing to sell cover and the cover buyer is willing to buy at a certain price but the system won’t allow them to match the “trade”.

Theoretically, keeping a slower decay speed allows the Mutual to capture more value on a single cover buy, as the price someone pays might be slightly higher on average.

In the bear market with relatively infrequent cover buys, users only occasionally noticed the downside. However, in recent weeks there have been several instances where there was demand for popular Protocol Cover products, like Pendle, but the price at which cover buys were willing to pay wasn’t reached for a week. These members were willing to purchase Protocol Cover but the slow price decay delayed their cover buy. In some cases, we could be missing cover buys because of this poor UX. This is important to note as yields continue to rise as we approach what could be a faster moving bull market.

I’m confident a better UX and value proposition for the Mutual is to increase the PRICE_CHANGE_PER_DAY parameter from 0.5% to 2.0%. The initial change should give us data to test the impact on daily cover buys in the coming months. Adjusting the PRICE_CHANGE_PER_DAY parameter presents little downside, and we’ll get more meaningful data to action if this parameter needs to be adjusted more in the future.

Technical Specification

The on-chain proposal will directly update the PRICE_CHANGE_PER_DAY parameter from 50 to 200 if approved.

Proposal Status

This NMPIP is open for review from Monday (4 March) until Monday (11 March), at which time, this proposal will transition to an on-chain vote.

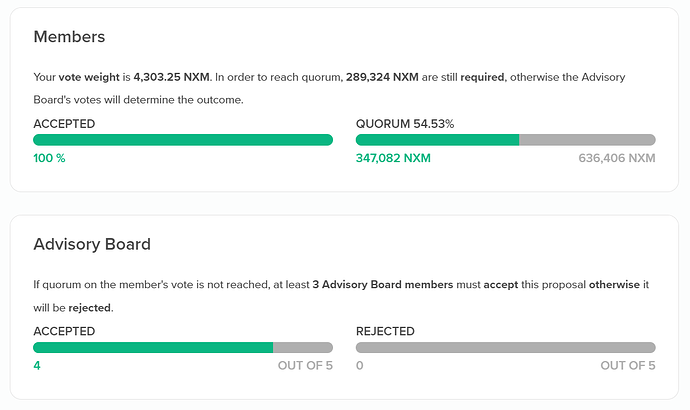

NMPIP-213 is on chain and open for voting!

The on-chain vote for NMPIP-213 will take place from 14 March until 17 March.

Members can review and vote on this proposal over the next several days (i.e., 14 March until 17 March).

Additional Resources

For the full background on how the pricing mechanism works please refer to the Pricing section in the Nexus Mutual documentation.

Edit: @BraveNewDeFi updated the proposal to include the dates for the on-chain proposal going to vote.