Last call for comments, review period: 19–25 June

Snapshot signaling votes: Open for voting between 26 June until 3 July.

- Signaling Vote: Should the mutual Stake with Rocketpool (#1)

- Signaling Vote: Amount of ETH to allocate to Rocketpool (#2)

Introduction

The Rocketpool protocol is permissionless, non-custodial and with over 2350 node operators is by far the most decentralised Ethereum staking solution.

What is rETH?

rETH is the liquid staking token (LST) of the Rocketpool protocol, it is the third largest ETH liquid staking token by TVL after Lido’s stETH & Coinbase cbETH.

Unlike stETH, rETH is a value accruing token, as staking rewards accumulate the value of the rETH token increases relative to ETH. rETH holders pay a 15%~ commission on staking rewards to Rocketpool node operators (Post Atlas upgrade this will trend to 14% over time).

Proposal

Stake 14400 ETH, approximately 10% of the Capital Pool with Rocketpool by exchanging ETH for the rETH token.

Rational

Investments using the capital pool should ideally align with the following considerations:

The investment should conform to the assets held by the capital pool (ETH)

It should be relatively low-risk and require a low management overhead on behalf of the mutual.

It should have a low technical overhead for integration.

It should afford the mutual the ability to return to ETH quickly without a lockup period or penalties in order to pay claims if the need should arise.

Liquid staked ETH is obviously an ideal choice.

This has been demonstrated by the mutuals existing successful investment in stETH.

Rocketpool has long been discussed as a consideration for a similar investment by the mutual however it has been held back by the lack of a suitable oracle as well as the requisite capacity to support a sizable amount of ETH without paying a premium.

With the recent release of the chainlink rETH/ETH Oracle as well as the Atlas upgrade which significantly boosted Rocketpool’s available capacity, these are no longer obstacles.

Rocketpool also has a large and notoriously passionate community of Defi enthusiasts which through this proposal, could be introduced to the mutual.

Amount

The capital pool currently holds 96939.7~ unproductive ETH, 32244~ stETH and 3619448 DAI with a further 13218~ WETH held in the Enzyme Vault.

A 14400 ETH investment (approximately 10%) staked with Rocketpool is significant but in-line with the low risk profile & suitability of liquid staked ETH.

As rETH can be held directly by the Mutual and exchanged easily through the Cowswap integration, this allocation can be easily adjusted to suit a future matching of capital to ETH/DAI liabilities if deemed desirable.

Technical & Oracle

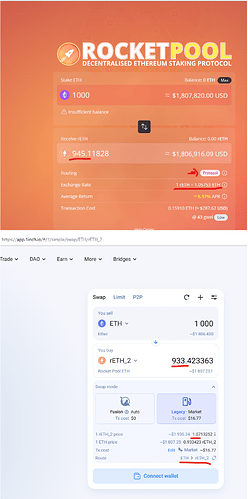

The Mutuals existing Cowswap integration can be used for a direct exchange requiring no additional development work.

The 1inch aggregator is currently updating its integration with the Rocketpool Deposit pool to match the scaling maximum now possible with the Atlas upgrade.

Once complete, The Cowswap integration via 1inch will be able to mint rETH directly through Rocketpool at the native asset value with no slippage. Minting rETH directly has a 0.05% fee to prevent gaming around exchange rate updates, this represents 3-4 days of staking rewards.

Chainlink rETH/ETH oracle - https://data.chain.link/ethereum/mainnet/crypto-eth/reth-eth

Peg Risk

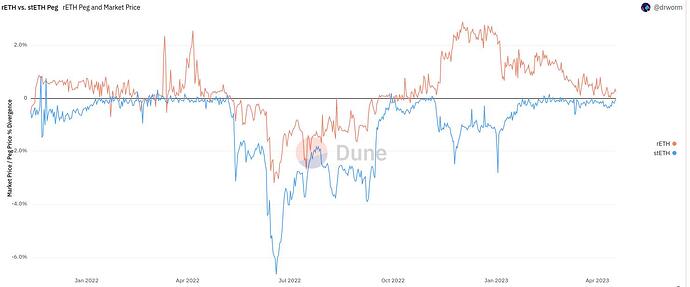

Compared to other LSTs, rETH has demonstrated a strong resistance to trading under the native asset value in varying market conditions, this is partly due to a sustained high demand for the rETH token as well as increased redemption confidence due to the ability to burn rETH directly in the protocol for it’s ETH value.

Source: https://dune.com/queries/1286351/2204808

Rocketpool primarily maintains the peg by utilising market arbitrage opportunities available to node operators. If a discount exists on secondary markets, node operators are incentivised to purchase rETH and exit their validators, this provides an opportunity to burn the purchased rETH at full value as they finalise their exit.

Protection from loss of value due to penalties or slashing.

When creating a validator, a Rocketpool node operator contributes a bond of either 8 or 16 of their own ETH as well as a supplemental collateral in the RPL token of at least 10% of the value of the matched ETH provided by stakers in the pool (2.4 ETH worth or 1.6 ETH worth, respectively).

In the event of the validator receiving penalties or being slashed, the node operator’s ETH bond is penalised first, followed by their RPL collateral. Only if the amount of lost ETH exceeds this amount does rETH suffer a socialised loss.

Rocket Pool Node Operator Set

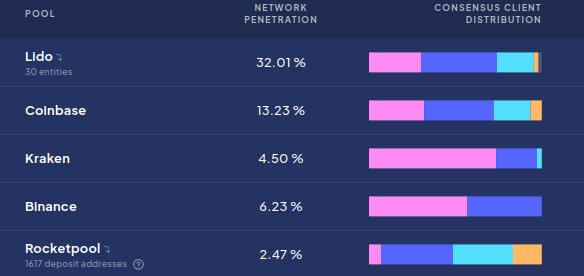

Though Rocketpool has only 2.5%~ of the total staked ETH, there are over 2350 node operators, with an estimated 1600~ unique entities. Compared to approximately 30 operators for Lido, the next most decentralised option.

