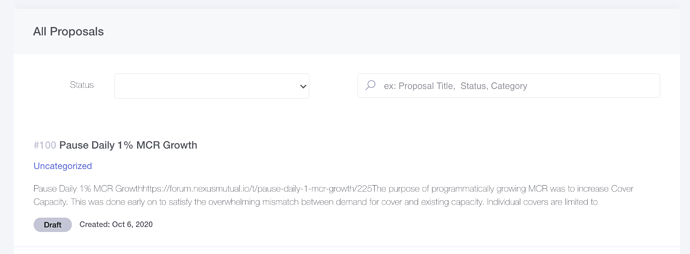

The purpose of programmatically growing MCR was to increase Cover Capacity. This was done early on to satisfy the overwhelming mismatch between demand for cover and existing capacity. Individual covers are limited to 20% of MCR to limit concentration risk to any individual cover.

MCR currently sits at 157,648 ETH, meaning individual cover capacity is 31.5k ETH (over $11m USD). Scrolling through the cover purchase menu will show you that none of the individual contracts are currently capped by MCR. On top of that, there’s about $180m in cover expiring over the two weeks (out of a total $230m) which will significantly open up capacity. The reason we’re seeing so much capacity expiring is because a lot of it was purchased to farm SAFE about a month ago. The shortest time period one can purchase cover for is 30 days, so we’re starting to see all of those purchases expire.

I’m sure there will be some cover purchased as capacity opens up, but it’s unlikely that all expiring covers will be immediately offset with new purchases. Since the purpose of growing MCR was to increase capacity, it’s also logical to stop growing MCR when we have this much excess capacity. At this point, we have the necessary capacity and the priority should be on expanding the types of cover we offer rather than purely expanding the depth of each cover.

Growing MCR by 1% per day also means it’s accelerating. At 50k MCR it goes up 500 eth, at 100k it’s 1k eth, and now it’s growing at 1.5k eth. This acceleration suppresses the desire for individuals to add to the capital pool. You’d effectively need ~$700k in daily inflows (1.5k eth*130%*price of Eth) to match MCR growth. That’s why we will continue to see MCR flatline around 130%.

I believe we’re now at a point where growing MCR this way is no longer necessary, and we can instead switch to a gearing factor approach. The plan was always to switch to a gearing factor approach once MCR was at an acceptable level, the difficult/impossible aspect was knowing that level in advance. It’s a function of several factors like cover demand relative to capacity, cover breadth, capital pool growth, and overall market conditions.

Then: Low MCR had to be accelerated to expand cover specific depth to match demand for cover. Cover breadth was nowhere close to where it needed to be for a gearing factor approach to be practical. The amount by which MCR grew was small enough to still encourage speculation driven capital pool growth.

Now: Individual cover depth is high enough to service current demand. Cover is also currently available on 45 contracts and that number will continue to grow, meaning MCR growth via gearing factor is a feasible approach. MCR is large enough that growing it at the same rate in current market conditions actually discourages capital pool growth.

If we get to the point where individual cover demand really begins to outpace capacity and we’re unable to grow MCR through the gearing factor approach, then we can always turn programmatic MCR growth back on.

Edit: the ‘gearing factor approach’ was supposed to hyperlink to this tweet thread where it’s explained (https://twitter.com/YanLiberman/status/1300875154722086912?s=20)