Overview

Our third operational quarter came to a close at the end of April, and I’m eager to share the progress we’ve made, our plans for the next quarter, and how we measured up against our key results we set in January.

Mutant Marketing was established to accelerate the growth of cover sales and membership in the mutual. In the last quarters, the Marketing Hub has added two Mutant Moderators, who help answer questions in a timely fashion and keep scammers out of our social channels; we’ve expanded our relationships with listed protocols; worked with existing partners to from new relationships with other projects; represented the mutual at two separate conferences, while providing support to the core team when they attended Devconnect and ETHAmsterdam; and we continued our track record of contributing to the growth in cover sold and premiums earned.

In this report, we will use historical cover sales and premiums for our quarterly reports.

All numbers in this report are as of 2 May 2022.

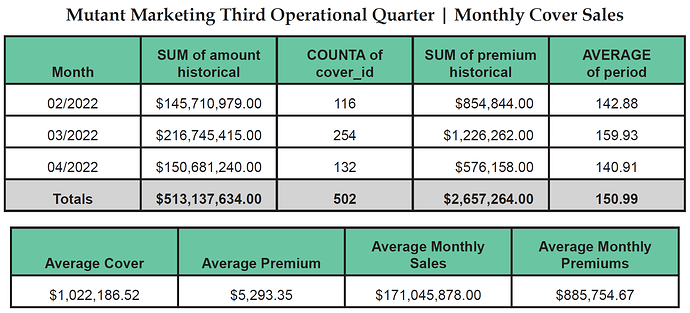

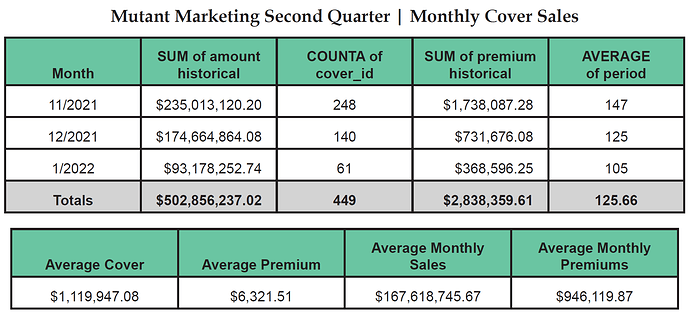

Cover Sales, Premiums Earned, and Growth | Third Quarter

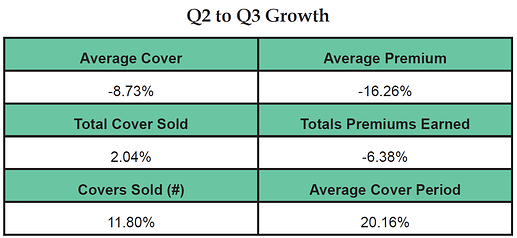

In the last quarter, Nexus Mutual sold $513,137,634 in cover and earned $2,657,264 in premiums. Compared to last quarter, total cover sold saw an increase of 2.04% while total premiums earned declined by 6.38%. Due to lower gas fees present during our third quarter, there was an uptick in 5-figure cover buys and thus an increase in the number of covers sold (11.80%).

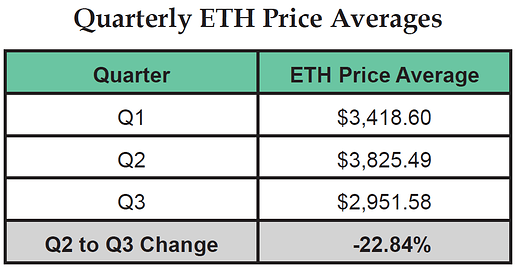

There were slight declines in the average cover sold and average premium earned; however, the average price of ETH declined by 22.84% quarter over quarter (QoQ), which means a reduction in platform capacity. Despite the market downturn and yield compression that took place, growth remained steady with a modest decline in premiums earned.

