Title: Q1, Q2 2023 | DAO team funding proposal

Six-month funding request: $344 500

Funding period: 1 February to 30 July 2023

Review period: 16–26 January

Overview

In the last two quarters, the existing DAO teams–Communication, Marketing, and Investment–have worked on behalf of members and focused on the priorities outlined in the Nexus Hubs: Proposed Teams, Priorities, and 6-month Budget Breakdown forum post.

Now that the six-month funding period is coming to an end, we, the DAO team leads, have outlined the proposed teams, their current priorities, and each team’s six-month budget breakdown in the Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown post, which accompanies this proposal.

The DAO team leads are also proposing the creation of two new DAO teams and splitting an existing DAO team into separate teams. In addition, we propose a change to how the teams manage funding and payments, which includes adding additional multisig signers.

Mission

Our mission is to build an ecosystem in which anyone can protect anyone else by sharing risk. We often refer to this as the global risk marketplace.

Values

Nexus Mutual members value:

-

Trust–our commitment to transparency and our track record for paying claims should speak for itself, as we know we earn trust through our actions.

-

Egalitarian–we are building for an open protocol and DAO, so that protection is accessible by anyone.

-

Integrity–we engage honestly with one another, keep our word, and always choose the right decision even when it’s difficult.

Proposed DAO teams for Q1 & Q2 2023

Operations team

Purpose

Provide support to other DAO teams, manage projects between DAO teams to improve communication and efficiency, help coordinate online and in-person events, and improve internal operations within the DAO.

How team aligns with DAO values, mission

The Operations team will strive to bring DAO community ownership to coordination of funds, projects, and events.

Through increased transparency, communication/coordination among DAO members and teams, and accountability around funding/performance, this team will help further decentralize the mutual and scale the DAO.

This team aligns with Nexus Mutual’s three core values.

Team

The proposed Head of Operation (i.e., team lead) is Kayleigh, who has provided community, communications, and marketing support for the mutual since 2018 within the Foundation.

R&D team

Purpose

Overcome hard problems faced by the protocol and ecosystem. Decentralize the problem-solving function, increase transparency, and attract skilled members who want to solve difficult problems.

How team aligns with DAO values, mission

The R&D team strives to overcome hard issues the right way, retaining focus on our mission and values, instead of taking shortcuts that may undermine them.

With a dedicated R&D team, members can effectively work together to face difficult problems and we will aim to attract skilled, active members to discuss, challenge and work together toward solutions.

This team aligns with Nexus Mutual’s three core values.

Team

The proposed Head of R&D (i.e., team lead) is Rei, who has served as a founding member of the Nexus Mutual protocol and made a variety of contributions since 2018. Most recently, Rei has led the tokenomics working group, which would now be managed by this team.

Community team (formerly, Communications)

Previously, this team handled both communications and marketing. Over the last six-month period, BraveNewDeFi and Claudio realized two things:

-

The function of these two teams were similar but distinct. After discussing between each other, the two decided it would be best to split into two separate teams with a clear, defined focus.

-

The Communications team is responsible for keeping existing members informed and engaged, with the aim to maintain high retention rates within the mutual’s membership.

-

The Marketing team is responsible for attracting prospective, new members through defined marketing, content strategy and increased brand awareness, with the aim of driving membership growth and furthering brand awareness.

-

The Communications team is responsible for content creation, management of social channels, and member engagement. However, the primary goal is to drive existing member engagement and maintain high retention rates. For this reason, BraveNewDeFi decided to rename the team from “Communications” to “Community.”

Purpose

Provide tools to and educational content for members, staking pool managers, DAOs and our wider community in order to expand coverage. Design communication channels to drive community engagement, member retention.

How team aligns with DAO values, mission

The Community team provides key support to members in a variety of ways, whether it’s day-to-day questions or direct assistance during claim events. Through consistent support, communication, and engagement, this team strives to improve the member experience and improve access to resources.

This team aligns with Nexus Mutual’s three core values.

Team

The proposed Head of Community (i.e., team lead) is BraveNewDeFi, who has worked for the DAO since 2021. In that time, he has updated and maintained the V1 documentation, developed the mutual’s DAO working group model, launched the first DAO team, and standardized the claims process to reduce friction for those submitting claims.

Sem has served as Community Manager since February 2022, when she joined the team and began providing support to members on Discord and LinkedIn. In that time, Sem has conducted research for the Discord reorganization, potential moderation tools, risk, and governance models. Sem writes a majority of the weekly newsletter and puts together the weekly cover sales, active coverage data.

Marketing team

Purpose

Expand Nexus Mutual’s brand awareness, engagement with target audiences and drive growth in new membership. Create and execute marketing campaigns; develop and distribute content; and manage Nexus Mutual’s marketing channels.

How team aligns with DAO values, mission

The Marketing team creates awareness about the risk marketplace and reaches prospective members around the world. With a defined content strategy and data-driven metrics to demonstrate their impact, the Marketing team can grow brand awareness and membership within the mutual, while providing DAO members with a measure of their success.

This team aligns with Nexus Mutual’s three core values.

