I was thinking about Balancer’s BAL liquidity mining program to offset gas costs over the weekend. Though I’m working on more than enough objectives right now, I thought I would take the mutual’s pulse regarding this idea.

NXM for Gas Program

Since the launch of Protocol Cover, the mutual has seen some massive cover buys. In my opinion, this is a testament to the value that we are providing with Protocol Cover. Ethereum scaling solutions, layer two solutions, and other chains are all options for members who don’t have massive holdings or anyone looking to mitigate gas costs.

For a short while, we all enjoyed low gas prices toward the end of April that averaged about 56 gwei. Gas prices once again are on the rise. The average gas price in the last week has been ~174 gwei. Because buying cover is a more complex transaction, the gas fees for cover buys can be prohibitive for members who are buying cover for assets <$100,000 in value.

Here’s a good Dune Analytics Dashboard for Gas Price Averages over time.

Though we’ve had larger cover buys, we’ve had fewer daily transactions by unique users according to the data in this Dune Dashboard. I can’t make a direct correlation, but I would assume prohibitive gas costs have been a deterrent for many members as of late.

One way to overcome significant gas costs and encourage cover buys is to offer NXM rewards that offset the gas costs associated with buying a cover policy.

The program would apply to cover purchases: no other transactions would be eligible.

Case Study: Balancer Labs

Balancer Labs run a similar program, which started as a pilot program and then was approved by the community to run for a longer period due to the success of the pilot program.

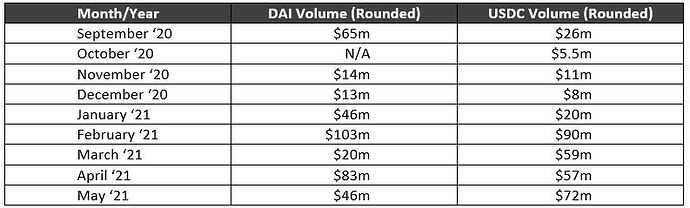

In this Dashboard, we can see that weekly transaction volumes (in USD) increases starting in January and have stayed consistent with the initial increase and, in some weeks, trended higher. One consideration we can take into account is the price increase of many assets from November '20 until present. But look at the volume of DAI and USDC transactions:

Weekly Volumes for Balancer Exchange (Rounded)

Again, we can attribute an uptick in volume to the bull market to some degree; however, the weekly volumes rose across the bar for multiple assets, which includes the stablecoin assets listed in the above table. USDC trading volume increased notably from the 2020 months to the 2021 months: January was the start of the pilot program and in March, the program was extended through governance.

In this Dashboard, we can see a large jump in new users on Balancer’s exchange. An aggressive marketing campaign was done to promote the BAL gas incentives. If you listened to the Bankless podcast in March, you heard about the program.

Balancer’s program delivered results, and I think it can be a driver for cover buys in smaller denominations.

Benefits

The benefit of rewarding members with nominal amounts of NXM—fractional amounts of NXM cannot be wrapped. A member would have to buy significant numbers of cover policies to game the system.

We could introduce a measure that doesn’t allow a member to buy small cover policies over and over to accrue NXM. The rewards wouldn’t be equivalent to gas costs; it would be an amount that offset gas costs.

The goal would be to drive cover buys, market the program in an effort to grow our membership, and remove the deterrent high gas prices introduce to members with smaller deposits in DeFi.

Conclusion

I’m just looking for community sentiment and feedback on this idea. This would be a solution we can introduce in the near future. For now, if members can provide any comments on this topic, I would appreciate it.

Please take this poll regarding this idea: https://forms.gle/YQDzyB2BpTrXMFQW9

Any additional feedback is welcome below this post. Thanks for taking the time to read this post. ![]()

![]()