Hi all - this is @rok one of the co-founders of etherfi.

Introduction

The following is a proposal to invest a portion of Nexus Mutual’s capital pool into etherfi’s weETH.

etherfi is the largest liquid restaking protocol on Ethereum. weETH is etherfi’s non-rebasing, natively restaked token. By holding weETH, users earn base staking yields, etherfi points, and restaking rewards. The staking rewards are based on the staked ETH amount and protocol’s subsequent yields. These have been performing at market since launch in November. Additionally users earn the restaking rewards based on the natively restaked ETH in the protocol level and protocol’s restaking yields (+ EigenLayer points). Users do not need to make separate actions or lock up their assets. Stakers can redeem ETH out of eETH/weETH without the 7 days withdrawal period as long as etherfi has the available liquid ETH in the contract. Users can always redeem 1:1. etherfi is the only native Liquid Restaking Protocol with withdrawals enabled. The depth of our liquidity on chain and having withdrawls enabled has helped us keep a very tight peg. Our whitepaper also provides a deep dive into the specs of the protocol.

Stakers through etherfi can stake in native ETH. At its core, etherfi is focused on decentralization as a primary objective and wants to minimize counterparty risk wherever possible. We want to be the safest, most decentralized staking option in the Ethereum network.

The benefits to allocating a portion of the treasury are:

-

Deep Liquidity and withdrawals - etherfi has the deepest liquidity on-chain of any LRT (liquid restaked token). The deep liquidity has helped us maintain a very tight peg.

-

Increased Rewards - In addition to the base staking rewards that Lido and Rocketpool provide, you will earn restaking rewards and both etherfi + EigenLayer points with weETH. The additional rewards are all upside, but are significant resulting in significant APY depending on when the ETH is staked.

-

Diversification of Ethereum - Lido now controls nearly 30% of validators on Ethereum which is a risk to the network. More stake across different providers is a good thing, etherfi has self limited to 22% of the network stake.

We appreciate all feedback through comments, suggestions, concerns/red flags, and areas that require further due diligence.

This is a Request For Comment with the expectation that after a period of discussion the proposal would move to a signaling vote, with options decided based on member feedback. etherfi will work to make sure Nexus Mutual is benefitting in every way possible from the etherfi protocol.

Rationale

Why Invest?

It has been well documented in prior proposals, including Proposal 13 (Lido) and Proposal 197 (Rocketpool), of the benefits of staking ETH. There is continued incentive to stake ETH from the mutual capital pool to earn yield while being long ETH.

Why etherfi?

etherfi is a decentralized, non-custodial delegated staking protocol with a Liquid Staking Token. One of the distinguishing characteristics of etherfi is being the only protocol where stakers control their keys. Having allocated some of the mutual’s capital pool already to staking, etherfi will allow for better diversification of the mutual’s stake and increased rewards. Furthermore, investing assets into etherfi will drive growth for the capital pool while prioritizing security.

With most other delegated staking protocols the starting point is that the staker deposits their ETH and is matched with a node operator, who generates and holds the staking credentials. Although this approach can be implemented such that the protocol is non-custodial, in practice in most cases it creates a mechanism that is custodial or semi-custodial. This can expose the staker to significant and opaque counterparty risk, you’re effectively forced to ask your node operator for permission to exit your validator. With etherfi the staker controls their keys and retains custody of their ETH while delegating staking to a node operator. This significantly reduces their risk surface area.

Nexus Mutual and etherfi have a working relationship already, as the Mutual provides cover for etherfi Liquid, which is a managed DeFi vault strategy.

Proposal

Amount and Duration of Investment

The proposal: Stake 6,585 in etherfi’s weETH

This represents investing ~7.54% of the mutual’s current Capital Pool.

There is no set duration for this investment. However, periodic reviews every 6 months including a call with the etherfi team to discuss updates, developments, concerns or additional staking opportunities.

The cap of the investment should aim to be around 15% of the pool as suggested for stETH and rETH.

Parameters

Minimum amount of asset: 6,585 ETH

Maximum amount of asset: 14,000 ETH

Technical

There are several users and stakeholders on etherfi:

-

Stakers who are also bond-holders

-

Stakers who only hold weETH or eETH, the etherfi LRT (Liquid Restaking Token)

-

Node operators

-

Node services users

Staking

Each validator is spun up using the workflow below:

-

A node operator submits a bid in order to be available to be assigned a validator node to run. Trusted node operators may submit a nominal bid to be marked as available. Trustless node operators participate in the auction mechanism and are assigned validators based on their winning bid.

-

The staker deposits their 32 ETH into the etherfi deposit contract. This triggers the auction mechanism and assigns a node operator to run the validator. This also mints a withdrawal safe and two NFTs (T-NFT, B-NFT) that confer ownership of the withdrawal safe. The T-NFT represents 30 ETH and is transferable, this is sent to the liquidity pool where weETH and eETH can be minted. The B-NFT represents 2 ETH and is soulbound. The only way to recover the 2 ETH is for the validator to be exited or fully withdrawn.

