Overview

This post is done in conjunction with the Q3 & Q4 2023 | DAO Teams Budget Request proposal. Below, members can find the information for each proposed team, their current priorities, and each team’s six-month budget breakdown. This information informs the DAO team funding proposal.

Proposed DAO Teams

As highlighted in the Q3 & Q4 2023 | DAO Teams Budget Request proposal, there are four existing teams (the Community, Marketing, Operations, and R&D) and one existing committee (Investment) requesting funding for the next six-month period.

Now that the previous six-month funding period is coming to an end, the DAO team leads have outlined their purpose, priorities, ongoing responsibilities, team, and budget funding request for the next six-month period, from 1 August 2023 to 31 January 2024.

We also review the existing teams’ past performance and the status of the Q1/Q2 priorities. You can review the previous budget proposal and priorities post from last quarter below:

- Q1 & Q2 2023 | DAO Teams Budget Request Proposal

- Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown

Community team

Purpose

Provide tools to and educational content for members, staking pool managers, DAOs and our wider community in order to expand coverage. Design communication channels to drive community engagement, growth.

Priorities

-

Regular updates on the new tokenomics project. The Community team will work alongside the Foundation and R&D teams to provide members with weekly updates on the progress being made on new tokenomics. As the R&D team shares updates, the Community team will share these updates across Discord, The Hedge, and on community calls.

-

Increase visibility, transparency and engagement between staking pool managers and community. Our goal is to create a bridge between members and staking pool managers, so members can support pool managers by staking and delegating, buying cover from their pool(s), helping to create awareness about new distribution channels/strategies, etc. The Community team will make sure that capacity requests are directed to pool managers; members who need additional capacity can submit their requests directly to staking pool managers.

-

Own and drive engagement on the Nexus Mutual governance forum. The Community team will work to transform the forum into a town hall, where members can go to find the latest updates, connect with other members, talk about risk management and keep up to date on new listings, and more. As the team makes progress on improving the forum, we’ll share updates with the community through the weekly newsletter, The Hedge.

-

Update and improve the Discord experience. Currently, Discord is the most active community channel within the mutual. Sem and BraveNewDeFi will use the current Discord engagement data as a baseline and experiment with different strategies to drive engagement on Discord. Members can expect an update to the bots used within the server, the introduction of a ticketing system for support requests, a customizable Discord experience for each member based on roles, and more.

-

Improve V2 documentation; create guides. The Community team owns the V2 documentation, and as changes are made to the Nexus Mutual UI, BraveNewDeFi will expand the documentation, create how-to guides, and offer more support to staking pool managers.

Ongoing responsibilities

- Writing, distributing the weekly newsletter

- Holding the bi-weekly community call

- Providing community support on Discord, Twitter

- Regular updates on governance discussions, development progress, DAO initiatives, etc.

- Improving UX in communications channels (e.g., Discord reorganization, etc.)

Team

-

Head of Community (FT). BraveNewDeFi

- Description. Directs community operations, writes and distributes content for the mutual, writes and maintains the Nexus Mutual V2 docs, works with Community Manager to provide timely support to members across various channels, and manages multisig payments through Utopia.

- Salary. Payment will be $10,000 monthly for a 6-month total of $60,000.

-

Community Manager (FT). Sem

- Description. Responsible for community management, content production and coordination across the social channels, including content delivery in targeted channels. Conducts regular research on ways to improve member experience within Discord, governance forum, etc. Supports knowledge and project management.

- Salary. Payment will be $6,666.67 monthly for a 6-month total of $40,000.

Budget request

| Resources | Requested funding for six-month period |

|---|---|

| Team lead salary, BraveNewDeFi | $60,000 |

| Community manager, Sem | $40,000 |

| Travel | $8,000 |

| Discord improvements | $1,000 |

| Graphic designer for documentation visuals | $800 |

| Discord notifications bot maintenance | $750 |

| Total | $110,550 |

Q1 & Q2 2023 Performance

-

V2 documentation. When Nexus Mutual V2 launched, the new documentation also went live. BraveNewDeFi worked with the Engineering team to understand the V2 protocol and explain the core protocol functions in accessible language. In time, the V2 documentation will be open sourced and others will be able to contribute. Before this happens, BraveNewDeFi will create a usage guide and a contributors guide to encourage consistent practices for anyone who contributes to the V2 documentation. You can review the Nexus Mutual V2 documentation here.