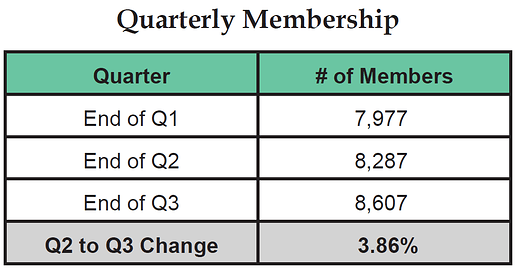

Membership, Existing and New Users

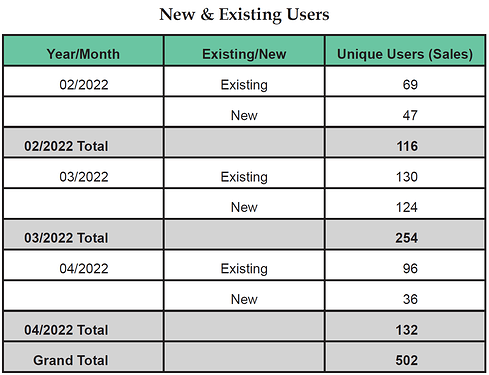

Membership in the mutual grew from 8,287 to 8,607, a 3.86% increase. What’s more, we saw an uptick in new members buying cover, as noted by the New and Existing Users data presented below:

There are some interesting details I’ll share regarding new and existing users when I review Nexus Embassy performance farther into this review.

Q3 Focus

While Nexus V2 will create new possibilities for the mutual, Mutant Marketing has been working to make each audience aware of the benefits that V2 unlocks for them. We want members, protocols, and institutions to realize the potential available once the new iteration of the protocol launches.

Mutant Marketing will continue to work with the core term to educate the DeFi community about the improved user experience and the added composability benefits present in V2, as well as the role of syndicates in the protocol going forward.

Objective

Ensure Nexus V2 is received as the premier on-chain market for risk within DeFi.

Key Results

Within Mutant Marketing, we have been focused on:

-

Creating educational materials for Nexus V2

-

Defining syndicate pipeline, onboarding process

-

Securing new partnerships, generating new leads

-

Representing the mutual at industry events

-

Scaling Mutant Marketing, onboarding new contributors

Of our three (3) key results, two (2) are dependent on the launch of Nexus V2. I’ll speak to these key results below in greater detail.

The Objective and Key Result (OKR) framework is meant to keep organizations focused on outcomes by defining goals and establishing measurable outcomes. OKRs are meant to motivate and inspire; these goals may seem lofty, and that’s because they are. By setting lofty goals, Mutant Marketing is working to reach new heights every quarter.

Key Result #1

Generate conversations that lead to ten (10) protocol integrations for the mutual over the next two quarters.

Through the last several months, I have been sharing information about Nexus V2 during our weekly Mutant Meetup calls. You can find some of those resources below:

-

Week 1: Cover Policy Improvements and the Dynamic Pricing Model

-

Week 3: Syndicate Types, Advanced Features, & Competitive Advantage

In the weekly Nexus Mutual Newsletter, I’ve included a call to action for those who are interested in learning more about syndicates. To date, I have 16 active conversations with individuals/organizations that are interested in running syndicates.

In addition to these 16 syndicate leads, I have 12 leads on potential integrations. Because all syndicates can have a frontend integration and any listed protocol can add a frontend integration to offer coverage to the people deploying funds in their dApp at the point of deposit, there’s myriad possibilities for platforms and protocols to offer coverage and earn commissions from cover buys the originate in a frontend integration.

The economic incentives present in Nexus V2 better align interests, and I have seen considerable interest from listed platforms. Throughout the next quarter, I’ll continue these conversations and work to secure ten (10) or more integrations for or shortly after the Nexus V2 launch.

