Last call for comments, review period: 19–25 June

Snapshot signaling vote: Open for voting between 26 June until 3 July.

Context

Nexus Capital Pool liquidity is intended to be utilised in productive venues, following the investment philosophy described here and Nexus Community leanings expressed on various posts in the forum.

This RFC proposes allocating 5% of the 96,956 ETH (i.e. 3.35% of the Total Capital Pool Liquidity) in Morpho-Aave V2/V3 to earn interest from lending ETH while maintaining directional long exposure to ETH

About Morpho

Overview

Morpho is a lending protocol, the third biggest on Ethereum after Aave and Compound, with +$700m currently deposited.

Morpho improves the capital efficiency of positions on lending pools such as Aave and Compound by matching lenders and borrowers peer-to-peer, strictly improving APY on both sides. While offering superior rates, Morpho preserves the same user experience, liquidity, and parameters as the underlying lending protocol.

Morpho has raised $20M, with the latest $18M funding round led by a16z crypto and Variant.

Morpho value proposition

On Morpho, depositors/borrowers can receive two rates:

- Liquidity is matched peer to peer: users receive an improved rate, called the p2pRate

- Liquidity is not yet matched (peer to pool): users receive the APY of the underlying pool Indeed when a Morpho user is not matched, Morpho will tap into the liquidity of the underlying lending pool. In this case, Morpho redistributes all the pool APY + all pool liquidity rewards.

If there are not enough peers to match the total amount that a user deposited/borrowed, it is possible to have some funds matched and the rest sourced through the pool. In this case, the liquidity that matches P2P will earn the P2P APY while the rest of the liquidity will earn the pool’s APY. Either way, users always have the incentive to deposit in Morpho as they’re getting better/equal rates equal to one of the underlying protocols alongside MORPHO tokens that are currently distributed

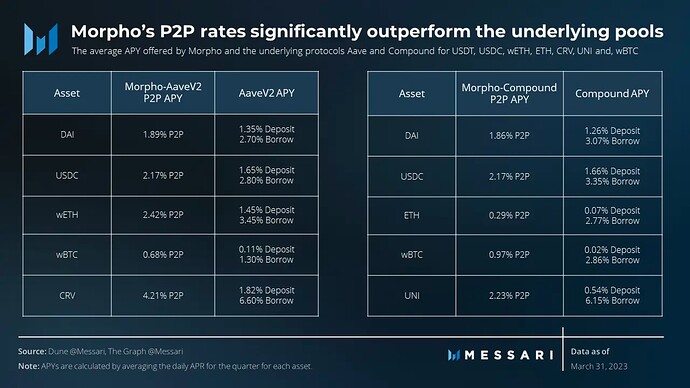

Using Messari’s data from Q1-23, Morpho-Aave outperforms the underlying pools by:

- +42.85% on the DAI market

- +29.03% on the USDC market

- +42.56% on the wETH market

Morpho matches users Peer to Peer using a matching engine. Learn more

A robust and conservative strategy for Nexus

Nexus philosophy of investment

Considering ETH as cash, Nexus defines investment risk relative to holding ETH. From this ETH base, Nexus introduces three risk buckets for its investment strategy: lower, medium, and higher risk. stETH is used as the benchmark for yield and the lower risk bucket will consist mostly of ETH2 staking. The lower risk bucket has a max allocation ranging from 30% to 80%.

Morpho risks profile: lower risk

| Type of risk | Risk level |

|---|---|

| Illiquidity Risk | LOW |

| Morpho position can be withdrawn instantly, in a block’s time. Morpho is as liquid as the underlying borrowable lending pool. If you can immediately borrow billions on Aave - Open Source Liquidity Protocol (resp. Compound), you will be able to immediately withdraw/borrow billions on Morpho-Aave (resp. Compound). | |

| Basis Risk | LOW |

| Supplying ETH on Morpho is ETH denominated | |

| Protocol Risk (DeFi Safety Score) | LOW |

| Morpho is the number 1 out of 300+ projects on https://defisafety.com/appwith a 98% mark | |

| Liquidation Risk | LOW |

| Morpho replicates on-chain the different risk parameters of the underlying lending pool, like the oracles, collateral factors, close factors, etc. | |

| Leverage | LOW |

| Supply ETH on Morpho doesn’t involve leverage | |

| Counterparty Risk | LOW |

| Morpho is permissionless and non-custodial. Aave is permissionless and non-custodial | |

| Economic risk | LOW |

| Risk of attacks on collateral + the risk of morpho being liquidated, however, As long as liquidators perform liquidations, Morpho cannot be liquidatable. |

Morpho belongs to the lower risk bucket, with the same risk parameters as Aave but a strict APY improvement.