Team

The proposed Head of Marketing (i.e., team lead) is Claudio, who has worked for the DAO since May 2022 and brings with him 10 years’ experience in digital marketing. As a strategic marketer, Claudio is data-driven, customer-centric, and passionate about online branding and visibility with a specialized focus in online advertising.

Investment team

Purpose

Invest Nexus Mutual’s assets in a way that maximizes the return without negatively impacting the mutual’s ability to pay claims on a timely basis.

How team aligns with DAO values, mission

The Investment team reviews investment opportunities, writes detailed investment strategy proposals for the governance forum, where they provide members with the potential benefits, risks, and considerations necessary to make an informed decision ahead of on-chain governance votes.

This team aligns with Nexus Mutual’s three core values.

Team

The proposed Head of Investment (i.e., team lead) is Dopeee, who has been working for the Foundation since 2021 and is an inaugural member of the Investment team, where he has served as the team lead since July 2022.

Custodying, managing DAO team funds and payments

To date, our existing DAO teams have held their budgets within different multisig Safes, which both have a 2/3 signer threshold. As the DAO scales, it is important to monitor spending and ensure any funds requested are used to fulfill each team’s purpose, meet their goals, and further the Nexus Mutual mission.

Going forward, we propose that the Community team’s multisig is repurposed as the DAO team multisig, which would take custody of funds approved by the DAO for teams. If budgets are held within one multisig with a larger signer threshold (3/5 signers), team leads can hold each other accountable for expenses and can maintain timely payments for full-time, part-time contributors and contractors.

Multisig signers

Currently, the Community multisig has three signers:

- Head of Community | BraveNewDeFi

- (Proposed) Head of Operations | Kayleigh

- Head of Investment | Dopeee

We propose increasing the DAO team multisig signers to include:

- Head of Community | BraveNewDeFi

- (Proposed) Head of Operations | Kayleigh

- Head of Investment | Dopeee

- (Proposed) Head of Marketing | Claudio

- (Proposed) Head of R&D | Rei

Each signer is required to secure their address with a hardware wallet and make themselves available to sign several transactions a month.

The DAO teams use Utopia, which is built on top of Safe, to manage standard payroll.

Team expense requests, payment process

During the six-month funded period, each team lead can make an expense request on Utopia to fund things such as software, tooling, travel expenses, content creation, etc. These expense requests would be reviewed by the other team leads, who will assess the ROI, our wider goals and overall budget status and then approve, amend, or deny each request. Full-time and part-time salaries will be distributed monthly, as outlined in this funding proposal.

Any team lead that wants to hire a contractor will be required to submit a request, where they provide the contractor’s qualifications, potential contributions to a project, pay rate, and max budget request. In addition, team leads will verify that a contract agreement is drafted to ensure both the team and contractor have clear, defined deadlines, deliverables, expectations, and payment schedules and details.

This approach would streamline payments and align teams, so each project and funding request goes through a review process. DAO team leads can ensure:

- Miscellaneous projects are monitored and evaluated in line with team standards

- Payments for all contributors are timely and reliable

- Team leads can collectively assess budget status, drive decisions to maximize our allocated funding, and reduce expenses wherever possible

- Contractor agreements require multiple sign offs, approvals rather than one person making decisions with limited oversight

- Team leads can evaluate each expense, allow leads to consider other options such as monetising services

Total DAO team funding requests

| Team | Requested funding for six-month period |

|---|---|

| Operations | $63 000 |

| R&D | $57 000 |

| Marketing | $77 000 |

| Community | $90 000 |

| Investment | $37 500 |

| Discretionary budget (shared by teams) | $20 000 |

| Total | $344 500 |

See the Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown post for a detailed breakdown of costs.

Review period

The following two forum posts make up the DAO team funding requests for Q1 & Q2 2023.

- Q1 & Q2 2023 | DAO Teams Budget Request Proposal

- Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown

- Review of DAO team purpose, priorities, ongoing responsibilities, team members, and budget request

- Existing teams also include Q3 & Q4 2022 performance reviews

These posts will be open for review and comment from 16–26 January.

If no substantial comments are received, this funding proposal will transition to a Snapshot vote, which will open on 27 January and will close on 3 February.

We look forward to the community’s review and comments!

Proposal Status

Snapshot vote closed as of 2 Feb 2023 at 9am EST: Snapshot

Voting period: 2pm UTC on 27 January until 2pm UTC on 3 February.

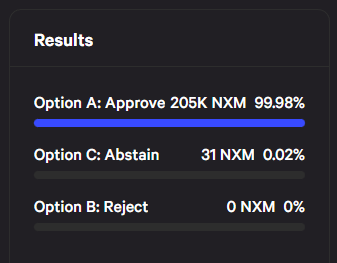

Voting choices

- Option A: Approve proposed teams and aggregate funding request of $344,500

- Option B: Reject proposed teams and aggregate funding request of $344,500

- Option C: Abstain

Vote Outcome

Members voted with 205k NXM to approve Option A, which approved the proposed teams and the aggregate funding request for Q1 & Q2 2023.