As a truly decentralised protocol, Rocketpool is also resistant to interruption of staking services as a result of regulatory or enforcement action, such as what has been experienced by users of Kraken. A geographically diverse set of small operators staking from home reduces the fragility of rETH as well as the Ethereum network as a whole.

As the Rocketpool node operator set consists of a large selection of individual operators with varying hardware & setups, outages & slashings tend to be isolated to a single or small number of validators. Contrast with large institutional staking, where a single mistake can cause the slashing of hundreds of validators at once.

This along with an emphasis on staking client diversity means the likelihood of a large correlated slashing event occurring with Rocketpool is very low.

Source: rated.network (note the increased use of minority clients)

However should a black swan event occur, due to the bond & collateral design, the rETH token has best-in-class resistance to losses in such an event.

This article has a comparative analysis of the different approaches to staker protection taken by Rocketpool, Lido & Stakewise - LSD Insurance, Illustrated

(Note: The bonded design is now even more robust due to the implementation of skimming)

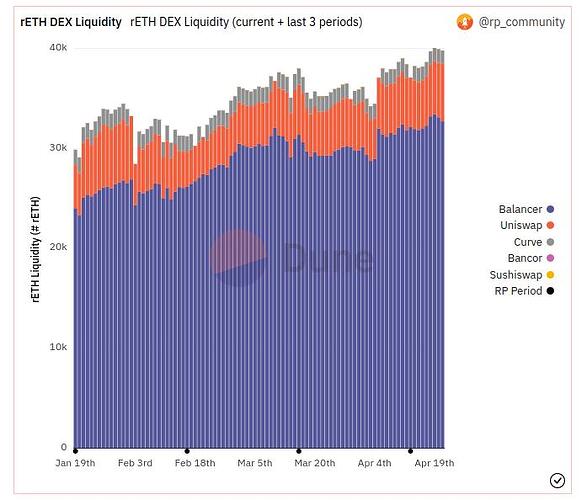

Liquidity

Historically secondary market liquidity for rETH has been relatively low compared to stETH but through the introduction of the Incentive Management Committee, the Rocketpool protocol DAO has committed to a long-term incentive program with the goal of encouraging the growth of deep liquidity and facilitating the redemption of large amounts of rETH with low slippage.

As capacity for rETH has recently opened up, we expect liquidity to increase going forward.

Using the mutuals existing Cowswap functionality, at the time of writing it is possible to immediately exchange approximately:

5000 ETH worth of rETH with 0.15% slippage.

14400 ETH worth of rETH for ETH with 0.63% slippage.

This assumes the Rocketpool Deposit pool is completely empty, in the event that it is at maximum capacity as has been the case for most of its history, it would be possible to redeem over 18000 ETH worth of rETH immediately with zero slippage or potentially even at a premium.

Cover Risk

Unlike Lido (via cvxstethCrv Yield token), Coinbase (Custodial Cover) or Stakewise (ETH2 Slashing Cover), Rocketpool is not covered by the mutual in any capacity and therefore an investment does not conflict with any existing exposure.

Smart Contract Risk

Rocketpool takes security very seriously and no piece of code touches mainnet without receiving audits from a top tier audit firm.

The Rocketpool smart contracts have received extensive and independent audits from Consensys Diligence, Sigma Prime & Trail of Bits.

Audits

Consensys Diligence

2023/01 - https://rocketpool.net/files/consensys-diligence-atlas-v1.2.pdf

2022/06 - https://rocketpool.net/files/consensys-audit-redstone.pdf

2021/05 - https://consensys.net/diligence/audits/2021/04/rocketpool/

Sigma Prime

2022/12 - https://rocketpool.net/files/sigma-prime-atlas-v1.2.pdf

2022/06 - https://rocketpool.net/files/sigma-prime-audit-redstone.pdf

2021/11 - https://rocketpool.net/files/sigma-prime-fix-review.pdf

2021/05 - https://rocketpool.net/files/sigma-prime-audit.pdf

Trail of Bits

2021/10 - https://github.com/trailofbits/publications/blob/master/reviews/RocketPool.pdf

Bug Bounty

There is also an ongoing bug bounty program with Immunefi for up to $250,000

https://immunefi.com/bounty/rocketpool/

Further Resources

Maker rETH Collateral Onboarding Risk Evaluation

Aave [ARC] v3 Ethereum market rETH onboarding

Rocketscan.io - Rocketpool statistics

Dune - @rp_community

A note on The RFC from Avantgarde Finance

Having read the proposal I am supportive of the prominent inclusion of rETH.

However as others have pointed out, holding rETH directly in the capital pool is easily actionable and it is questionable whether the additional management oversight with corresponding fee is a meaningful benefit.

Disclosures

I am a member of the Rocketpool Protocol DAO Incentive Management Committee and have been a member of the mutual since 2020.

Proposal Status

This RFC was posted on 24 April, and the Investment committee has issued a last call for comments during the next week (19–25 June)!

They want to hear your feedback and comments on this RFC before a non-binding Snapshot signaling vote is opened to gauge member sentiment regarding this RFC proposal.

Status:

Open for comments: 19–25 June- Snapshot signaling votes: open from 26 June until 3 July

Edit: @BraveNewDeFi added the proposal status and timelines for review, per @Rei’s message in the thread below.

Edit 2: @BraveNewDeFi updated this RFC to include links to the non-binding Snapshot signaling votes at the start of this RFC and in the Status section.