Hey Muir glad to have you on board and thanks for your proposal. The Investment Committee (recently set up) has been looking into this issue and I think generally the community agrees that something should be done on this front.

A few comments :

Scenario 1.

Completely make sense to buy wNXM below book value as it is value accretive for the mutual.

Scenario 2.

I don’t agree here. Buying wNXM above book value means that we are trying to artificially maintain a price for the token, using our Capital Pool. In a long enough timeframe, it leads to the distribution of our Capital Pool to the market.

alternative : we could hold at 0 value (meaning it counts as 0 in the MCR calcs) the wNXM bought below book value. This way, MCR drops below 100% and arbitrageurs are no longer able to redeem cash inflows from the bonding curve.

Liquidity

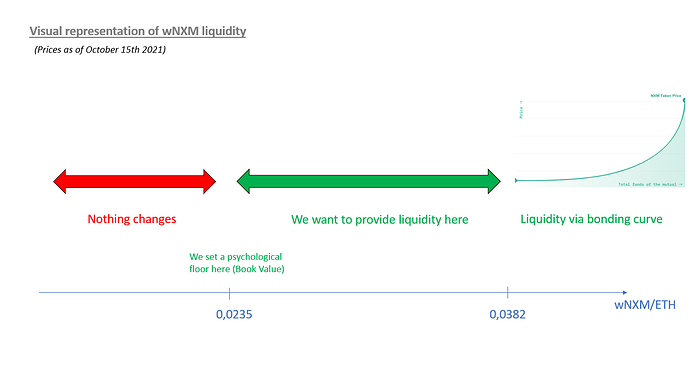

Also agree something should be done on this front. However, providing liquidity on Bancor/Sushi would mean providing liquidity for all prices. The issue is we don’t need to provide liquidity above MCR=100% prices. Also, we don’t want to provide liquidity for prices below book value. Here is a representation of what I mean :

The solution would be to provide liquidity on Uniswap v3 for the range of prices between book value and the bonding curve price.

Implementation

The team will have better insights about this but development resources are a real bottleneck. In order to automate everything, it would require to do direct integrations with the Capital Pool and lots of development.

But it would still possible to do it custodially/with a multisig and it would be way easier.

Ultimately, if the lights are green on the legal/tax front, it will be up to the community to vote on this! Happy to have this discussion!