Hi @Uisce.eth,

Very excited to see that there is now a rETH/ETH chainlink oracle and that liquidity for rETH is improving!

A few questions :

To acquire rETH, Nexus can either buy on secondary markets or mint it using the Deposit Pool (via 1inch/cowswap integrations).

To sell rETH, Nexus could sell on secondary markets or redeem in the Deposit Pool.

Is this correct?

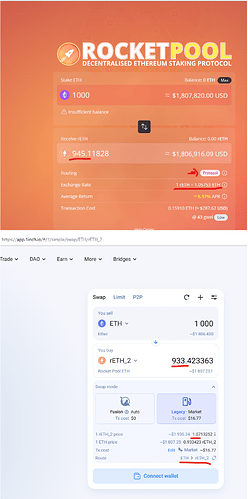

Could you give more details on how the price in the Deposit Pool is determined since there is a significant difference with the open market price :

–

Could you give more details on how the deposit pool is processed? If Nexus deposits 14 400 ETH via 1inch/cowswap, how long do you estimate it will take to be fully processed? What will be the impact on the overall yield of rETH as a result of our deposit, while it sits in the queue?

–

Can you be more specific on the mechanisms that will improve liquidity/redemptions?

–

Can you give more details on how this incentive works?

–

For the future proposal, I think it might be useful to provide a more detailed outlook of the risks as well as the rewards that the mutual can expect. Here is the past proposal for stETH as reference : Proposal: Increase the Allocation of the Capital Pool to stETH

–

Overall quite positive about this ![]()