Introduction

The purpose of this forum post is to establish community consensus on the proposed tokenomics mechanism & begin a discussion on parameterisation.

So far, the discussion has been ongoing in the #tokenomics-revamp Discord channel and individual interactions amongst stakeholders.

Work has been focussed on the mechanism and associated modelling described in Nexus Mutual Tokenomics Proposal - Design v1.3, with the latest version of the model itself available on Github.

NB: The stochastic scenario modelling section at the very end of the document is due to be filled in next week.

Out of Scope

Please do not discuss the following topics on this forum post and keep discussion focussed on the buying/selling mechanism. If you’d like to propose anything related to the following topics, please create a separate thread.

Anything to do with MCR other than removing the floor is out of scope - should be a separate upcoming project.

For now, any additional capital attraction mechanisms are also out of scope.

Mechanism Tl;dr

This is a brief summary of the buying & selling design proposed in Nexus Mutual Tokenomics Proposal - Design v1.3. For full detail please see the document.

- The MCR floor is removed & MCR is driven by Cover Amount going forward.

- Every time there is a buy on the protocol, the price goes up

- Every time there is a sale on the protocol, the price goes down

- This is achieved via a notional Uniswap v2 pool, with the mutual itself as the only liquidity provider

- There is a target liquidity in ETH in the pool - if the pool is below this liquidity, additional liquidity is provided to the pool (subject to an MCR limit). If there is an excess, it is withdrawn.

- Buying NXM from the protocol is disabled below book value to avoid dilution of members’ book value

- Selling NXM to the protocol is disabled above book value to avoid dilution of members’ book value

- Instead there is a ‘ratchet’ mechanism that moves the protocol NXM price towards book value over time from below and above

Key discussion points

From my perspective, these are the things we should agree on as a community when it comes to this proposal moving forward.

- There is a balance to be struck between retaining capital in the pool and providing exit liquidity to members who want it

- The proposed mechanism is a reasonable, working way to achieve this

- How much liquidity roughly should we be injecting on an ongoing basis into the pool to allow members to exit?

If we agree on these points, we can move forward towards parameterisation of the mechanism, and I will set up a separate forum post if it makes sense to do so.

High-level Timeline in 2023

Below is a timeline from my perspective going forward, provided there is agreement on the mechanism. As always, way more important to be thorough and ensure code & mechanism is rock-solid rather than shipping something with holes in it.

Q1 Feedback on mechanism and parameter discussion. If no major red flags and nothing significant needs to be redesigned, engineering work begins to convert tokenomics spec to solidity code after v2 is live.

Q2 Code finalised, appropriate testing, audits.

Q3/Q4 Governance process, New mechanism live.

Proposal Status

- Open for comment

Open for a Snapshot Signaling Vote

Snapshot signaling vote

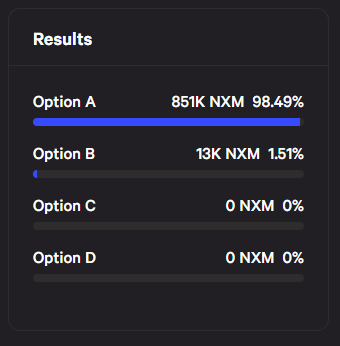

Signaling Vote: how to proceed with tokenomics proposals

This proposal has been transitioned to a Snapshot signaling vote to gauge members’ support for either proposal or if there is demand to seek alternative proposals to the two existing tokenomics proposals.

After an open comment and review period, the choices presented in the Snapshot signaling vote are:

-

Option A: Ratcheting AMM design

-

Option B: Modifying the existing bonding curve design

-

Option C: Make no changes

-

Option D: None of the above. Explore other solutions.

Members can vote to signal their support for one of the options above.

You can vote on the Snapshot proposal from 15 February at 9am EST / 2pm UTC until 22 February at 9am EST / 2pm UTC.

Snapshot signaling vote outcome

Members signaled their support for Option A: Ratcheting AMM design.

@Rei will create a separate proposal to continue the discussion, per his comments further down in this thread.

Edit: @BraveNewDeFi added “Proposal Status” and updated to reflect proposal status.

Edit 2: @BraveNewDeFi updated to include the outcome of the Snapshot signaling vote on 22 Feb 2023.