Introduction

The purpose of this post is to adjust the way NXM is bought back from the market.

Problem

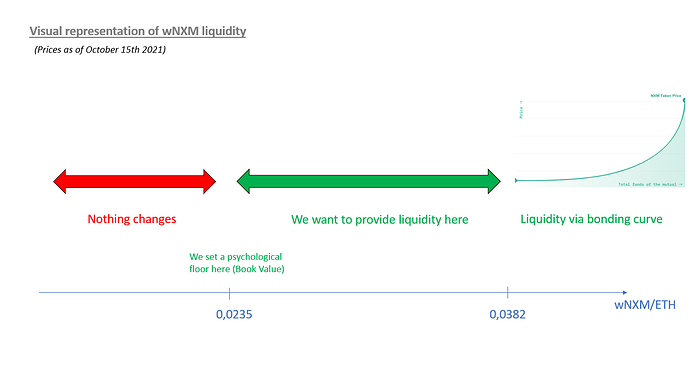

Currently wNXM is trading at a large discount to NXM due to the MCR% remaining under 100% for an extended period of time. The only people who are able to sell to the bonding curve are bots who sell immediately when the MCR% rises above 100%. This is extracting value from members of the Mutual who are forced to sell wNXM at a large discount if they need liquidity. While the long term solution to this is to increase the MCR%, there are short term solutions that can benefit both the Mutual and members who would like to sell.

Proposed Solution

There are 3 different wNXM scenarios that need to be accounted for:

- wNXM is trading below book value (As it is currently)

- wNXM is trading above book value but below bonding curve price

- wNXM is trading above bonding curve price

Scenario 1.

In the case where wNXM is trading below book value, it makes sense for the mutual to repurchase as much wNXM as possible. This increases the book value of everyone else’s NXM because the circulating supply decreases more than the Net Asset Value of the mutual. (Everyone’s NXM will be redeemable for more ETH if the mutual were to dissolve)

Scenario 2.

While wNXM is trading above book value, but below the bonding curve price, the Mutual should only be purchasing NXM from the open market (Buying wNXM and not buying on the bonding curve). To make this happen, I suggest implementing a lower MCR% threshold of 95% for the Mutual to purchase wNXM using the capital pool. Whenever the MCR% is above 95%, the mutual will purchase wNXM off the market as long as the price is below the bonding curve price. This means that arbitrage bots will not be able to redeem NXM against the bonding curve because MCR% will stay below 100% until wNXM trades in line with NXM, and that arbitrage profit will instead go to Mutual members.

Scenario 3

In the case where wNXM is trading at or above the bonding curve price, the Mutual should not be purchasing wNXM. In this scenario, people will be buying NXM from the bonding curve and selling it to the market as wNXM to equalize the prices.

Additional Notes

As the Mutual buys wNXM from the market, it also would make sense to add these tokens as liquidity to an wNXM/ETH AMM. (Bancor/Sushi/Etc). This would deepen the wNXM liquidity and earn fees for the protocol, without actually taking on any additional downside risk. (Since the Mutual would be holding eth anyways and there is a set Eth value for each wNXM via the bonding curve)

It should be noted that any attempt to buy wNXM below book value would probably be front run by speculators, so the actual capital requirements of raising the wNXM price to book value would be low. (although the more wNXM that can be bought below book value, the better for Mutual members)

The buying of wNXM could be fully automated using on chain keepers, or manually triggered by members of the Mutual. In either case, specific parameters for purchasing could be defined in a smart contract. Some thought would need to be put into ensuring that wNXM buybacks were not front run.

Conclusion

The best long term solution is to raise the MCR% via capital inflows, but this will take a significant amount of time, and it is beneficial to Mutual members to have liquidity now. The solution I propose solves the issue of liquidity while also generating significantly increased revenue compared to the current model. I would love to hear any comments or alternative solutions to this issue.

It has been mentioned that there may be Legal/Tax limitations to this approach. Any details regarding this would also be very helpful.