Stacked Risk Cover will be a generalised way of covering virtually all risks in a protocol in a simple way using options. So we need to create a specific list of ideas

How it Works (example)

User puts DAI into the Curve yPool and gets yCRV tokens in return. These tokens earn yield and can always be referenced back to a notional value of USD.

User buys stacked risk cover on yCRV.

At any point in time during the cover period the user can swap their yCRV tokens worth 100 USD (notional) for 90 DAI.

This means if the yCRV tokens materially de-peg for whatever reason the user is protected from the worst downside.

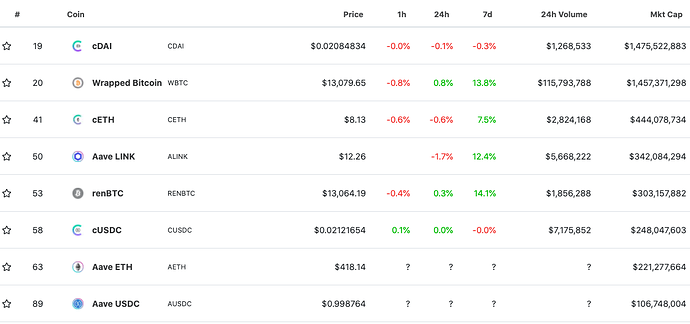

Please list products you would like to see, like the yCRV example above, and we will add them to the potential product list. We’re looking for both USD based coins and ETH based coins.