Official News

Cover Buys for 18–26 September

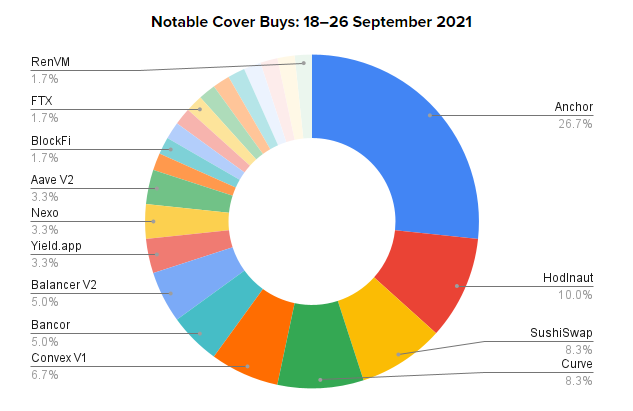

During this time, there were $36,497,321.92 in Cover Buys, and Anchor Protocol had the greatest demand for cover buys in the last week. The most often asked question in our Discord server and Telegram group is, “When will more capacity on Anchor open up?”

There is demand for Anchor cover availability, so Risk Assessors should review the Anchor Protocol to determine if it’s trustworthy with bug-free code. Anchor Audits & Bug Bounty Program

Keep in mind, the more that you stake, the more cover is available. Anchor is incredibly popular now and if you think the risk is worth it, we’d highly encourage you to stake on Anchor to create additional capacity.

In the last week alone, the mutual has received $205,280.51 in premiums, and $102,640.25 was distributed to Risk Assessors!

Twitter Spaces

The mutual is starting a Risk in DeFi Series, which will be hosted on Twitter Spaces. The first instalment will be a discussion about Wallet Security and Management. Hugh Karp will talk with the GridPlus team about the risks users take on when they self-custody their funds and how to best protect your assets when participating within DeFi.

This Twitter Spaces event will be held on Thursday (10/7) at 11am EST. Those who attend this event will receive a POAP, which can be used to enter a raffle. The GridPlus team has been kind enough to give away a Lattice1 hardware unit to the lucky winner of our raffle!

Mutant Meetups

On Tuesday (9/28), the mutual held our first Mutant Meetup, a weekly community call held every Tuesday at 10am EST in the Community Calls voice channel within the Nexus Mutual Discord server. Every Tuesday, we’ll share updates and host discussions about all things Nexus Mutual with our Mutant community.

For members who missed the first Mutant Meetup, don’t fret: we recorded the call. https://twitter.com/NexusMutual/status/1442884833731096576

Below is an overview of what was discussed on this week’s Mutant Meetup call.

-

Cover Buys: A Week in Review

-

Current Active Shield Mining Campaigns

- BarnBridge | 0.00100 BOND / NXM

- Visor Finance | 0.16000 VISR / NXM

- New Listing!

-

Goldfinch Finance, a decentralized credit protocol that allows anyone to be a lender, not just banks.

-

In the coming month we’ll have several new listings and Shield Mining Campaigns to share with the Mutant community.

-

Rei provided an update on the Investment Hub’s progress and future plans. You can find more detail here:

- Investment Hub Update: Investment Hub Update

- Investment Philosophy: Investment Philosophy

- Proposal: Increase the Allocation of the Capital Pool to stETH: Proposal: Increase the Allocation of the Capital Pool to stETH

The above proposal is now in governance. Make your voice heard here: https://app.nexusmutual.io/governance/view?proposalId=157

- BraveNewDeFi provided an update on Mutant Marketing’s progress and current focus.

-

Nexus Embassy Programme: https://nexusmutual.gitbook.io/docs/nexus-hub/mutant-marketing/nexus-embassy-programme

-

Nexus Community Ambassador Programme: https://nexusmutual.gitbook.io/docs/nexus-hub/mutant-marketing/ambassador-programme

-

Creating branded content for social media campaigns

-

Creating a community-run website with content aimed at different audiences along with educational resources and a dedicated blog.

- Nexus Mutual for DAOs

- Nexus Mutual for Institutions

- Nexus Mutual for Individuals

-

The Mutant community granted PlannerDAO 1,000 NXM to begin work on the Finance Advisor DeFi Toolkit. This will enable financial advisors to offer Decentralized Finance advice and guidance to their clients in a compliant and safe manner. You can review the Snapshot vote here, and BraveNewDeFi wrote about why this is a huge opportunity for the mutual.

-

Hugh shared more information about the upgrades the team is referring to as Nexus V2. The development team has been hard at work, and the upgrades will bring the following improvements to the protocol:

-

Flexible Cover Buys: members who hold cover will be able to extend their coverage without buying a new policy at expiry, and members can increase or decrease the amount of coverage they would like to have.

-

Cover Policies Will Be Tokenised: When a member buys a cover policy, the policy will be tokenised as an NFT.

