The Investment Hub team presents its May 2024 newsletter, where we share insights surrounding the Capital Pool and Nexus Mutual’s investments. The goal is to make key data transparent and easily accessible to everyone.

State of the Capital Pool

Monthly Change

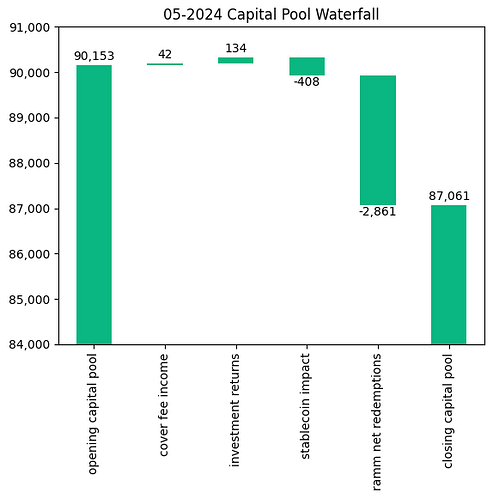

The Capital Pool has reduced by 3.4% in ETH terms this month. The largest impact has still been from withdrawals via the RAMM, but the ETH price increase from ~$3000 to ~$3800 also caused a meaningful FX impact as a result of the stablecoin holdings.

The various impacts on the capital pool are summarised in the waterfall chart below.

Note that the opening balance in May is significantly higher than the closing balance in the April newsletter as a result of including the (already recovered) claim reimbursements in the Advisory Board (”AB”) multi-sig.

The cover fee income is net of distribution commissions and excludes covers paid for in NXM. In such a case, the cover fee gets burned and there is no change in the Capital Pool.

→ Members can track in/outflows on the Ratcheting AMM Dune Dashboard.

→ Members can track the cover income on the Covers Dune Dashboard.

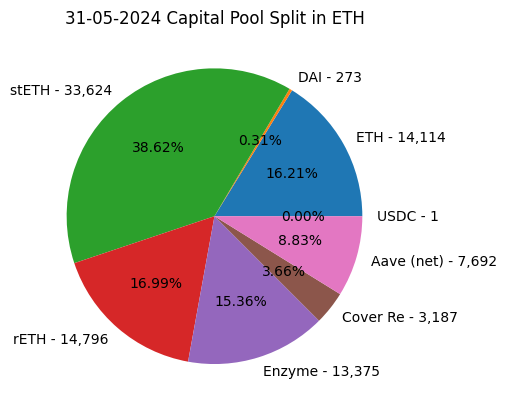

End of Month Pool Split

The split of the Capital Pool at the end of May ‘24 in ETH terms is as follows.

→ Members can find the updated split at any time on the Capital Pool and Ownership Dune Dashboard.

Cover Re

On May 23rd, the Advisory Board invested 12m USDC into Cover Re.

In order to complete this investment:

- The Capital Pool transferred 4.09m DAI to the AB multi-sig, where the AB converted it to 4.09m USDC

- The Capital Pool transferred 9,340 ETH to the AB multi-sig which was deposited to Aave V3 as aEthWETH.

- 6.20m USDC was borrowed on Aave V3

- The above USDC, combined with the 1.71m USDC already in the AB multi-sig from FTX claim recoveries, was transferred to an address controlled by Cover Re.

The Capital Pool holds single-purpose tokens which are linked to the current value of the Cover Re investment. This value is expected to be manually updated on a quarterly basis to reflect the value of the investment.

The return is expected to be significantly higher than the cost of the Aave debt (net of the ETH supply income).

State of the Investments

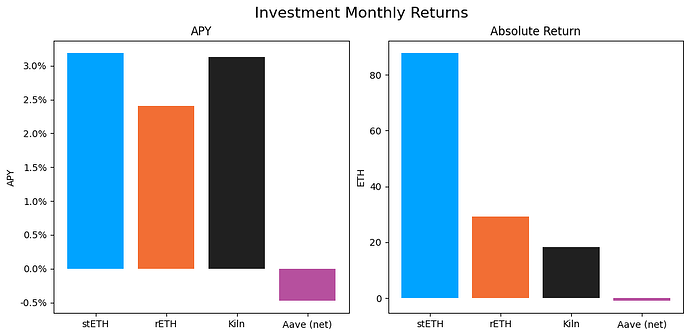

In the last month, the Mutual earned 134.3 ETH on its investments, overall, as broken down below.

stETH Monthly Return: 87.753

stETH Monthly APY: 3.186%

rETH Monthly Return: 29.226

rETH Monthly APY: 2.401%

Kiln Monthly Return: 18.248

Enzyme Monthly APY: 1.502%; Kiln Portion Monthly APY: 3.132%

aEthWETH Return: 2.851

aEthWETH APY: 1.403%

debtUSDC Return: -3.824

debtUSDC APY: 11.255%

Aave Net Return: -0.973

Aave Net APY: -0.474%

Total ETH Earned: 134.254

Total Monthly APY: 1.833%

Based on average Capital Pool amount over the monthly period

All returns after fees

The active staking investments yielded between 2.4% and 3.2% APY, reflecting the lower ETH staking yields.

The Aave USDC debt position, collateralised by ETH, produced a net APY of -0.5%.

The Capital Pool overall earned 1.8% APY based on the average Capital Pool value over the course of the month.

Note that the Kiln APY is slightly lowered due to launching 5 new validators on the 3rd of May month which weren’t live for the whole period, but were reflected in the invested amount throughout the month.

Investment Committee Priorities

- The Divestment Framework has gone through the RFC stage and has been published as an NMPIP on the forum. The IC is working with the Foundation Engineering team to prepare for the governance vote and to coordinate the first stETH → ETH transaction now expected at the start of July.

- We have been working with external teams for allocating the idle ETH in Enzyme. Expecting two proposals to be put to the members this week, with the Investment Committee coordinating the governance process.

- DAO Treasury investment work - ongoing conversations with a service provider, aiming for a proposal this month.

- The Investment Committee is also preparing a framework for repaying the Aave USDC loan from the Mutual’s stablecoin cover fee income and a series of thresholds for topping up the ETH collateral if required at lower ETH-USD levels. We expect to post the RFC on the forum shortly.