Key Result #2

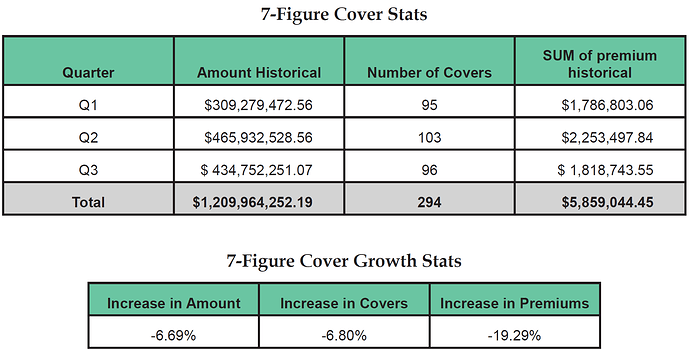

Grow 7-figure cover buy volume from $775.2m to $1.55b over the next two quarters, which represents a 100% increase compared to our last two quarters.

From 1 February to 30 April, the mutual sold $434,752,251.07 in 7-figure cover buy volume, which generated $1,818,743.55 in premiums. We achieved 56.08% of our $775.2m quarterly goal. Mutant Marketing played a role in generating large cover buys, but I want to highlight the incredible work @ricky and @Dopeee have been doing on the BD side. In February, the mutual sold our largest cover policy to date: an 18,335 ETH cover buy worth $47,885,886!

We set our sights high on 7-figure cover buys for these two quarters. Yield compression across DeFi and falling ETH prices have had somewhat of an impact on cover buys, but we are still seeing significant demand, especially from larger institutions.

Key Result #3

Generate conversations that lead to eight (8) basic syndicates within the next two quarters.

As I highlighted in the Key Result #1 section, I have 16 current syndicate leads. In one week’s time, I’ll be representing the mutual at Permissionless, where I have meetings set with various parties interested in learning more about syndicates and Nexus V2.

When I attended ETHDenver and PlannerDAO’s Crossroads conference, I spoke about the benefits that Nexus V2 brings, and I highlighted how PlannerDAO could structure a syndicate to further expand the offerings in their DeFi Toolkit.

To further generate interest in syndicates and V2, I am working with a graphic designer to create marketing assets. I’m also working with a cinematographer and an illustrator to make videos that highlight the benefits that Nexus V2 brings to members of the mutual and those who wish to use their risk expertise to generate revenue as syndicate operators.

Nexus Embassy Performance

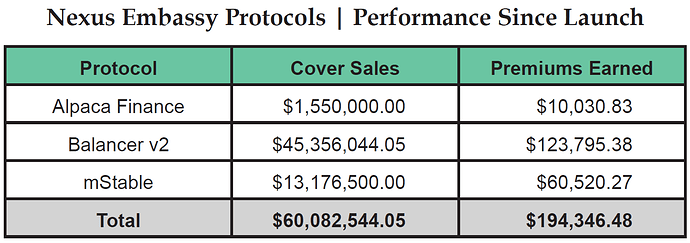

Since we launched the Nexus Embassy program in September 2021, we have seen growth from the first to second quarter, as noted in our previous report. At the outset, the goal of this program was to establish closer relationships with protocols listed on Nexus and establish partnerships with those protocols. Our Ambassadors have been able to help those protocol communities capture more risk averse DeFi users by educating them about Nexus Mutual’s cover products and the protections they offer.

To date, Ambassadors have helped the mutual reach new users and sell $60,082,544.05 in cover, which brought in $194,346.48 in premiums. After roughly eight (8) months, this program has delivered enough value to offset our Q3 + Q4 budget by 76.18%. The increase in cover buys that we’ve seen can be connected with our Ambassadors presence over the last eight months:

-

11 of 14 Q3 Balancer covers were purchased by users who first bought cover after the Embassy launch

-

3 of 5 Q3 mStable cover were purchased by users who first bought cover after the Embassy launch

I can also track cover buys via the weekly reports I receive from our Ambassadors.

We are able to reach more risk averse people where they are deploying funds and our presence has had a positive impact on cover sales. This is, perhaps, a small sample of the impact point of sale integrations in Nexus V2 will have on our quarterly sales.

