[RFC]: Deprecate Yield Token Cover product

Summary

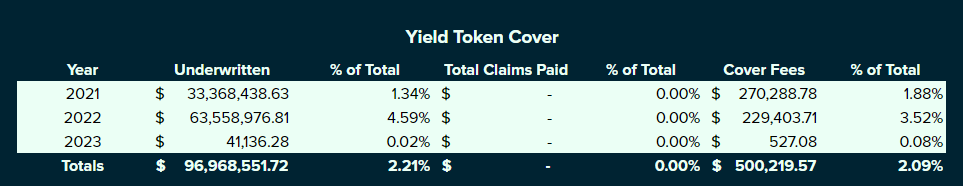

Since Yield Token Cover first launched in July 2021, Nexus Mutual members have sold $96.9m in cover and earned $500k in cover fees, with no loss events occurring that led to a payout.

While none of the cover product offerings for Yield Token Cover have resulted in claim payouts, we’ve seen a general lack of demand for Yield Token Cover.

I propose that Nexus Mutual members take action to deprecate (i.e., delist and no longer offer) the Yield Token Cover product, which will effectively be replaced in the future when the Covered Vaults product launches.

Rationale

Below, you can find a high level overview of the historical cover sold and fees earned for Yield Token Cover products since launch.

Source: Covers Dune Dashboard

Yield Token Cover was approved through governance and released in July 2021. The cover product as summarized in Hugh’s Medium article as follows:

Yield Token Cover provides coverage against the full range of risk that a protocol, or combination of protocols, is exposed to. This includes technical risk of the smart contracts failing, oracle failure or manipulation, stablecoins de-pegging, governance attacks, in fact any risk that causes the protocol to lose value. There is one requirement, for coverage to be possible the protocol needs to provide its users a Liquidity Pool (LP) token that represents their deposit into the DeFi product. This LP token is required for claims submission.

While Yield Token Cover has allowed the mutual to offer stacked risk protection, members interested in buying Yield Token Cover have had difficulty understanding the product. While there are several reasons why Yield Token Cover hasn’t been as successful as other cover products, I’ll focus on the core two points.

Lack of adoption

Since Yield Token Cover launched, members have sold $96,968,551.72 (2.21% of total cover sales) and earned $500,219.57 (2.09% of total cover fees). You can see a breakdown of annual and total sales and fees earned in the table above.

In 2022, we has an increase in cover buys due in part to the Convex MIM pool Yield Token Cover product and the fear that MIM was prone to a depeg event due to the correlation to UST and the UST Degenbox strategy and the FTT backing to the MIM stablecoin in the months leading up to the FTX collapse. Even with the uptick in 2022, Yield Token Cover has not seen the same success that Protocol Cover and Custody Cover has seen.

The prospective market for Yield Token Cover is likely smaller because it’s a more sophisticated product that many members have a hard time understanding. We’ve seen many, many questions about Yield Token Cover over the last two years. After answering questions about the cover, we generally did not see resulting cover buys.

In the last issue of The Hedge, the Community team shared that active cover across Yield Token Cover was at $61,100. You can review the current active cover amount on the Covers Dune Dashboard.

Soon to be replaced in favor of Covered Vaults

While adoption has been lackluster to date due to the technical nature of the product and the higher pricing due to stacked risk, the Covered Vaults product will replace Yield Token Cover, as a more user-friendly option.

With Covered Vaults, people can deposit with needing to join as members; the vault buys cover using a portion of yield, so depositors don’t have to buy their cover; and in the case a loss occurs, the vault would file a claim and receive reimbursement directly, so depositors wouldn’t have to do anything to receive reimbursement.

Covered Vaults will serve as a true embedded cover product, which can appeal to a larger market.

Both Yield Token Cover and Covered Vaults require a group claims process, and the frontend team has not yet built the user interface for group claims at this time. Given the current engineering priorities, the engineering team’s time and resources would be better allocated if the group claims UI can be developed closer to the launch of Covered Vaults.

I welcome other members’ thoughts on the prospect of deprecating Yield Token Cover while we wait for Covered Vaults to launch.

For more information, you can read about Yield Token Cover in the Nexus Mutual documentation.

Specification

If members were to support sunsetting Yield Token Cover after an NMPIP is posted and a successful on-chain vote, Yield Token Cover would be deprecated by:

-

Setting the

isDeprecateflag to true on all existing listings under Yield Token Cover -

Removing “Yield Token Cover” references and associated listings from the Nexus Mutual UI