NMPIP-209: Launch Tokenomics Upgrade

Summary

Now that the Ratcheting AMM (RAMM) codebase has gone through an audit from Chaos Labs and iosiro, the tokenomics upgrade proposal can move forward.

The DAO R&D, Community and Foundation Engineering teams are proposing to replace the Bonding Curve with the Ratcheting AMM (RAMM), with the initial parameters outlined below, and to remove the Minimum Capital Requirement (MCR) Floor.

Rationale

Starting in December 2020, the Minimum Capital Requirement Ratio (MCR%) fell below 100% and the redemption restriction prevented members from redeeming NXM for ETH, as outlined in the original Nexus Mutual whitepaper.

Between December 2020 and August 2021, the open market price diverged from the NXM price in ETH terms, with the open market price falling below Book Value per NXM in August 2021—the open market price has remained below the Book Value per NXM since this time.

The proposed RAMM mechanism has the following aims:

- Bring the price of NXM and the open market valuation together again

- Allow members who wish to exit to do so directly from the protocol at a reasonable price

- Allow the protocol to capture capital when members wish to provide it

- Create positive value for long-term aligned members

Replacing the Bonding Curve with the RAMM mechanism AND removing the MCR Floor will allow members to freely redeem and mint NXM as outlined in the Ratcheting AMM Whitepaper V1.0.

Technical Specification

The proposal is to launch the RAMM with the following parameters:

| Parameter | Description | Proposed Value |

|---|---|---|

| liqtarget | Target ETH liquidity | 5,000 ETH |

| liqSpeedout | Max amount of ETH that is removed from the pools daily as long as liq > target_liq | 100 ETH |

| initialBudget | Amount of ETH that needs to be injected before the liqSpeedin and ratchetSpeedb parameters change from initial to long-term state | 43,835 ETH |

| fastLiqSpeedin | Initial state: max amount of ETH that is added to the pools daily. This value is active until an amount of ETH equal to initialBudget has been injected into the pools | 1,500 ETH |

| liqSpeedin | Long-term state: max amount of ETH that is added to the pools daily. This value becomes active after an amount of ETH equal to initialBudget has been injected into the pools | 100 ETH |

| ratchetTarget | Middle value towards which the spot prices move | Book Value |

| oracleBuffer | Margin to allow for oracle lag when calculating Book Value in ETH. Secondary function - create spread | 1% |

| ratchetSpeeda | Daily decrease in spota when above ratchetTargeta | 4% of ratchetTarget |

| fastRatchetSpeedb | Initial state: Daily increase in spotb when above ratchetTargetb | 50% of ratchetTarget |

| ratchetSpeedb | Long-term state: Daily increase in spotb when above ratchetTargetb | 4% of ratchetTarget |

| spota | Opening spot price in the Above Pool. | Equal to Bonding Curve price at time of on-chain implementation |

| spotb | Opening spot price in the Below Pool. | Equal to 50% of open market price at time of on-chain implementation |

The proposed initial_budget, fast_liq_speed_in and fast_ratchet_speed_b have been set so that the Initial State will inject ~30% of the Capital Pool as RAMM liquidity and, assuming a maximum redemption speed, will last for one (1) month, in line with members’ previously signalled support.

The proposed time frame for members to redeem their NXM at maximum speed down to the current cover-driven MCR is three (3) years, as members previously signalled support for this time period.

Proposal Status

This proposal is open for comment and will close after a minimum of seven (7) days from the date of this posting.

This NMPIP is open for voting in the Nexus Mutual UI until Saturday (18 November 2023) 11:50am UTC.

All members can participate in the on-chain governance vote!

The proposed timeline for NMPIP-209 and the on-chain governance vote is shared below.

-

15 November 2023. NMPIP-209 is put on chain for an all-members governance vote, where voting will be open for three (3) days. Voting will come to a close on 18 November 2023 11:50am UTC.

-

19 November 2023. The outcome of NMPIP-209 will be subject to a 24-hour cool-down period.

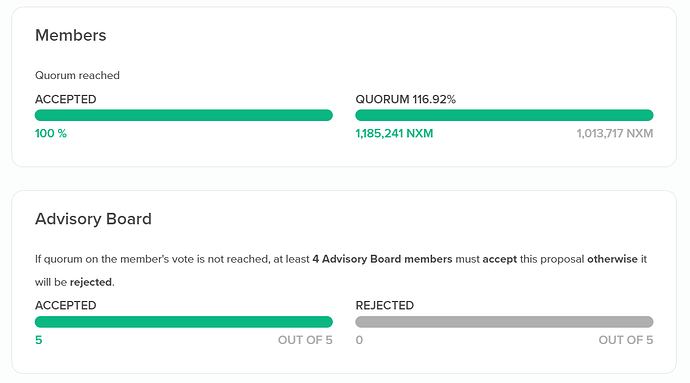

Outcome of the Vote

After the three-day voting period ended, members unanimously voted to approve NMPIP-209, which granted the Advisory Board the power to replace the Bonding Curve with the Ratcheting AMM (RAMM) and remove the MCR Floor.

Once the Advisory Board completes the upgrade, the DAO Community team will share an announcement on this forum post and the Nexus Mutual blog, as well as on the Mutual’s social channels.

Additional Resources

You can review the past discussions on the tokenomics parameter discussions, the regular tokenomics updates, and the audit reports for more information:

- Nexus Mutual documentation | Token Model page

- The Ratcheting AMM Whitepaper V1.0

- Liquidity Parameters Discussion | Overview

- Pre-Discussion Phase: RAMM Education Guide, Call for Questions

- Liquidity Parameters Discussion (Part 1) | How much ETH liquidity do we start with?

- Liquidity Parameters Discussion (Part 2) | What parameters do we need to achieve the outcome members’ signalled support for in Part 1?

- Parameter Discussions (Part 3) | Oracle Buffer and Initial Prices

- Tokenomics Updates

- Chaos Labs Economic Audit Report

- iosiro draft Solidity Audit Report