Hi everyone,

Will be providing updates in this section of the forum from the team & the engineering effort as we work through the detail of implementation.

First up is a slightly modified version of @Hugh’s recent Discord update.

Aiming to post here regularly to keep people up to date.

The Nexus Mutual Foundation and DAO teams had an offsite in Lisbon recently, and dedicated time to review the tokenomics changes members have signaled support for.

The goals of the workshop sessions were to:

- Understand the mechanics in detail

- Identify any big technical challenges that might require revisiting the business requirements documentation and/or proposed Ratcheting AMM (“RAMM”) design

- Identify any areas of concern from an edge case and/or attack perspective

- Discuss the need for a TWAP and brainstorm potential solutions (biggest gap in the current business requirements)

The workshops went really well. During discussions, Hugh & the engineering team didn’t run into any obvious technical issues. There is one potential attack scenario, where oracle manipulation could take place on the TWAP, so this will be top of mind while reviewing solutions.

The team has identified several potential solutions, which will be further researched, reviewed, and discussed. Worth noting that finding a solution is more of an optimisation issue than any big research work to be concerned about.

After the offsite, the next step is for the engineering team to draft the detailed technical specifications & for myself/Hugh to support with ad-hoc scenario analysis and decisions around specific edge cases that arise.

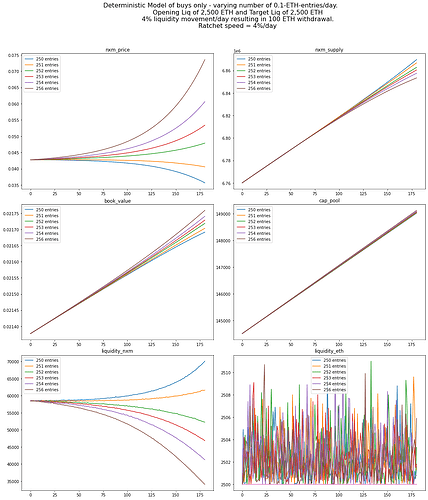

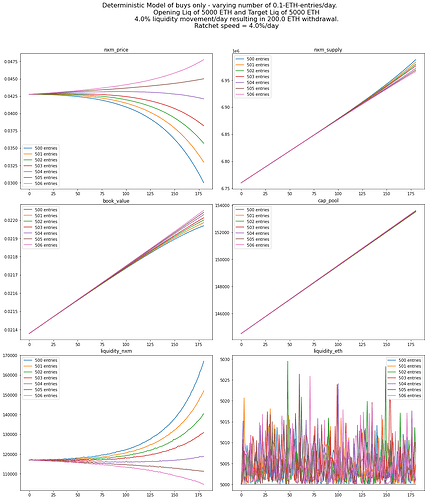

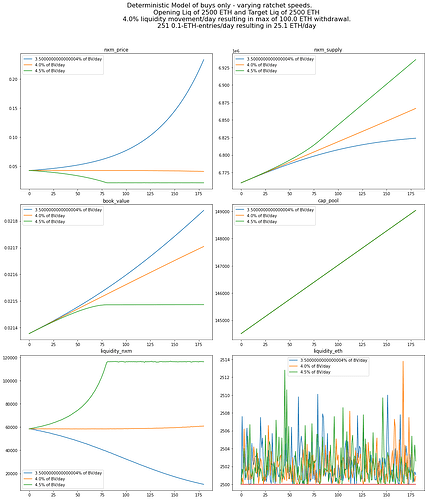

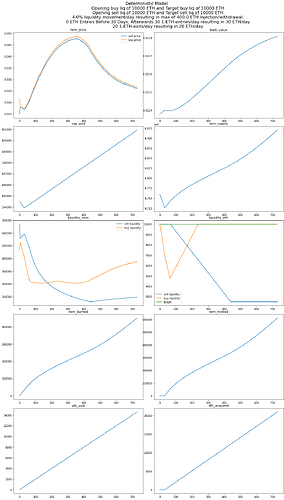

Once this step is complete & the engineering team move to implementation, we will kickstart the community discussions around parameterisation, focussing on initial and ongoing liquidity injections into the RAMM pools.

It was agreed that some of the engineering team will focus solely (as much as possible) on the tokenomics project. This will ensure we continue to make progress.

There is no firm timeframe for the tokenomics project like many have requested. Security is our first priority, and we will provide regular status updates and keep members informed of next steps.