The DAO Community team presents Nexus Mutual DAO’s Q3 2023 Insights report, where we share data points and analysis from the Nexus Mutual DAO Dune dashboards and highlight exciting underwriting developments from the last quarter.

Overview

Throughout 2023, the Mutual has made significant progress on underwriting initiatives. The Nexus Mutual Foundation and DAO teams launched Nexus Mutual V2 in March 2023, which introduced many product improvements ranging from multi-event tokenised cover to dynamic pricing. Nexus Mutual V2 transformed the protocol into the premier risk management infrastructure layer, where experts can build underwriting businesses. This improved functionality is attracting more underwriting experts to our ecosystem.

Below, we’ll take a look at Q1–Q3 2023, examine cover sales, and review NXM staking rewards.

Q3 2023 Cover Sales & Investment Earnings Breakdown

Cover Sales

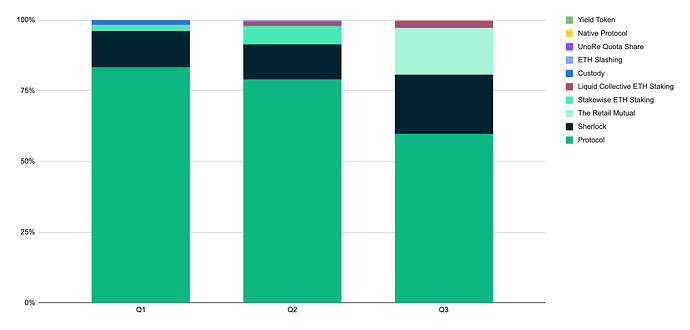

During Q3 2023, Nexus Mutual members sold more than $52m worth of cover and earned over $413k worth of cover fees. Protocol Cover sales declined from Q2 to Q3, but new cover products, such as The Retail Mutual Cover and Uno Re Quota Share Cover, countered the drop in Protocol Cover sales. In the past, Protocol Cover has represented over 80% of the total risk underwritten by members.

We’re now seeing growth across several other cover product types, which is helping to diversify the Mutual’s exposure to risk. Underwriting risk that isn’t tied to DeFi yields and brings consistent cover fees into the Capital Pool is a sign of maturity within the Mutual. This development allows members to reduce correlation risk across cover products. You can see a full breakdown of the Mutual’s risk diversification from Q1–Q3 2023 below.

Source: Nexus Mutual DAO Covers Dune dashboard

Investment Earnings

After members voted to approve NMPIP-196 and NMPIP-197, an additional 21,024 ETH was allocated to ETH staking through Rocket Pool (14,400 ETH) and Kiln (6,624 ETH). The Nexus Mutual Capital Pool now holds 54,211 staked ETH, which is allocated across Lido, Rocket Pool, and Kiln. More than 37% of the Capital Pool is now invested in staked ETH and members earned 557 ETH ($1.05m) in staking rewards over the course of Q3 2023.

DAO Commissions

Easy integrations are possible in V2. This allows others to distribute Protocol Cover and other cover products in third-party user interfaces (UIs). Teams that sell cover through third-party UIs can introduce a commission at the UI level–this creates an incentive for others to distribute Nexus Mutual cover products. In March, a commission was introduced in the Nexus Mutual UI, which is directed to the DAO treasury address. In Q3, the DAO earned ~$21,000 in commissions from cover sales. The DAO treasury has earned a total of ~$72,000 in commissions to date.

Innovative, Ongoing Partnerships

In 2023, we’ve seen risk experts continue to build on top of the protocol and deploy their own staking pools, where they underwrite new and existing cover products. The Sherlock team has been purchasing cover from Nexus Mutual since 2022, and they now manage Staking Pool 11, where they’ve allocated staked NXM to the various Sherlock Quota Share Cover listings. With Nexus Mutual’s infrastructure, members are able to foster strong partnerships with risk experts, like the Sherlock team, that lead to consistent cover buys and allow other crypto-native cover providers to underwrite more risk, while contributing to the Mutual’s Capital Pool.

In Q3, we saw continued cover buys from teams who have been long-time partners, new staking pools, and new cover products that all represent significant cover fees for members.

Partnering with InShare

For the first time, on-chain capital is being leveraged to cover excess losses for a discretionary mutual operating in the United Kingdom (UK). Through our partnership with InShare, we’re providing protection against excess losses due to fire, theft, and accidental damage for over 5,000 small business owners in the UK.

This partnership is the first instance of any on-chain cover provider underwriting risk in traditional markets, and it showcases the potential to underwrite an array of risks with the V2 infrastructure. Looking ahead, we’re eager to see more experts from traditional risk markets building within the Nexus Mutual ecosystem and expanding cover for more traditional risks.

