Hello @rei & all,

we’re glad to see this proposal moving forward and believe the updates will bring significant benefits. We are ready to support its implementation as soon as NMPIP 226 gets a final binding vote from the DAO.

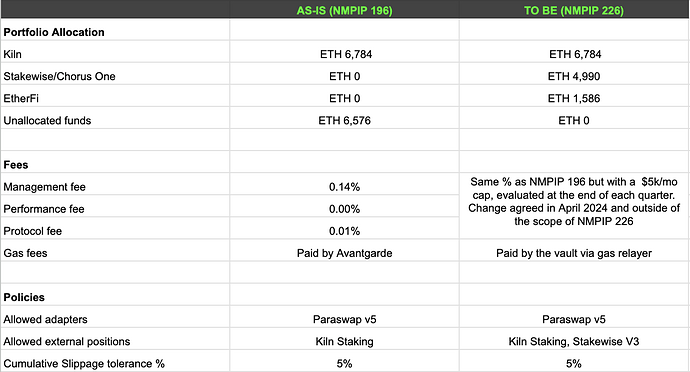

In the latest proposal for NMPIP 226, a few changes are being introduced compared to the current NMPIP 196 structure.

As thoroughly described above, the portfolio will be fully allocated with the addition of Stakewise/Chorus One and EtherFi, which will hold 4,990 ETH and 1,586 ETH respectively, while Kiln remains unchanged at 6,784 ETH.

As a reminder of the recent changes in the fee structures, the management fee stays at 0.14% but now capped at $5k per month, reviewed quarterly. The performance fee remains at 0.00%, and the protocol fee stays at 0.01%. Also, gas fees are now paid by the vault via a gas relayer, instead of by Avantgarde Treasury.

Policy-wise, the allowed adapters and slippage tolerance remain the same, but the allowed external positions will now include Stakewise V3 alongside Kiln Staking. While the addition of Stakewise V3 in the vault settings requires a vault reconfiguration, the exposure to EtherFi’s weETH can be achieved through Paraswap v5 without further adjustments or policy changes.

This new configuration aims to diversify staking positions and optimize fee management and we think it will bring significant benefits to Nexus Mutual. You can find a recap of the changes i the table below.

We hope it helps to give full visibility the scope of NMPIP 226 and we remain available in case of questions from the Nexus community.