Proposed allocation strategy in Morpho

Given the max allocation rules exposed earlier and the degree of risk incurred by Morpho, an initial deposit of 5% of the 96,960 ETH (i.e. 4.848 ETH or 3.35% of the Total Capital Pool Liquidity) into Morpho-Aave is proposed. This amount would be earning improved rewards from lending ETH while leaving substantial room for higher yield/riskier strategies.

Morpho exemplified different allocation scenarios below to give perspective to the community and help make them an informed decision.

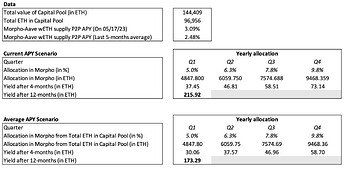

Projected Returns for the Capital Pool

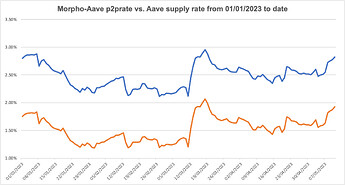

ETH being an oversubscribed market on the demand side, Nexus ETH allocation would be 100% matched peer-to-peer, thus enjoying improved rates. Using data from the last 5-months), the average P2P rate (supply rate) on Morpho Aave is 2.48% (3.09% on 05/17/23)

Nexus can then expect to grow its treasury by the following:

MORPHO Liquidity Incentives

Morpho currently offers liquidity incentives in the form of the MORPHO token, distributed based on liquidity provided to the protocol across multiple “ages” subdivided into claimable periods via Merkle Tree reward distribution. The MORPHO token is not transferrable as of now.

Diversification option from holding Liquid Staking Tokens

Morpho-Aave is the best place to lend ETH with reduced exposure to LSTs. If LSTs depeg/get slashed a lot, borrowers get liquidated and ETH is safe. If liquidators fail, there is however a dependency).

In that sense, supplying ETH on Morpho offers diversification from validator and slippage risks that accompany holding Liquid Staking Tokens. Indeed, Morpho enables enhanced “liquidity”: if the unstaking queue is full, it may be better to have a position on Morpho to withdraw liquidity rather than LSTs. This is even more valid for large positions that would have a large slippage to exit

Risks, tracking, and decentralization

Aave/Compound risk frameworks

Morpho being built on top of Aave/Compound, it inherits their high-quality code as well as their risks. Today, the risks related to the Aave platform are:

- Smart contract risks (risks of a bug within the protocol code)

- Economic risk (risks on the collateral liquidation process)

In order to minimize smart contract risks:

- Aave V2 holds security at its core with audits by Consensys Diligence, CertiK and Certora as detailed in Security & Audits.

- Aave V3 holds security at its core with V3 audits by Trail of Bits, ABDK, Peckshield, OpenZeppelin, [SigmaPrime] and formal verification by Certora further detailed in Security & Audits

- Aave has an ongoing bug bounty campaign live and running.

- The Compound protocol has been reviewed & audited by Trail of Bits and OpenZeppelin.

- The Compound protocol was developed with specifications of security principles, and formally verified by Certora using Certora ASA (Accurate Static Analysis), which is integrated into Compound’s continuous integration system.

In order to minimize economic risks:

- Liquidators receive discounted collateral in return (also known as the liquidation bonus) which creates incentives for them to liquidate. On both protocols, the liquidator ecosystem is extremely competitive and active

- An Aave Market Risk Assessment has been produced by the quantitative modeling team of Gauntlet Networks which was then reviewed after the CRV event in 11/23. Aave V1, V2, and the Safety Module have been stress tested via agent-based simulation. The simulations show the model is currently able to remain solvent under extreme market conditions, showing appropriate risk management. As a result, Gauntlet Network provided some parameter suggestions to further reduce the risk of insolvency.

- Aave has built an elaborate due diligence process, developed by the Risk Management Team, to assess the risk of currencies supported by Aave. The risk assessment considers market, counter-party, and smart contract risks for the currencies selected for the Aave protocol, aiming to contribute to higher risk standards within DeFi.

- Aave V3 brings improved risk parameters and new features to protect the protocol from insolvency.

- Gauntlet has constructed a simulation-based market stress-testing platform to evaluate the economic security of the Compound protocol, as it scales supported assets and volume.

Morpho smart contract risks

Morpho adds extra lines of code compared to a lending pool alone. The top audit firms worldwide performed over 20 audits to limit this additional risk. Morpho Labs team also formally proved part of the protocol in a Yellow-Paper and with the help of Certora.

