Overview

In our most recent Mutant Meetup call, we had a discussion about how the community can get involved in the listing process for new protocols. We know that members of our community are active in myriad communities and DAOs across the DeFi ecosystem. Given that, there’s the potential that our members could help us solve for the two existing bottlenecks in the listing process:

Demand for Potential Listings

When new listings are evaluated, the number one question is: If we list the protocol, will members buy coverage?

At the moment, the mutual has active listings for:

-

85 Protocols

-

7 Yield Token Cover Products

-

13 Custodians

New listings with insufficient demand will spread available staked NXM too thin, and if Risk Assessors don’t stake against a platform or cover product, then the premiums remain prohibitively high. That doesn’t benefit our membership.

The most successful listings have regular cover buys and these are the protocols that our members use to generate yield within DeFi. We could create a process on the forum to discuss listings, gauge member sentiment, and determine if Risk Assessors have any concerns.

We can add a new category on the forum “Potential Listings,” to filter for these discussions. For any listing discussions, we can provide a barebones template with the most important considerations:

- Name of Project

- Date of Launch

- Audit(s)

- Bug Bounties

- TVL/AUM

- Recent Growth

- Potential Risk(s)/Stacked Risk

- Potential Demand

- Shield Mining Availability

- Temperature Check

This wouldn’t necessarily be done for every single listing, but any potential listings where demand is uncertain. Once this information is posted on the forum, our community can discuss a potential listing for a period of 10 days. We can use a forum poll to gauge sentiment, but we would need something that can accurately reflect member sentiment/demand as well.

During the evaluation process, we can poll our members using Snapshot to conduct a temperature check. Using Snapshot for temperature checks would solve for users bombarding our forum to get their community’s protocol listed when those users have no intention of buying cover. It would allow our members and NXM holders to signal their support for a new listing. We could always run the risk of voter fatigue if this route is chosen.

Bootstrapping Capital for New Listings

Having demand for newly listed protocols is half the battle. Before members are willing to purchase cover, the annual cost of coverage needs to be at a reasonable rate, which typically means being between 2.6% to 5% per annum. Unless there are extremely high yields, cover policies with an annual cost greater than 5% will have limited to no demand as the cost of coverage increases.

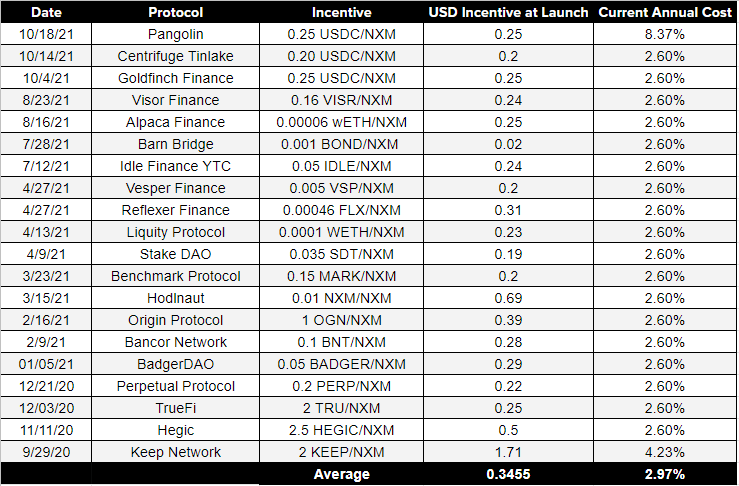

This is why Shield Mining Campaigns play an important role in the listing process. The average incentive for Shield Mining is $0.3455/NXM staked; the average annual cost of coverage from all existing Shield Mining Campaigns, new and old, is 2.97%. Of the protocols that have used Shield Mining Campaigns to bootstrap staking, there are only two protocols that have an annual cost higher than the minimum 2.6% annual cost.

Newly listed protocols pay $0.3455/NXM to open up $313.18 of available cover since the capacity factor for newly listed protocols is 2x.

Without a low annual cost, we know users won’t buy cover. Given the efficacy of our Shield Mining Campaigns, newly listed protocols can allocate anywhere from $50k to $300k to create an initial $12mm to $30mm in available cover capacity. For any initial listing, a protocol’s willingness to work with our community to bootstrap the initial staked NXM is crucial to drive cover buys and capture those more risk averse investors or high-value investments from individuals/institutions who want to deposit but need a way to hedge against smart contract, technical failure risks.

Take into consideration that our average cover buy since launch in 2019 is $876,481 adjusted for recent prices, an initial $15mm of cover capacity can be sold out with 17+ large cover buys.

Open Discussion

At the moment, we have a section in the Nexus Mutual documentation where custodians and protocols can request a listing on Nexus Mutual. There are some soft requirements there, but any input on future requirements for community contributions would also be welcome. Modifying the current system would allow us to engage our community and filter listings based on projected demand.

Our membership could be a huge asset in determining whether or not there is sufficient demand to list a proposed protocol on Nexus. If we can show there is adequate demand from the outset, we can reach out and see if a team is willing to run a Shield Mining Campaign to bootstrap enough capital to back cover policies and reduce the cost of coverage to the target of 2.6% annually. The pricing mechanics will change when Nexus V2 launches, but for the purpose of this post, I’ll use the current minimum of 2.6% as the target.

Nothing in this post is steadfast. I’d love to hear what other Mutants think about a potential community-driven aspect to certain listings.

@BowTiedIguana, I know you brought up some similar points in your Sales efforts and onboarding new protocols forum post, so I’d be interested on your thoughts here, too.