-

V2 content. When Nexus Mutual V2 launched, the Community team worked with the Marketing and Business Development teams to create content specific to staking pool managers who are interested in building on top of the Nexus Mutual V2 protocol and content for existing distributors, so they could adapt their protocol to continue selling Nexus Mutual cover now that V2 is live. The Nexus Mutual V2 launch communications, the initial V2 launch post, the BootNode and CowSwap integration announcement, and the various coverage in The Hedge and on community calls were all written and distributed by the Community team.

-

Discord notifications bot project. On Monday (5 June), the Community team launched the Nexus Mutual notifications bot in the Discord server and announced the launch in the newsletter and on the community call. With this bot, members can now opt-in for reminders two (2) weeks before their cover expires reminding them to check capacity and renew their cover; they can also request additional capacity, get a quote for cover, check on the current capacity for cover products, see the total TVL of the capital pool and the assets held in the capital pool, and more. The commands will be expanded over time and the user experience will be improved based on feedback from members.

-

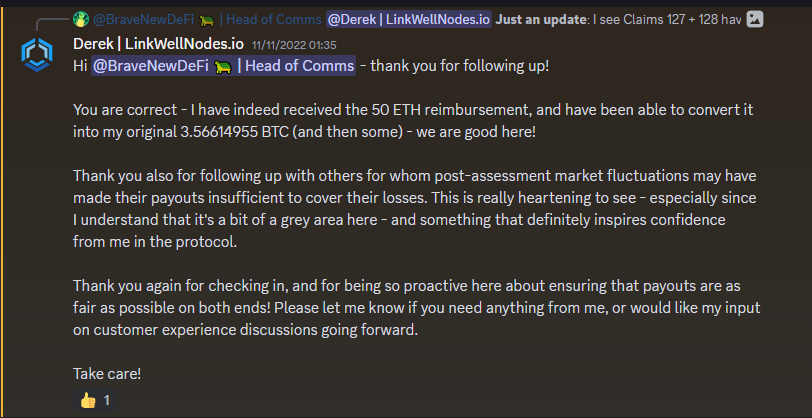

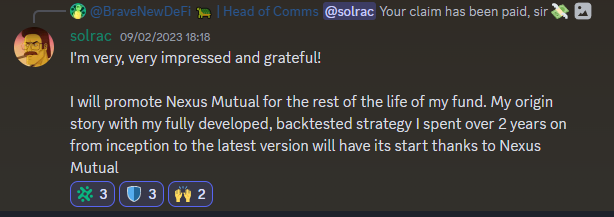

Claims guidelines, support. Over the last six-month period, 55 claims were filed, approved, and paid out. These claims were filed for Hodlnaut, FTX, BlockFi, Ease, Euler, and Sherlock. You can review the major loss event summaries in the V2 documentation. For each claim event, the Community team made announcements as claims were filed, created public claims trackers for all members to audit the claims process at a high level, published claims filing guides ahead of the claims filing dates, helped members through the claims submission process, assisted with loss calculations, answered support questions and provided regular updates throughout the claims assessment voting period, and let members know when their claims were approved. Members have shared their thanks and thoughts on our contributions to the claims process in the last two quarters, which are shared below. The Community team also worked with members who redeemed Euler claims and secured the return of 120.56 ETH and 1,720,207 DAI to the capital pool after the Euler Finance team provided reimbursement to affected users.

-

Governance forum overhaul, update. The Community team is in the process of overhauling the forum, with the expectation that the core changes will be made by the end of the funded period (i.e., end of July 2023). Since the initial changes and recategorization of the forum, long-time members have provided positive feedback and staking pool managers are happy to have defined channels they can own and use to engage with and update members. As more progress is made, the Community team will provide updates on community calls and in the newsletter.

