The Investment Committee team presents its July 2024 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

Monthly Change

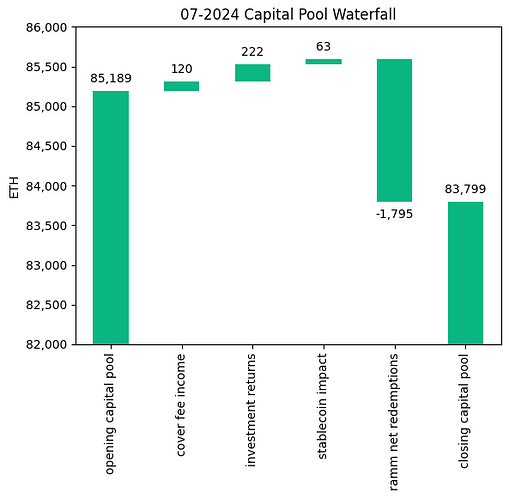

The Capital Pool has reduced by 1.6% in ETH terms this month. The largest impact has still been from withdrawals via the RAMM, but these withdrawals have continued to slow down rapidly (1.8k ETH in July compared to 2.3k ETH in June and 2.8k ETH in May), indicating a decreasing number of tokens wishing to exit. There has been a small positive FX impact as a result of the stablecoin holdings due to the slight drop in ETH price, as well as very good results from Cover Fees and Investment holdings.

The various impacts on the capital pool are summarised in the waterfall chart below.

The cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

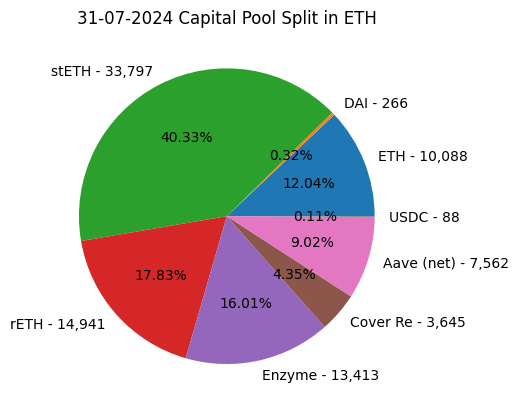

End of Month Pool Split

The split of the Capital Pool at the end of June ‘24 in ETH terms is as follows.

A portion of the DAI was used to repay the outstanding Aave USDC loan and the largest portion of cover buys in July were denominated in USDC.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

Aave USDC Loan

On July 2nd, the Advisory Board repaid 243k USDC from the Aave loan, bringing the outstanding debt balance at the time down from 6.18m to 5.94m USDC

State of the Investments

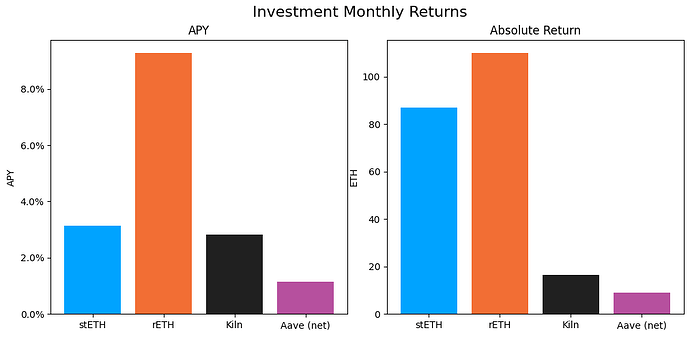

In the last month, the Mutual earned 222.5 ETH on its investments, overall, as broken down below.

stETH Monthly Return: 86.916

stETH Monthly APY: 3.138%

rETH Monthly Return: 110.036

rETH Monthly APY: 9.276%

Kiln Monthly Return: 16.639

Enzyme Monthly APY: 1.351%; Kiln Portion Monthly APY: 2.817%

aEthWETH Return: 16.829

aEthWETH APY: 2.179%

debtUSDC Return: -7.928

debtUSDC APY: 5.349%

Aave Net Return: 8.901

Aave Net APY: 1.147%

Total ETH Earned: 222.492

Total Monthly APY: 3.206%

Based on average Capital Pool amount over the monthly period

All returns after fees

The active staking investments yielded between 2.8% and 9.3% APY. The high yield on the Rocket Pool portion is a result of an anomalous deviation in the ETH/rETH exchange rate at the end of July, the impact of which is likely to be reversed in following months.

The Aave USDC debt position, collateralised by ETH, produced a net APY of 1.1%.

The Capital Pool overall earned 3.2% APY based on the average Capital Pool value over the course of the month. The higher-than-average result was driven mainly by the rETH exchange rate.

Investment Committee Priorities

- The first set of stETH → ETH divestment transactions has been completed at the end of August with help from the Foundation Engineering team, totalling 4,393 stETH. Documentation in progress for future transactions.

- The Stakewise/Chorus One and EtherFi proposals have been implemented in the Enzyme vault. The vault now holds 1,515 weETH and 4,989 ETH has been deposited with Chorus One.

- We are also working with Enzyme and Chainlink to incorporate the ongoing unclaimed rewards from our ETH staked with Kiln into the NXMTY oracle.

- DAO Treasury investment work - Karpatkey proposal in late stages of governance.

- NMPIP 227 proposing a framework for repaying the Aave USDC loan has been approved and three repayments have been made to date. The process for making repayments and collateral top-ups, if required, has been documented for future actions.