[RFC]: Update Protocol Cover wording

Summary

Since the first iteration of Protocol Cover launched, both the community and Foundation + DAO teams have identified areas for revision and improvement to the existing Protocol Cover wording v1.0.

I request that Nexus Mutual members review the proposed changes to Protocol Cover and work to revise Protocol Cover wording v1.0 to an updated Protocol Cover wording v2.0. This request for comments [RFC] will be open for at least twelve (12) days.

At either the end of the twelve (12) day period or when members’ comments are addressed, I will propose a formal NMPIP to update Protocol Cover wording.

Proposed Protocol Cover wording v2.0

Rationale

In 2021, Hugh first proposed updating Smart Contract Cover v1.3 in the Protocol Cover (new cover wording) post on the forum. After receiving feedback, this was then moved to an on-chain vote, where members approved the more comprehensive Protocol Cover to take effect.

Since the launch in 2021, there have been five (5) loss events where members voted to approve and pay claims. There were also a few claims that were submitted, which were not covered. From those claims events and feedback from members, the Foundation and DAO teams identified areas for improvement and clarification.

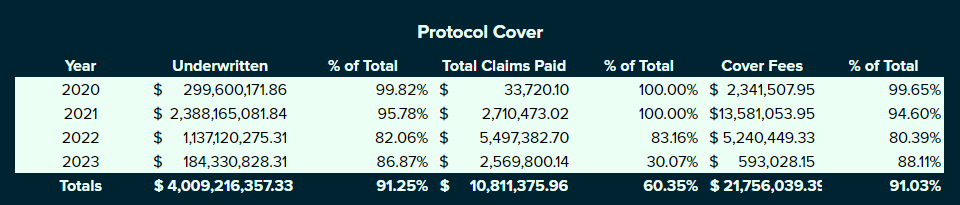

Below, I’ll review some of the past loss events and claims filed, as well as the lessons learned from each one. I’ll refer to figures in the table below throughout.

Note: the total claims paid reflects all claims paid across Smart Contract Cover and Protocol Cover.

Source: Cover Dune Dashboard, Claims Dune Dashboard

Covered loss events since 2021

Since Protocol Cover launched in April 2021, the mutual has paid $8,403,526.87 in claims across the CREAM Finance, Rari Capital Fuse, Perpetual Protocol V1, Bancor V3, Euler Finance, and Ease loss events. This represents 46.85% of all claims paid; important to note that Protocol Cover has been the most successful cover product launched to date and has earned members considerably more than claims paid.

As broken down by loss type:

-

Code being used in an unintended way | $7,641,583.91

-

Economic design failure | $761,942.96

Controversial claims that were paid

Members discussed both Perpetual Protocol V1 claims and the Bancor V3 claim at considerable length, since some members classified these as caused by economic design failure. Because this protection is vague, it has been cited in various other claims as the reason for a loss.

The “economic design failure” clause potentially opens members up to market-based risk and other such edge cases, which was not the original intent when the original Protocol Cover proposal was discussed in early 2021. Instead, it was designed to cover edge cases such as the MakerDAO Black Thursday event, where the code performed as it was designed but allowed people to submit 0 DAI bids and win auctions, which resulted in bad debt accruing within the protocol.

In the Proposed changes section below, you can review the suggested change to update this protection to Sudden and Severe Economic Event, which is well defined to provide members with clarity on exactly what is covered by this clause.

Improvements to add clarity

In the past, claims have been filed by members, who cited frontend attacks, user interface issues, and token depegging events (e.g., the UST depeg) as the cause for their loss, although Protocol Cover only protects against a loss of funds within one designated protocol.

In the Proposed changes section below, you can review the suggested additions to the Exclusions section, where these events have been noted as exclusions to provide further clarification to members who buy Protocol Cover.

Section covering Reimbursements and how they are treated

In the current Protocol Cover wording, there is no guidance on how reimbursement is handled when a member has redeemed a claim prior to receiving reimbursement directly from the designated protocol. It is clear that the objective of Protocol Cover is for a covered member to be able to seek recovery if there is a loss of funds, not for a covered member to benefit from additional income.