Uno Re

In August, the Uno Re team launched Staking Pool 18 and began purchasing Uno Re Quota Share Cover to offset risk from their Uno WatchDog product, where they underwrite excess risk for their WatchDog coverage. The Mutual is working with Uno Re to help expand cover within DeFi, while contributing more cover fees to the Capital Pool.

OpenCover

In September, OpenCover–a light protocol and frontend that enables you to purchase and manage DeFi cover from Nexus Mutual on L2s–announced their launch on Base and Optimism. The OpenCover team allows anyone to purchase Protocol Cover from Nexus Mutual on L2s. By allowing users to buy cover on the networks where they are active, OpenCover is making Nexus Mutual coverage more accessible to a retail audience and helping users reduce gas costs.

With Protocol Cover now available on Base, Optimism, and more networks coming soon, the OpenCover team is expanding the Mutual’s reach and protecting more users. Keep an eye on OpenCover for news on new chain launches and other developments.

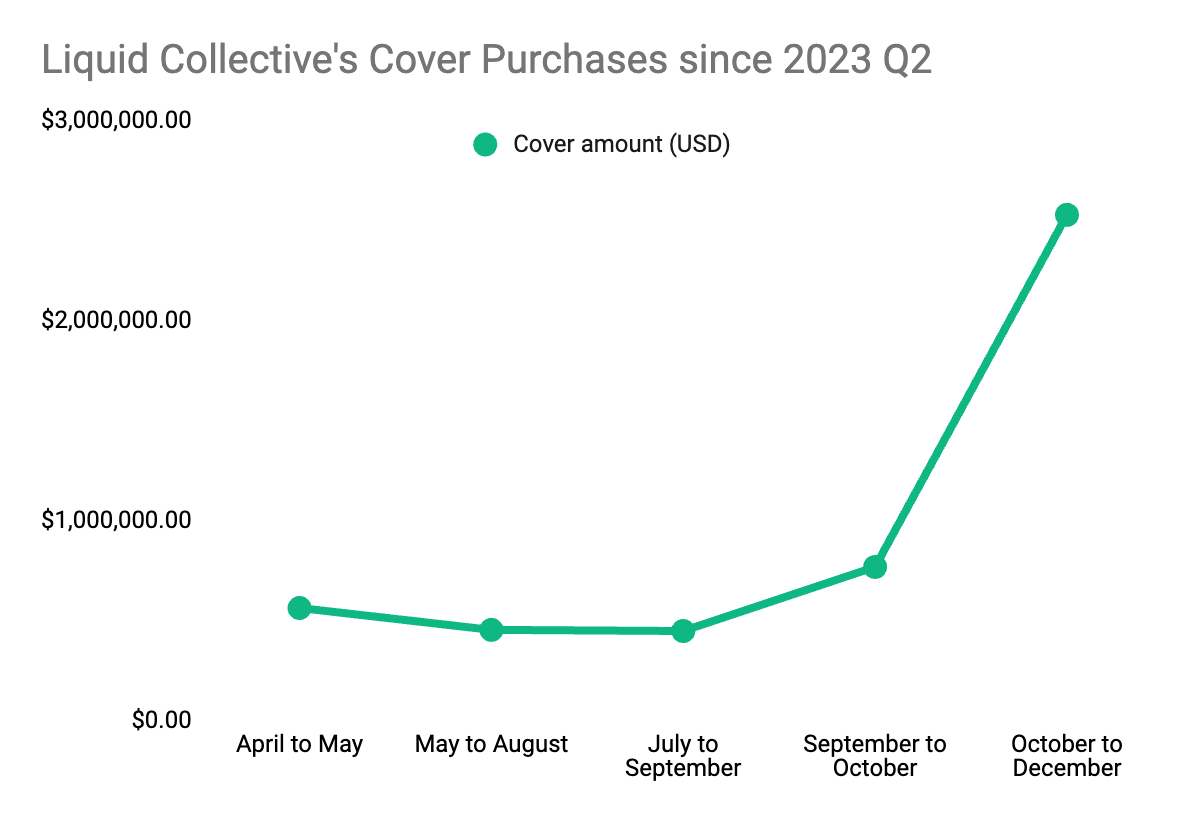

Liquid Collective

Since November 2022, Liquid Collective has been purchasing cover to protect their users against ETH slashing risk. They’ve seen tremendous growth in 2023, and they’ve been scaling their coverage as their TVL grows.

Through our collaboration with Liquid Collective, Nexus Mutual has seen consistent growth in cover purchases every month in Q2 and Q3 2023. Notably, in October, the institutional liquid staking protocol bought covers at 4.5 times their average monthly amount from the previous six (6) months.

