The Investment Committee team presents its April 2024 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

Monthly Change

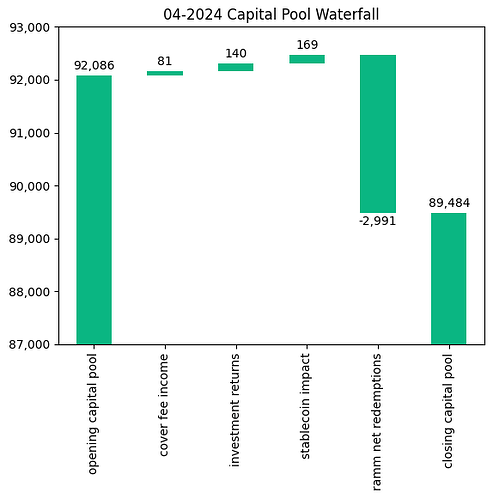

The Capital Pool has reduced by 2.8% in ETH terms this month, largely as a result of withdrawals via the RAMM. Compared to March, there has been a positive impact from the growth in Cover buys as well as a positive impact from the stablecoin portion of the Capital Pool.

The various impacts on the capital pool are summarised in the waterfall chart below.

Note that the cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

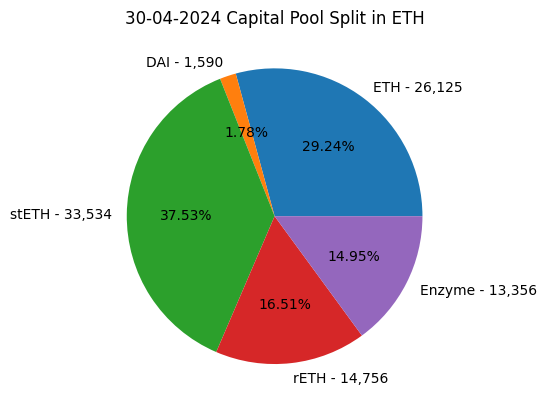

End of Month Pool Split

The split of the Capital Pool at the end of April ‘24 in ETH terms is as follows.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

→ Note the difference of ~100 ETH between the sum of the pie chart and the closing value in the waterfall chart above is mostly explained by timing differences in assessing RAMM volumes and ~30 ETH acquired from Enzyme fee rebates.

State of the Investments

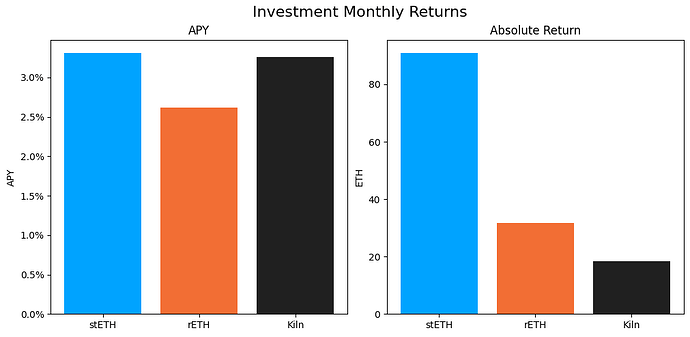

In the last month, the Mutual earned 141.1 ETH on its investments, overall, as broken down below.

stETH Monthly APY: 3.311%

stETH Monthly Return: 90.9

rETH Monthly APY: 2.618%

rETH Monthly Return: 31.745

Enzyme Monthly APY: 1.523%; Kiln Portion Monthly APY: 3.26%

Kiln Monthly Return: 18.451

Total ETH Earned: 141.097

All returns after fees

The active investments yielded between 2.6% and 3.3% APY. The capital pool overall earned 1.9% APY based on the average Capital Pool value over the course of the month.

Note that the rETH value is lower than last month due to minor fluctuations in the rETH/ETH exchange rate.

Investment Committee Priorities

- The Enzyme <> Nexus Mutual relationship has been updated, see @moss update here. We have also completed the following actions:

- Enzyme have claimed their share of the protocol fee. Having applied the 50% discount, this increased the value of the vault by ~31 ETH.

- ~181.5 ETH has been claimed as ETH staking rewards from Kiln, at a gas cost of ~1.1 ETH. 160 ETH has been redeployed to new Kiln validators.

- We have also received ~7.7 ETH in Kiln referral rewards, due to be deposited (net of the reward claim gas costs) into the vault.

- Drafting a plan for divesting out of investment assets over the course of the year as more ETH is required for the RAMM redemptions and the upcoming Cover Re investment. The projections have been completed, drafting the doc now and expecting to publish on the forum w/c 20th May.

- Preliminary conversations taking place with Enzyme and Ether.fi for new investment opportunities.

- DAO Treasury - in conversation with a variety of potential service providers for active management, more to come soon.