To clarify how reimbursement is treated in relation to claims filing, the Reimbursements section has been added, as outlined in the Proposed changes section below.

Transferring Cover NFTs after a loss event

The last change I’ll highlight before itemizing the others below is in relation to how Cover NFTs are treated.

Now that Covers are tokenized as NFTs, there is potential for people to either sell or transfer Cover NFTs after a loss event to others who realized a loss but did not buy cover before the loss occurred. This would expose the mutual to greater losses in the future, so a provision in the Protocol Cover wording has been added under clause 1.2 to protect against people trading Cover NFTs after a loss event occurs.

Specification

If members support updating Protocol Cover from v1.0 to the proposed v2.0, changes to the following sections apply but are not limited to (please read the proposed Protocol Cover wording for a complete review of the changes):

-

Removed the plain English overview to avoid confusion, as an overview is already provided in the Terms and Conditions when members get a quote before buying cover.

-

Changed the wording in the opening clause from “…may pay a claim…” to “…may approve a Claim…” to reflect that members have the discretion to approve claims and, if approved, claimants can redeem their requested claim amount.

-

Changed clause 1 and associated subclauses to better define the protections Protocol Cover offers

-

Introduced a Deductible, which is 5% of the Claim Amount.

-

Collected into Sudden and Severe Economic Event, which includes oracle failure, governance attacks, and severe liquidation failures.

-

-

Clause 1.4 has been amended to increase the “cool-down period” from 3 days to 14 days. This allows members more time to wait for a post-mortem and any potential plans for a protocol team to reimburse users directly. For many loss events, post mortems are delivered between 7-12 days after the loss occurs.

-

Clause 2 was added to clarify that members whose claims are approved are able to redeem their requested Claim Amount within thirty (30) days of a claim being approved by Claims Assessors.

-

Under Exclusions, we’ve proposed the following additions:

-

any events or losses where the vulnerability in a deployment of the Designated Protocol originates on a non–Ethereum Virtual Machine compatible chain.

-

any events or losses resulting from the de-peg of any asset that the Designated Protocol generates.

-

Any events of losses due to the user interface or website errors where the Designated Protocol continues to act as intended.

-

Any events or losses due to the failure of any components of the Designated Protocol that are used to bridge assets from one blockchain to another.

-

Any events or losses that occur prior to the Cover NFT being transferred to another address unless it meets the criteria listed in clause 1.2.

-

-

Addition of the Claim Amounts section, which:

-

Clarifies that requested claim amounts should reflect actual loss when the actual loss amount is less than the total covered amount

-

Defines that losses due to Sudden and Severe Economic Loss Events are limited to losses that occur within the first two (2) hours, so members are not exposed to losses that occur over longer periods of time.

-

Provides clarity on how loss is calculated for members filing claims and members assessing claims

-

-

Addition of Reimbursements section, which outlines that members who buy cover and redeem a payout agree to assign all rights over any recoveries or Reimbursements to Nexus Mutual DAO and/or the Foundation.

- Clause 9 specifies that, where possible, members who file claims should send any tokens that are likely to be used by the Designated Protocol for future Reimbursements to Nexus Mutual DAO and/or the Foundation in advance of submitting a claim.

-

Added more defined terms to provide more clarity to members buying cover and assessing claims

-

Claim

-

Claim Amount

-

Claim Assessor

-

Cover

-

Cover NFT

-

Covered Member

-

Deductible

-

Foundation

-

Loss Event

-

Material Loss

-

Member

-

Member Address

-

Member Smart Contract Data

-

Reimbursement

-

Sudden and Severe Economic Event

-

User

-

See the redline and proposed Protocol Cover wording v2.0 below.

RFC | Comment and Review period

This RFC post will be open for review and comment from 7–20 June.

NMPIP

If no substantial comments are received, this proposal will transition to a Nexus Mutual Protocol Improvement Proposal (NMPIP), which will open for comment from 21 June and will close on 9 July.

On-chain vote

After 10 July, the NMPIP will transition to an on-chain vote, which will open after 9 July.

We look forward to the community’s review and comments!

Proposal Status

- Open for comment