In more detail:

- Morpho is the number 1 out of 300+ projects on DeFi Safety with a 98% mark.

- 20 audits were made on Morpho contracts with top-tier auditors like Trail of Bits, Chainsec, Spearbit, etc. Morpho has a recurrent partnership with Spearbit.

- Parts of Morpho’s code were formally verified in Why3 or with Certora’s automatic formal prover

- Morpho’s logic has been formally described in the [Yellow Paper]). The Yellow Paper also proves important properties about the improvement of Morpho compared to underlying lending pools.

- Morpho has a large $555,555 Immunefi Bounty for smart contracts and front end

Morpho economic risks

As Aave, Morpho bears the risk of the collateral listed on the protocol. Yet, out of the 21 assets listed on Aave, Morpho listed only the 7 considered the safest. Moreover, Morpho replicates the exact same risk parameters of aave (LT, LTV, oracles, …) for each asset.

Moreover, Morpho bears the risk of the health of its position in Aave itself. Liquidations happen when the ‘health factor’ of an account’s total loans is below 1, anyone can make a liquidationCall() to the [Pool] contract and pay back part of the debt owed

However, as proven in the Yellow Paper, Morpho cannot be liquidated if there are working liquidators on the protocol (see the “non-liquidation theorem” references in sections 3.4 and 6.4). The intuition behind it is that an aggregation of healthy positions is a healthy position itself.

A “supply-only” position on Morpho does not require active management as it does not have any liquidation risk. Yet, as in any lending protocol, there is a risk of bad debt. Bad debt occurs for a protocol when accounts that should have been liquidated weren’t (usually because the value of the collateral dropped instantly)

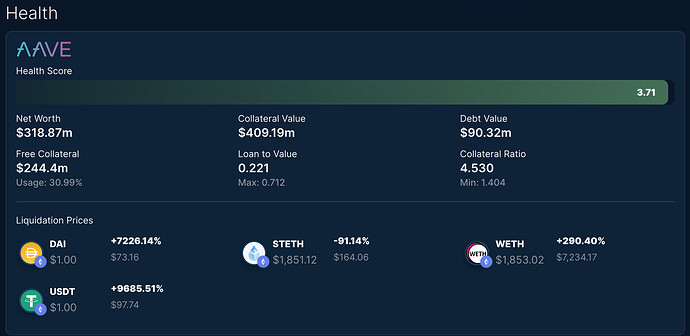

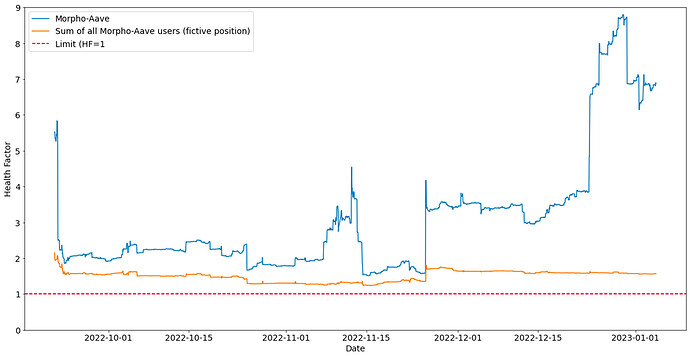

Warden Finance enables tracking the health of the Morpho position taken on the pool.

At the time of writing, Morpho-Aave V2 Health Score is 3.71 which means Morpho is only using 30.99% of its potential borrowing power.

Over the period 10/22-01/23, looking at the comparison of the evolution of the health factor of Morpho-Aave and that of its users combined, Morpho-Aave is healthier and the HF belongs to the 2-9 interval and is trending higher. (See image below). More color on this here

Tracking a position on Morpho

Many tools can help one track positions on Morpho. Specifically, Warden.Finance can also be used also to give a comprehensive overview of a position on Morpho for a given address including:

- P&L

- Positions breakdown

- Health

- Transactions Simulation tool

A “supply-only” position on Morpho does not require active management as it does not have any liquidation risk. At the time of writing, Morpho-Aave V2 Health Score is 3.71 which means Morpho is only using 30.99% of its potential borrowing power.

Nexus could be monitoring more closely when the Health Ratio of Morpho-Aave V2/V3 position approaches the 1.2-1.5 range and should consider taking action if it ever goes lower and could use HAL to create tailored notification alerts. These numbers are arbitrary and should be used for guidance only.

