Claim 23 | Cover ID 1375 | ExtraFi Protocol Cover (OpenCover)

- Claim Request: 47,150.79 USDC

- Total Cover Amount: 361,001.03 USDC

- Cover Period: 10 October 2024 to 9 November 2024

- Reported Date of Loss in Claim Submission: 9 October 2024

- Assessment Period: 13 December until 16 December 2024

Overview

On 13 December 2024, a claim was filed for the ExtraFi listing under the Protocol Cover product type.

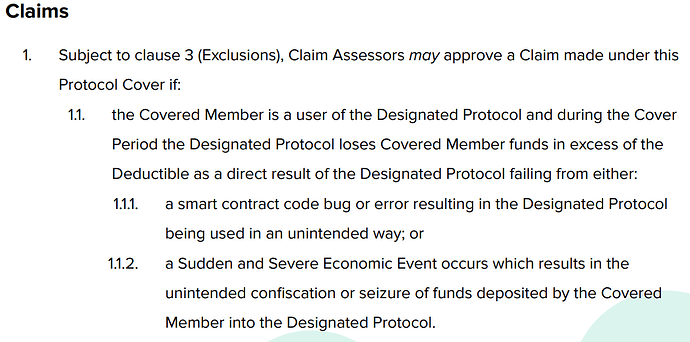

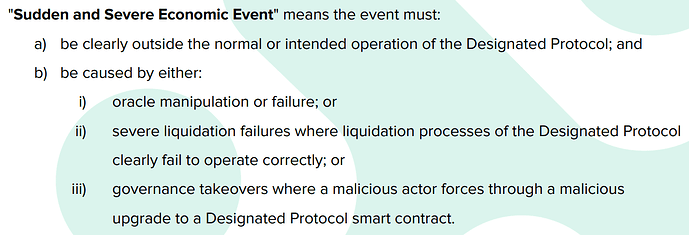

In the incident details for this claim, the claimant (OpenCover) shared the incident details on behalf of one of their users. The OpenCover user cited Clause 1.1.2 (“a Sudden and Severe Economic Event”), specifically “oracle manipulation” as noted in the incident details.

Excerpt taken from the Protocol Cover wording document. See the complete Protocol Cover wording for the full terms and conditions.

Excerpt taken from the Protocol Cover wording document. See the complete Protocol Cover wording for the full terms and conditions.

Incident Details

The following details were provided in the claim submission, which can be reviewed in the Nexus Mutual UI: Nexus Mutual

This claim is for $47,150.79 following a severe and sudden economic event on ExtraFi’s OVN lending pool. The loss was computed as $55,623.79, the value of the position on ExtraFi on October 9th before the incident, minus $5,991.37, the value of the position after the incident when residual value stabilized.

Onchain deposits to ExtraFi: https://basescan.org/address/0xbb505c54d71e9e599cb8435b4f0ceec05fc71cbd?fadd=0x9346A7b6244D56447F52aFFcbEbFD22456FDd588&mtd=0x594d81e5~Deposit+And+Stake (Breakdown: Total Deposited: $55,623.79. Recovered Value: $5,991.37; Net Loss Amount: $49,632.42 before deductible).

The incident linked to the loss has been publicly acknowledged by the Overnight team on October 18 as caused by recent modifications to the tokenomics structure which created the unforeseen sudden and severe economic event: https://overnightdefi.medium.com/overnight-finance-ama-recap-new-strategies-ovn-utility-and-future-plans-90bf9cb6fec4

The sudden systemic change was also later confirmed by a letter from Overnight’s CEO outlining the interplay of tokenomics, liquidity and OVN pools on Aerodrome: https://overnightdefi.medium.com/from-dusk-till-dawn-overnights-path-forward-62a55d508f52.

This incident is thus functionally equivalent to oracle manipulation and covered under clause 3.5 of the cover terms which excludes “losses resulting from movements in the market price of assets used in, or relied upon, by the Designated Protocol except for any losses caused by asset price movements where the price movement meets the definition of oracle manipulation under clause 1.1.2 (Sudden and Severe Economic Event).” https://api.nexusmutual.io/ipfs/QmdunFJm4A5CUW1ynM7bevsGt6UzQfw6K4ysKqvsqpjWCQ

Assessment

Members who stake NXM and act as claim assessors can discuss the claim submission in this thread. The claimant and other members can also participate in this discussion.

Learn more about Claim Assessment in the Nexus Mutual documentation.