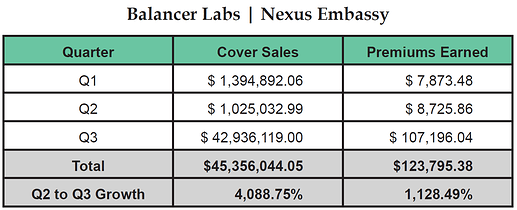

Balancer Labs Embassy

The Balancer Labs Embassy has seen explosive growth in both cover sold and premiums earned. Our Nexus Ambassador serving in the Balancer Labs Discord has been doing an excellent job of providing value to the Balancer community and working with Balancer’s Ballers to find more ways for our two DAOs to collaborate more in the future. Fungus’s work here has resulted in $42,936,119.00 in cover sold and $107,196.04 in premiums earned in our Q3. This represents QoQ growth of 4,088.75% in cover sold and 1,128.49% in premiums earned.

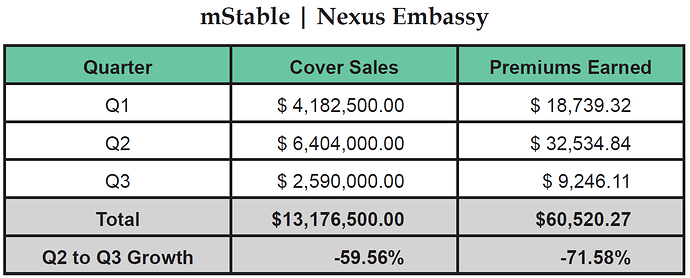

mStable Embassy

Our partnership with mStable has done nothing but grow in the last quarter. After the Decentralized Insurance Conference (D1Conf) in Amsterdam, mStable sponsored the Drinks After D1Conf event and our two teams were able to connect in person. I’ve worked closely with Theo of mStable to explore more ways Nexus Mutual can participate in co-marketing and collaborate with the mStable protocol. Our strong relationship with mStable resulted in the mutual creating a bundled Protocol Cover product for Gelt Finance.

Gelt Finance allows people to connect their bank accounts via Gelt’s application and deposit directly into mStable. Gelt’s non-custodial platform uses coverage from Nexus Mutual to protect a user’s deposits, up to $100,000. In this way, Nexus provides an FDIC-like cover product for the next wave of DeFi users.

In Q3, Fungus represented the mutual in the mStable Discord and answered users’ questions about Nexus Mutual coverage. We saw $2,590,000.00 in cover buys and earned $9,246.11 in premiums in the last quarter. This represents a decline of 59.56% in cover sold and a 71.58% decline in premiums earned. While we saw a decline in sales and premiums earned, the value that we have created with our mStable partnership will prove substantial on a longer timeframe.

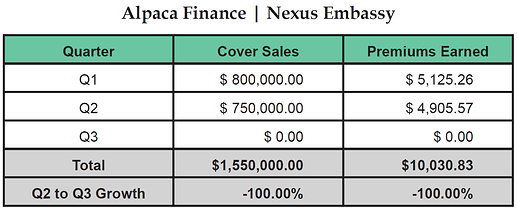

Alpaca Finance

In the last quarter, the mutual did not sell any cover policies for Alpaca Finance. Crypt0non has worked diligently to educate the community within Alpaca Finance, and I appeared on the Alpaca community podcast as well to talk about Nexus Mutual. Because we have not seen any demand in the last quarter for cover buys from Alpaca Finance, I have decided to put this Nexus Embassy on pause until we see a sign that demand for Nexus coverage within Alpaca is starting to grow again. It’s always a hard decision to put an Embassy on hold, but if we can’t justify the expense, it’s important that we try different approaches within the program.

Representation at Events

I’ll provide a brief overview of the work we’ve done to represent the mutual at various events so far this year.

ETHDenver

@Dopeee and I attended ETHDenver in February. During this conference, we both held meetings with various protocol teams and met up with Nexus Mutants during the conference. Jack and I met with the Index Coop and Notional Finance teams in ETHDenver and have since worked to identify areas for further collaboration. I met with the Bancor team during the conference and met Glenn, a long-time Nexus Mutant and Bancorian. Since ETHDenver, both Jack and I have worked more closely with these teams.