Morpho organization & Ownership

The Morpho Association is a French nonprofit entity grouping the main contributors and users of the Morpho protocol. Its aim is to develop the Morpho protocol by funding contributors, or by facilitating access to the protocol for users and developers.

Morpho Labs is a core contributor to the Morpho protocol. The company researches and develops new protocols to improve Morpho Additionally, it creates various tools to enhance the functionality and capabilities of Morpho

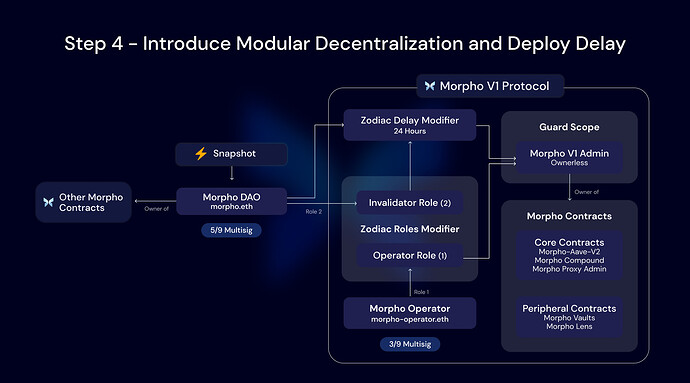

The Morpho Association deployed the foundational Multisig of the Morpho DAO. The signers include nine association members and require five signatures to approve a transaction, making it a 5/9 Multisig. In June 2022, the association deployed the first instance of the Morpho Protocol and transferred its ownership to the 5/9 Multisig.

This page contains all the relevant signers and modules in the DAO infrastructure.

Morpho’s current Decentralization framework

Decentralization is paramount to Morpho and the Morpho Protocol. The Morpho Association has begun a process of “Progressive Decentralization” via the Gnosis Zodiac Roles tool, to transfer control entirely to the Morpho DAO which is made up of $MORPHO token holders.

Morpho decentralization is a 7-step process currently in stage 4 called “Modular Decentralization and Deploy Delay”. Basically, the ownership of core contracts was transferred from the original 5/9 Morpho DAO Multisig to a new ownerless safe, a Delay Modifer module was deployed, and an Invalidator role was given to the 5/9 multisig.

Future Decentralization of Morpho

The future of Morpho decentralization is a work in progress that include 3 more stages eventually allowing to:

- Enable Governance Initiated Transactions

- Revoke Multisig Transactions

- Depreciate Multisig

Fees, and options

Fees

Using Morpho incurs no fees at the moment.

Deposit options

Morpho contemplates two deposit options:

- Nexus Treasury can deposit straight into Morpho from the Morpho App or the Safe App Hub, without any additional counterparty risk, for free. In the event of Nexus having specific integration requirements, Morpho would be happy to support the integration work and offer a peer review of the code. We’ve done this in the past with some integrators and was proven extremely useful.

- If some complex engineering work is required from Nexus to allocate on Morpho (like an oracle), Morpho is aware of the relationship Nexus has with Enzyme-Finance, the work done on the custom Chainlink oracle reporting the value in ETH back to the Capital Pool, (necessary to keep accounting the assets for possible claims) and other Enzyme features potentially dear to Nexus. Therefore, depositing into Morpho could be done through a vault managed by Enzyme. This option would require integration from the Enzyme side as well as community approval

After the implementation of this initial deposit, we propose a periodic re-assessment of the status of the vault to assess its performance and potential future allocation with the Nexus community

Useful links & metrics

| Protocol | Morpho |

| Strategy | Morpho-Aave v2 - Morpho-Aave v3 |

| App | https://aave.morpho.xyz/ // https://aavev3.morpho.xyz/ |

| Docs | https://docs.morpho.xyz/start-here/homepage |

| Blog | https://medium.com/morpho-labs |

| White Paper | https://whitepaper.morpho.xyz/ |

| Yellow Paper | https://yellowpaper.morpho.xyz/ |

| GitHub | https://github.com/morpho-org |

| Total supply to date | $734,000,000 |

Proposal Status

This RFC was posted on 24 May, and the Investment committee has issued a last call for comments during the next week (19–25 June)!

They want to hear your feedback and comments on this RFC before a non-binding Snapshot signaling vote is opened to gauge member sentiment regarding this RFC proposal.

Status:

Open for comments: 19–25 June- Snapshot signaling vote: open from 26 June until 3 July

Edit: @BraveNewDeFi added the proposal status and timelines for review, per @Rei’s message in the thread below.

Edit 2: @BraveNewDeFi updated this RFC to include links to the non-binding Snapshot signaling vote at the start of this RFC and in the Status section.