-

The staker encrypts the validator key using the public key of the winning node operator and submits it as an on-chain transaction. The transaction emits an event to which the node operator is listening.

-

The node operator launches the validator utilizing the decrypted validator key.

-

Node operator natively restakes the ETH on EigenLayer. Native restaking describes the process of changing an Ethereum validator’s withdrawal credentials to EigenLayer’s smart contracts. Native Restaking on EigenLayer consists of the following actions: Create New EigenPod, Set Withdrawal Credentials, Enable Restaking. Our whitepaper details more.

For more details on EigenLayer specifically they have good information on their site - https://docs.eigenlayer.xyz/eigenlayer/restaking-guides/restaking-user-guide/native-restaking/

- The staker (or node operator) may submit the exit command to exit the validator and recover the staked ETH into the withdrawal safe. The staker can then burn the NFTs to recover their ETH net of fees.The B-NFT is used to supply the deductible for slashing insurance (in case of a slashing event) and represents a responsibility to monitor the validator node for performance. It pays a higher yield than the T-NFT due to the added risk and responsibility. etherfi makes it easy to monitor validator performance via notifications and alerts. The B-NFT is used to supply the deductible for slashing insurance (in case of a slashing event) and represents a responsibility to monitor the validator node for performance. It pays a higher yield than the T-NFT due to the added risk and responsibility. etherfi makes it easy to monitor validator performance via notifications and alerts.

Rewards and Fees

Current rewards: 3.5% + points (etherfi and EigenLayer points have yielded ~70% APY)

Expected: ~7% in perpetuity. This rate is a bit more difficult to determine but AVS will pay for block space in the upcoming months, we’ve seen that to be around 100 basis points per AVS. This will be paid out in a variety of different ways, but we feel comfortable that it should be at least 7%.

Fees

90% of staking rewards go to the staker, 5% goes to the node operator, and 5% goes to the protocol. etherfi shares revenues they generate back with stakers and node operators. There are no other fees with any of our staking strategies, outside of initial gas fees to get staked.

Risks

Smart Contract Risks

Though our smart contracts will be crafted carefully, many times audited, and thoroughly tested, there always exist risks in interacting with smart contracts on the Ethereum network. etherfi has completed several audits.

Key Management Risks

With etherfi’s desktop and decentralized web applications, we’ve taken great care to utilize the latest, safest methods for key encryption and protection. However, ether.fi can make no guarantees or representation that our methods are or will remain 100% secure. Additionally, the care for one’s keys remains in the staker’s hands. Preventing user error, though a primary aim, is virtually impossible.

Regulatory Risks

etherfi firmly believes that the Ethereum network will become the settlement layer for global financial markets. Our convictions, however, are not guarantees about the future. Cryptocurrencies and Ethereum in particular have made the leap from niche to mainstream and this increase in prominence has been accompanied by an increase in governmental scrutiny. Any number of well-meaning and / or ill-informed public policies can temporarily or permanently derail the protocol, including but not limited to: bans on cloud service providers providing services to crypto related enterprises bans on ISPs providing crypto related services onerous taxes levied on various network transactions etc. We have taken every measure necessary to keep ourselves out of regions with heavy government scrutiny, including geofencing stakers in the US.

Qualitative vs. Quantitative Risk Assessment

Below are our self assessed risks using the assessment the mutual provided. We’ve provided further commentary on each below:

Illiquidity Risk - Low risk. weETH has deep liquidity on chain for normal swaps to ETH. Additionally, weETH can always be converted to eETH as per the rate provided per contract as calculated per the oracle. eETH is then redeemable for ETH, 1:1. The protocol keeps a buffer in the liquidity pool to facilitate these swaps.

Basis Risk - Low risk. Our protocol is ETH denominated, you can stake in native ETH as well.

Protocol Risk - Low risk. We take security very seriously at etherfi. We have done a series of audits and bug bounties. Additionally, we’ve provided a 3rd party risk assessment from Chaos Labs.

Liquidation Risk - Low risk. etherfi has no liquidation risk.

Leverage - Low risk. etherfi have no leverage.

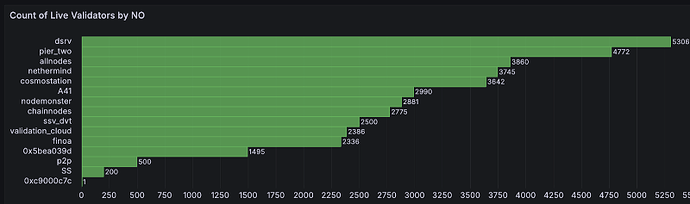

Counterparty Risk - Low risk. No node operator has more than 20% of our stake. We work with 10+ professional node operators and solo stakers. We have yet to have a slashing event. List of operators is below, with DSRV running the most nodes with ~13% of them.

Economic Risk - Low risk. Biggest risk would be slashing.

CLOSING REMARK

In conclusion, we believe etherfi provides an alternative for Nexus Mutual to safely increase their returns through restaking and diversifying from Lido and RocketPool. We appreciate your consideration and look forward to further strengthening our relationship with Nexus Mutual.

We could only post two links, so will put supporting links in as a comment.