Marketing team

Purpose

Ensure brand consistency across channels resulting in brand recognition. Expand Nexus Mutual’s brand awareness and engagement with target audiences. Drive growth in new membership and cover sales. Create and execute marketing campaigns; develop and distribute content; and manage Nexus Mutual’s marketing channels.

Priorities

- Content production. Strategize and coordinate the creation of marketing content to support Business Development initiatives to increase growth in membership and cover sales across different products.

- Content distribution. Evaluate the most suitable channels based on target audiences. Explore new ways to drive awareness of cover products and the V2 marketplace.

- Partnership awareness. Work closely with partners to increase Nexus Mutual’s brand awareness and recognition and leveraging partners channels and audiences.

- Active monitoring of key analytics. - Use data to evaluate the effectiveness and success of marketing activities. During Q1–Q2, we started to implement some data collection and we are now in the position to start analyzing this data to inform marketing activity. Build a marketing impact dashboard for internal use to quantify reach and performance.

Ongoing responsibilities

- Create, maintain a content calendar; define content strategy across channels.

- Collaborate with the Community team on content creation.

- Develop, implement wider marketing strategy/tactics to increase brand exposure.

- Working closely with Business Development to support cover sales and buyer partners

- Increase content creation for each audience, channel.

- Increase brand awareness and site traffic, one major KPI.

- Maintaining and updating website content.

- Monitoring the marketing impact dashboard and analyzing metrics to inform ongoing marketing efforts.

- Maintaining the DAO website

Team

-

Head of Marketing (FT). Claudio

- Description. Develop, implement a comprehensive marketing strategy. Develop, execute marketing campaigns that drive brand awareness and membership growth. Utilize data and analytics to inform marketing decisions and measure the effectiveness of campaigns. Continuously monitor industry trends and competitor activity to identify new opportunities.

- Bio. Claudio joined Nexus Mutual in May 2022. He brings 10 years’ experience in digital marketing to the DAO, as a strategic marketer who blends, leverages digital media into effective marketing strategies. Data-driven, customer-centric, passionate about online branding and visibility with a specialized focus in online advertising. In previous roles, Claudio has driven demand for digital products and managed multi-million dollars in ad spend while working as a Senior Digital Consultant in marketing agencies.

- Salary. Payment will be $10,000 monthly for a 6-month total of $60,000.

Budget request

| Resources | Requested funding for six-month period |

|---|---|

| Team lead salary, Claudio | $60,000 |

| Marketing manager, TBD | $40,000 |

| Webflow Expert (contractor) | $4,000 |

| Travel | $3,000 |

| Tooling, content creation | $10,000 |

| Total | $117,000 |

Q1 & Q2 2023 Performance

-

Updated brand launch. Our new brand was successfully launched last January and was greatly received by our community. The launch was supported by a variety of content to elevate the message: blog post, video highlighting the transition from old to new brand, social media posts and new website.

- Status: complete

-

New website launch. We now have a new website aiming to position Nexus Mutual as the leading provider of on-chain protection, which improves product discovery and serves as the current primary business objectives of growth in membership and cover sales. It also aims to appeal to new members and cover buyers by highlighting the fact that Nexus Mutual has paid claims to members more than any other coverage protocols. Finally it shows the potential achieved with the release of V2 where the mutual can scale to an on-chain risk marketplace with people launching staking pools and risk business on top of our protocol.

- Status: complete

-

V2 launch. Supported the launch of Nexus Mutual V2 with content production and distribution: blog post and video highlighting new features and evolution of the protocol into a risk infrastructure layer and risk marketplace.

- Status: complete

Operations team

Purpose

Operations provides support to all other DAO teams, ensures there are no blockers preventing teams from delivering on their priorities, and manages projects that span across multiple teams (i.e., Dune analytics launch, tokenomics revamp, brand and website launch, v2 content creation, etc.).