I also shared more insight and details about Nexus V2 with attendees; several syndicate leads originated from the conversations I had during ETHDenver.

PlannerDAO Crossroads

I secured our spot as the title sponsor for PlannerDAO’s inaugural Crossroads conference, where financial advisors met to talk about the intersection of traditional finance and crypto/digital assets. Both Hugh and I presented at Crossroads, and our presentations were well received. Many attendees were either aware of Nexus Mutual or had not heard of us before, but after I presented “Identifying Yield and Mitigating Risk with Nexus Mutual,” I had financial advisors asking me questions about the mutual’s cover products and the wider landscape of risk in DeFi and CeFi.

Since I attended this conference, I’ve followed up with 18 of the 35 attendees. Most are conducting due diligence on Custody Cover as a potential solution. However, individuals within PlannerDAO are working on the Financial Advisor’s DeFi Toolkit, and I spoke with those working on compliance on the toolkit. They were excited to learn that syndicates in Nexus V2 can be created with an underlying legal structure, which would allow a syndicate to stay complaint and offer real world cover products like Errors and Omissions (E&O) coverage.

I’m looking forward to working more with PlannerDAO on educational material and speaking with their community about risk in DeFi in the future.

Permissionless

Next week, I will be attending Permissionless with @Dopeee and working with Bancor on co-marketing efforts at the conference. Mutant Marketing is working with other DeFi protocols to co-host two happy hour events next week. Once the final details are confirmed, we will make an announcement.

My focus during Permissionless is sales and syndicates. I’ll be handing out Nexus <> Bancor t-shirts at the Bancor booth, as well as Nexus stickers and buttons. I’ve already set up several meetings and am scheduling more, as well. It’s always good to connect with others in the industry, and I look forward to talking more about Nexus V2 and the benefits it offers to members and potential syndicate operators.

Looking Ahead | Q4 and Beyond

Within Mutant Marketing, we’ll stick to our objective and supporting key results. As more technical information becomes available, I’ll create additional resources around Nexus V2. Once there is greater clarity on time to launch, I will start organizing a marketing blitz to ensure everyone in DeFi is aware of the coming innovation that V2 brings to members and people active on-chain.

In the next quarter, I’ll be onboarding at least one more Nexus Ambassador and establishing a new Nexus Embassy. Once the details are finalized, I’ll make an announcement on which protocol will host our next Embassy.

I’m looking to hire a full-time graphic designer to work within Mutant Marketing. If you are interested in working with us, please send me a message on Twitter, Discord (BraveNewDeFi#0027) or Telegram (@ BraveNewDeFi).

With Nexus V2 comes new possibilities for Mutant Marketing, I’ve touched on the direction I’m envisioning for our Hub in a past newsletter, but I’ve expanded on this initial idea. Over the next several months, I plan on creating a vision statement that will be released on Mutant Marketing’s one year anniversary.

I’ll also be exploring different solutions the Nexus DAO can use to further scale. This will be important for the future of Mutant Marketing as well.

I anticipate Mutant Marketing will start to scale into a powerhouse in the next several months. Our mission to grow demand for cover and onboard new members will be the core driver of all our key results and objectives going forward.

A Note on Support, Contributors

And while we have made great strides within our Hub in the last three quarters, I could not have done any of this without member support and the support of the Nexus core team. I feel very fortunate that I am able to work with an incredible team that is creating a powerful new infrastructure for risk in DeFi and beyond.

Thank you to all of the contributors in Mutant Marketing that have helped us expand the mutual’s reach in DeFi in the last three months.

- Jeremy | Marketing Advisor

- Fungus | Nexus Ambassador to mStable and Balancer Labs

- Crypt0non | Nexus Ambassador to Alpaca Finance

- jiraiya | Technical writer

- Chris | Copywriter

- Sem | Mutant Manager

- Dan | Mutant Manager