-

Partial Claims Will Be Enabled: Currently, the mutual does not have the technical ability to pay partial claims, but with the upgrades coming in Nexus V2, the mutual will be able to pay partial claims.

-

Greater Gas Efficiency: The upgrades will optimise the protocol for gas efficiency, which should reduce the cost for users.

-

On-Chain, Dynamic Pricing: Pricing will be brought on chain, which is another step toward decentralisation for the mutual, and cover will be priced using a utilisation model.

-

Delegated Staking: Risk Assessors will be able to form syndicates, and these syndicates will manage NXM delegated to them by members. Listen to the call for Hugh’s breakdown of why a syndicate approach will be hugely beneficial to the mutual going forward.

-

Tokenised Staking Positions: When members stake NXM, their stake will be represented by an NFT, which can be sold to exit out of positions more swiftly. Members will also be able to exit early if utilisation for a protocol, custodian, or cover product is low enough.

-

Easier to Build On Top of Nexus: These upgrades will make it easier for other protocols and brokers to build on top of Nexus Mutual, and the delegated staking upgrades will better align interests between subject matter experts and members looking to earn more NXM through Risk Assessment.

For greater detail, listen to the Mutant Meetup call: https://twitter.com/NexusMutual/status/1442884833731096576

Community Discussions

Community Fund - DPI INDEX Proposal

This proposal from INDEX suggests that Nexus Mutual should invest some portion of our capital pool to buy DPI, which is a DeFi index. DPI would give Nexus Mutual greater exposure to DeFi more broadly, and reduce our exposure slightly to ETH.

The communities thoughts on this are extremely important. Please take the time to read it and leave any comments or opinions that you have ![]()

Work with covered protocols to enforce the principle of indemnity

One of our members had an interesting point regarding our cover wording and asked whether it would violate the principle of indemnity and allow the insured double recovery of their losses.

While this thread is now closed, it’s an interesting read and will allow members to better understand our thoughts around the current cover wording and why it’s structured how it is.

Any thoughts? Feel free to open a new thread!

This is an extension of the following thread:

Opportunities

-

We are searching for a skilled copywriter. Love Nexus Mutual and want to get paid to amplify the Mutual and drive more cover buys? Join us! The ideal Mutant has experience writing copy, ideally around DeFi, and has a strong understanding of Nexus Mutual and the tokenomics. Together, we’ll create content that will be shared through the DeFi space to generate greater understanding of the importance of cover, what Nexus Mutual offers and why we’re the premier destination for DeFi cover. DM me if you’re interested!

-

We are still looking for a Discord Bot aficionado. We want to create an automatic integration from our other social platforms to our Discord, to generate more community engagement. We’re also very interested in a Discord Bot that would notify members when more cover capacity is available on popular protocols. DM me if you’re interested!

-

The Fund is open for business and we’d love to hear from you if you have any ideas, potential projects and collaborations. DM me if you’re interested!

Spotlight On: @mate

We want to draw attention to the value that our members provide to Nexus Mutual.

@Mate is one of our valued members. They’ve written endlessly about the risks that different protocols face and has helped the mutual to make better decisions around cover claims.

Risk assessment is at the core of Nexus Mutual and with no delegated staking currently available, the communication from Mate has been fundamental to members understanding the risks that certain protocols represent.

Thank you, Mate, for everything you do to support Nexus Mutual and our incredible community!

Protected Yield Opportunity

Love yield? So do we, especially when we’re protected!

Below is an awesome post from @BraveNewDeFi that details an interesting way that members can generate yield while protecting against risk:

Protocol: https://balancer.fi/

Chains: Arbitrum & Polygon

Balancer has a Liquidity Mining Campaign on both Arbitrum and Polygon, which both have attractive yields. Members can buy Protocol Cover for Balancer V2 for 2.6%/year and protect their deposits while taking advantage of high-yield opportunities:

Arbitrum

- GNO (80%) / WETH (20%)

72.05% with LM incentives

72.05% with LM incentives - MCB (60%) / WETH (40%)

47.58% with LM incentives

47.58% with LM incentives - WBTC (33%) / WETH (33%) / DEFI5 (33%)

34.87% with LM incentives

34.87% with LM incentives - LINK (80%) / WETH (20%)

31.47% with LM incentives

31.47% with LM incentives - BAL (60%) / WETH (40%)

25.45% with LM incentives

25.45% with LM incentives

Polygon

- WMATIC (40%) / MTA (40%) / WETH (20%)

64.10% with LM incentives

64.10% with LM incentives - LINK (25%) / WETH (25%) / BAL (25%) / AAVE (25%)

44.38% with LM incentives

44.38% with LM incentives - WMATIC (25%) / USDC (25%) / WETH (25%) / BAL (25%)

40.32% with LM incentives

40.32% with LM incentives

There is 3k ETH / 8.5mm DAI in available coverage for Balancer V2 ![]()

Protocol Cover protects assets deployed within a protocol across chains, so one policy covers deposits on Ethereum, Arbitrum, and Polygon ![]()