In addition to managing projects between and providing support to other DAO teams, Operations improves communication and efficiency as well as transparency between the team and community members, coordinates online and in-person events, and improves internal operations within the DAO.

Priorities

As Kayleigh will be going on maternity leave during this funding period, the Operations Team’s ongoing responsibilities are being handed over to be looked after by other team members during this period. These include:

- Monthly payroll

- Coordinating funding requests, ad hoc project budgets

- Project management

- DAO operating model considerations

- Team on-sites and events to coordinate goals and create roadmap

- Liaison with ad hoc contributors and committees

- Big gaps and missing skills horizon scanning

Ongoing responsibilities

- Bring DAO community ownership to coordination of funds, projects, and events

- Coordinate DAO teams projects, goals and strategy

- Coordinate, and execute team external events and conferences

- Provide oversight and support for cross-team projects

Team

-

Head of Operations (FT). Kayleigh

- Description. Serves as project manager for cross-team projects and ensures teams consistently meet their goals and stay within budget. Monitors funds, governance, grants and multi-sig/financial structure and provides insight to members on what DAO teams and grant recipients are delivering to facilitate accountability. Work to deepen knowledge on DAO management best practices, so Nexus Mutual can set the standard.

- Bio. Kayleigh has served as Head of Operations during Q1 and Q2 2023 and had been leading operations within the Foundation for Nexus Mutual before the protocol launched on mainnet. Since 2018, Kayleigh has provided community, communications, and marketing support for the mutual. In addition, she has coordinated numerous in-person and online events and ensured Foundation teams regularly communicated when working across projects.

- Salary. Payment will be $10,000 monthly for a 6-month total of $60,000. [Funded from existing surplus]

Budget request

| Resources | Requested funding for six-month period |

|---|---|

| Team lead salary and maternity pay, Kayleigh | (Funded from surplus) |

| Total | $0 |

Q1 & Q2 2023 Performance

-

Created internal project management system and wrote DAO operations manual to document payments processes, DAO teams funding and asset management. The tracking system was built in Notion, which helps each DAO team track their projects, provides transparency across DAO teams, and allows the Operations team to effectively keep team leads on track to complete their projects in a timely manner. Worked with the R&D team to develop DAO teams asset management practices and documented all payment procedures to ensure contributors receive payments on time. Established standard template for DAO team funding requests to standardize the process.

-

Created DAO community website landing page to go live this month. Developed a website for DAO community members, where they can view information about the DAO, our mission and values, current roadmap and priorities, DAO teams, and how to contribute to the DAO. Members will be able to find resources, information about governance proposals, and more. The website will host information directly related to the DAO with the goal of helping more people become engaged DAO members.

-

Coordinated whole team on-site events to align, monitor goals and projects. Planned and executed the DAO and Foundations teams onsite in April, where the current Nexus Mutual Roadmap was outlined and finalized. After the onsite, the Operations team has kept both the Foundation and DAO teams accountable by actively tracking their progress on their projects and helping remove blockers.

-

Coordinated creation of the first Nexus Mutual Roadmap with whole team goals and objectives. Worked with the Foundation and DAO teams to determine the priorities and deliverables for the next six-months to give members greater insight into what the Nexus Mutual contributors will be focused on. Each team’s deliverables are outlined in this post, as well, so members have a transparent list of deliverables tied to the mutual’s current priorities set during the April 2023 onsite.

-

** Supported brand and website launch**. Worked with the Marketing and Community teams to progress these two projects. Helped clear blockers, created agreement with relevant contractors, and provided feedback throughout the process.

R&D team

Purpose

Decentralize the problem-solving function within the DAO, increase transparency, and attract skilled members who want to solve difficult problems while driving member engagement.

