There have been some interesting suggestions in this thread and it’s great to see the community so engaged with a topic.

I agree that purchasing wNXM below book book value makes sense for the mutual, and would like to see this go to vote soon.

In terms of buying wNXM above book value, but below the bonding curve price, think how this would work. We buy 1 wNXM at say $120, and then we redeem it at the bonding curve for $150 worth of ETH. Seems great! But WE are the mutual. So when we redeem the NXM for ETH, we take the ETH from the pool… only to then put it straight back into the pool. So, the ETH in the pool has not changed at all. What’s different? The NXM that we redeemed was burned.

So by buying above book and below the bonding curve price, all you’re doing is a buyback and burn. But, you’re doing it ABOVE the value of the assets that NXM token “owns”, which makes no sense, you’re just destroying value.

When it comes to the issue of removing the ability to redeem through the bonding curve, this would be problematic for the tokenomics and also to our members. I tend to dislike changing the rules in the middle of the dance, and members bought our token with the idea that they would be able to redeem above 100% MCR. If we remove that, we’re screwing them. On the tokenomics side, without sell pressure NXM price on the bonding curve will get out of whack, so we’d need to adjust the formula, which seems unwise.

Some of the other suggestions include separate pools and bans on bots. These are overcomplicating the issue IMO. Allowing for a redemption queue would prevent most of these concerns, is easier to implement I believe and is already in governance (though never voted on).

I’d like to see us take the following to governance ASAP:

-

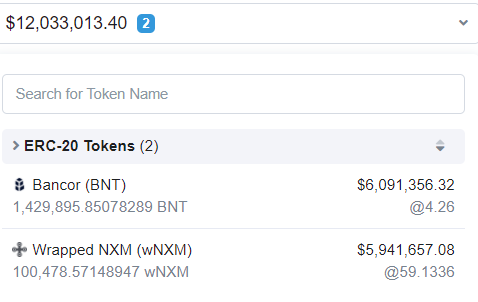

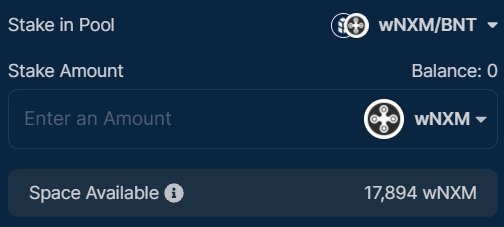

Give the investment committee the power to purchase wNXM tokens on an on-going basis using the capital pool, when they believe that doing so will add value to the mutual.

-

Create a queue system that would allow for redemption of NXM to ETH through the bonding curve, when MCR is above 100%.

This mandate would allow the committee to execute on the plans above, to remove wNXM from the market when below book value and to contribute to an LP to provide greater liquidity, or to burn if more liquidity is not necessary.

The 2nd is more complicated and would require some development work, but I do believe it’s necessary based on the communities response. Clearly, the current system feels unfair to members and that’s something that we should prioritize fixing IMO.

(edited $ number for above book value to represent updated valuation)