Recently we’ve added quite a few new protocols to Nexus which have attracted meaningful staking but not enough to bring prices down for new covers to be bought.

There are a few challenges with the current staking approach that hamper this:

- Stake is locked for 90 days regardless if cover is bought

- stakers are unsure of demand

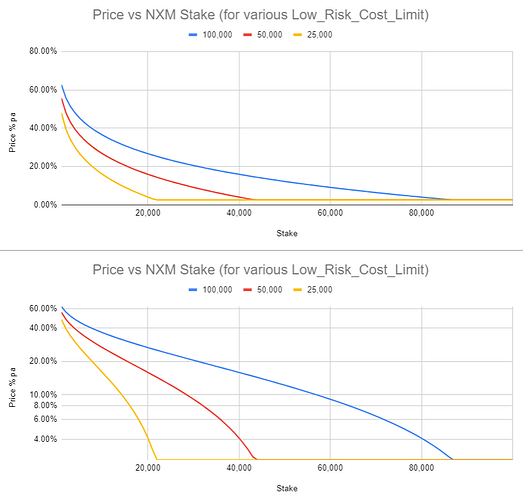

- At a low_risk_cost_limit of 100,000 it takes 76,000 staked NXM to bring the pricing down to 5% pa

Staking 3.0 will allow unlocks immediately if there isn’t any cover, so this will improve the longer term situation but I believe we’d benefit shorter term from a lower risk cost limit. This will make it easier to bootstrap new cover markets, increase diversification and ultimately sell more cover.

Capacity on any new cover is still limited to the staking value so the mutual is still “protected” via the stake. Covers aren’t getting sold at high prices anyway, so here we allow lower volumes of cover to be sold at lower prices that are still fully backed by stake.

I believe it is a relatively low risk way of improving sales before we work out the best way to proceed with supply/demand pricing.

I propose decreasing the low_risk_cost_limit to 50,000 NXM (from the current 100,000 NXM)

Graphs show price at various low_risk_cost_limits, second graph on log scale.