Priorities

The main priority of the R&D team is to ensure system design is fit for purpose and maintains pace with growth, mainly through ownership of two projects:

- Tokenomics design, so that the protocol can recycle and attract new capital

- MCR update, so that risk is allowed for appropriately by the protocol

During this funding period, R&D will also support the Investment Committee by acting as a liaison between the committee and the other full-time contributors to Nexus Mutual within the DAO and the Foundation.

Ongoing responsibilities

- Lead project on new tokenomics implementation. Communicate, refine, and generate consensus amongst the wider community, DAO team and the Foundation. Collaborate with the Engineering team on implementation details. Drive the project towards launch as quickly as possible by identifying outstanding gaps and working to eliminate them.

- Update the calculation of the Cover Amount/MCR parameter. Create an improved process for refreshing the cover-based MCR calculation parameter on a regular basis.

- Maintain Dune dashboards on an ongoing basis and adapt them quickly to any protocol changes. If necessary, create new dashboards to capture new elements of protocol.

- Act as liaison between Investment Committee and the Nexus Mutual DAO and Foundation, especially around the prioritizing and technical integration of upcoming investments.

Team

-

Head of R&D (PT): Rei

- Description. Responsible for leading projects, managing contributors, working with DAO and Foundation members to increase participation in research and design.

- Bio. Has served as Head of R&D since Q1 2023. Began working on Nexus in May 2018 as the first full-time employee, covering economic design, legal set-up, actuarial modeling, documentation, and early business development. Advisory Board member since February 2020. Previously qualified as a UK actuary, held a variety of back-office and front-office corporate roles in reinsurance and brokerage.

- Salary. Payment will be $5,000 monthly for a six-month total of $30,000.

-

Dune Wizard (Contractor): Guy

- Description. Responsible for writing SQL queries in Dune, capturing accurate current and historic information across the Nexus Mutual smart contracts.

- Bio. Professional software engineer with 7+ years of working in C++, Python and SQL, overall a keen technologist with personal interests in ML/AI and Blockchain development.

- Payment. Paid $60/hr with a max budget of $6,000 during the funding period.

Budget request

| Resources | Requested funding for six-month period |

|---|---|

| Team lead salary, Rei | $30,000 |

| SQL Contractor/Dune Wizard | $6,000 |

| Total | $36,000 |

Q1 & Q2 2023 Performance

- Tokenomics revamp.

Moved the project from design stage to a community-approved implementation outline. Worked with community members to put forward alternative designs and discussed benefits and drawbacks of the proposed designs.

Following Snapshot approval of outline, kept members and contributors up to date with implementation progress.

Worked with the Engineering team to convert outline into a mechanism that has a workable solidity implementation and refined design in a way that is resilient in a wide range of scenarios. Keeping the design up-to-date in the simulation environment (latest branch).

- Dune analytics launch.

Successfully launched three detailed dashboards capturing Covers, Claims and Capital Pool and Ownership information, with a Staking dashboard (capturing staking distribution, rewards and information about staking pools) close to completion. Incorporated the launch of Nexus Mutual V2 and conversions from Dune v1 to Dune v2. Launched a Nexus Mutual project page on Dune. Agreed process with team for maintaining and updating dashboards on an ongoing basis so that they don’t become out-of-date as the protocol changes.

- MCR refresh.

Project largely in scoping stage in first part of current funding period. Ensured that protocol retains the tools required to monitor the key variable of Active Cover Amount during V2 implementation. Kept the Engineering team up to date on requirements from their side for the upcoming work. Generally this project was somewhat de-prioritised during Q1 & Q2 as over-capitalization of mutual remains in favor of the Tokenomics project.

Investment committee

Purpose

Invest Nexus Mutual’s assets in a way that maximizes the return without negatively impacting the mutual’s ability to pay claims on a timely basis.

Priorities

Due to the state of the market and the preference for members to be long-ETH in the short term, the main focus of the committee members is on ETH-denominated investments, especially ETH staking.

Ongoing responsibilities

-

Conducting new research on investment opportunities and proposing these ideas to members

-

Researching changes in existing investments

-

Maintaining the Investment Philosophy

-

Investment proposals for the DAO treasury

Team

-

Investment Advisor (PT): Nico

- Bio. I am the Chief Investment Officer of Coaction Global, a property and casualty insurer providing tailored insurance solutions for businesses. I provide oversight and strategic direction of their multi-billion dollar investment portfolio consisting of core, core plus, and alternative assets.

- Payment. Determined by hours worked on a monthly basis.

-

Investment Advisor (PT): Gauthier

- Bio. Former M&A analyst, I have moved on to invest in Real Estate. However, during the first lockdown in 2020, I dived deep into the crypto rabbit-hole and have been investing with a strong focus on DeFi protocols ever since. I’m serving as a discord moderator in the Nexus Mutual community, and as a multisig signer for the DAO treasury. I have been a very vocal advocate for Nexus Mutual on Twitter, and also wrote a guide about Nexus Mutual’s tokenomics. I have a strong vested interest in Nexus Mutual and going forward, I aim to identify what are the best investment opportunities for the mutual.

- Payment. Determined by hours worked on a monthly basis.

-

Investment Advisor (PT): Guillaume

- Bio. Business professional with more than 15 years’ experience, with a good analytical and structured approach to all types of problems. My skills in project management and risk management can be complementary to the profiles of the initial team. Also a retail investor in both DeFi and TradFi (a long-time investor in insurance stocks). I’d like to keep contributing to the Investment team around both set-up/structure as well as the process to surface and implement direct DeFi investments in line with the strategy.

- Payment. Determined by hours worked on a monthly basis.

Budget request

| Resources | Requested funding for six-month period |

|---|---|

| Hours funding | (Funded from surplus) |

| Total | $0 |

$100/hr for each contributor is suggested, to be paid out in wNXM based on book value at the time of distribution.

Q1 & Q2 2023 Performance

- Invest more of the Capital Pool in ETH staking solutions.

During this period the investment committee had conversations with around 10 teams implementing various types of ETH staking solutions, scrutinizing their approaches and assessing them from a risk and technical integration perspective. Worked with mutual members to review their initial proposals and get them ready for the forum and governance. There are a number of active ETH staking proposals on the forum due to proceed to governance imminently, which committee members have expressed their support for.

- Rebalance assets and liabilities.

Members expressed a clear preference for members to be long-ETH in the short term, therefore, alongside the ongoing overcapitalization of the mutual, rebalancing assets and liabilities has been put on hold.

- Invest the DAO treasury (formerly, Community Fund).

Prior to the launch of Tokenomics, diversifying the treasury away from wNXM was deprioritised as unlikely to yield a positive outcome. This decision has been justified by the increase in the price of wNXM during the funding period.

- Manage the M11 / Maple recovery.

Assets were withdrawn from Maple, with full recovery on the Auros portion. Full details here.

Total DAO team funding requests

| Team | Requested funding for six-month period |

|---|---|

| Community | $110,550 |

| Investment | (Funded from surplus) |

| Marketing | $117,000 |

| Operations | (Funded from surplus) |

| R&D | $36,000 |

| Discretionary budget (shared by teams) | (Funded from surplus) |

| Total | $263,550 |

See the Q3 & Q4 2023 | DAO Teams Budget Request for the high level proposal.

Review period

The following two forum posts make up the DAO team funding requests for Q3 & Q4 2023.

-

Q1 & Q2 2023 | Proposed Teams, Priorities, and 6-month Budget Breakdown (this proposal)

- Review of DAO team purpose, priorities, ongoing responsibilities, team members, and budget request

- Existing teams also include Q1 & Q2 2023 performance reviews

These posts will be open for review and comment from 12–24 June.

NMDP

If no substantial comments are received, this funding proposal will transition to a Nexus Mutual DAO Proposal (NMDP), which will open for comment from 1 July and will close on 8 July.

Snapshot vote

After 8 July, the NMDP proposal will transition to a Snapshot vote, which will open on 9 July and will close on 14 July.

We look forward to the community’s review and comments!

Proposal Status

- Open for comment