Source: Nexus Mutual DAO Covers Dune dashboard

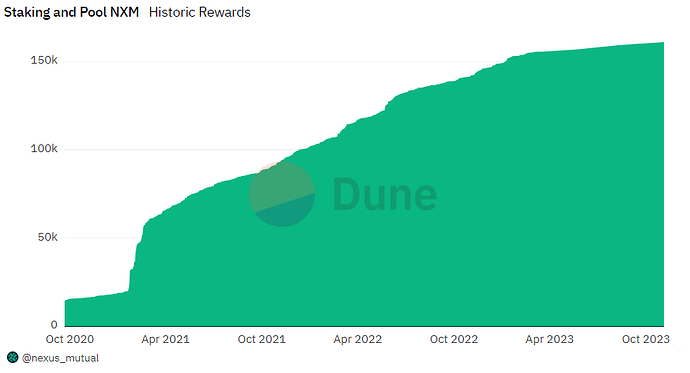

Staking Rewards Breakdown

Source: Nexus Mutual DAO Staking Dune dashboard

In Q3 2023, Nexus Mutual members who allocated NXM to one of the V2 staking pools have earned nearly 2,000 NXM in staking rewards. NXM stakers allocate capital that is used to create open capacity, which allows other members to purchase cover and protect themselves against risk.

Of the NXM staking rewards distributed, 41% of rewards came from staking pools that were underwriting Protocol Cover, while The Retail Mutual Cover cover buys earned NXM stakers in Staking Pool 5 (Unity Cover) 27% of NXM rewards. The Sherlock team’s consistent Quota Share Cover buys earned NXM stakers in Staking Pool 11 22% of NXM rewards.

Staking Pool Managers

The teams who launch and manage staking pools can receive staked NXM delegations from other members. Staking Pool Managers serve as the risk experts who allocate staked NXM to various cover products, set the available capacity and pricing for the cover products in their pool, and work with the Nexus Mutual team to develop new cover products. Below, we’ve highlighted a few of the risk experts building on V2.

- Unity Cover has introduced ground-breaking products in partnership with institutional players in both DeFi and TradFi. They underwrite various ETH Slashing Cover listings and The Retail Mutual Cover. Learn more about Staking Pool 5 and review the individual products Unity Cover is currently underwriting.

- Sherlock has revolutionised smart contract audits by offering up to $5 million in post-audit coverage. To learn more about the individual protocols the Sherlock team underwrites, please review Staking Pool 11.

- UnoRe’s WatchDog protocol audits and threat detection service is helping DeFi teams ensure their codebase is ready for production, free of flaws, and secure after the auditing process is complete. Learn more about Staking Pool 18, where you can view the protocols the Uno Re team is currently underwriting.

Learn more about NXM staking and Staking Pool Managers in the Nexus Mutual docs.

Q3 Claims Review

Throughout 2023, Nexus Mutual continued to provide members with unrivaled protection that pays when it’s needed most. In Q3 2023, Nexus Mutual members approved and paid $18,962.99 to cover buyers who filed claims.

In total, Mutual members have paid $8,883,212.99 in claims to cover holders affected by the FTX, BlockFi, Gemini, and Euler Finance loss events. For the majority of the claims paid to date, the Nexus Mutual team has been working tirelessly to seek reimbursement, per the mandate in NMPIP-205, as the above custodians are going through bankruptcy proceedings and Euler Finance provided reimbursement after claims were paid. The members who received claim payments are required to assign the value of their paid claims from any reimbursement to the Mutual.

In the case of the Euler Finance exploit, the Euler team was able to recover most of the stolen funds in April 2023. The majority of cover holders who received an Euler claim payment reimbursed the Nexus Mutual protocol after the Euler team provided them with reimbursement for their losses. To date, ~$2m in WETH and DAI has been returned to the Mutual. The Nexus Mutual team is seeking recovery from the remaining Euler cover holders who received a claim payment and were reimbursed by the Euler team.

Learn more about the Mutual’s claim history by reviewing the DAO’s claims database and the Claims Dune dashboard.

What’s Up Next

The Mutual’s third quarter saw the release of new cover products, expansion into real world risk, and increased cover buys from long-time partners. The fourth quarter brings NMPIP-209: Launch Tokenomics Upgrade—the governance proposal to replace the Bonding Curve with the Ratcheting AMM—and added functionality to the protocol and user interface.

We look forward to sharing the Q4 2023 Insights report with members in January. Until then, check for the governance forum and the Mutual’s social channels for the latest updates and developments.

Let’s Stay Connected

![]() If you’re a risk expert working in traditional finance and want to learn more about how you can contribute to the future of risk sharing, simply reply to this thread for us to find the best way to onboard you to our community.

If you’re a risk expert working in traditional finance and want to learn more about how you can contribute to the future of risk sharing, simply reply to this thread for us to find the best way to onboard you to our community.

![]() If you’re building in DeFi, get in touch with us through our website.

If you’re building in DeFi, get in touch with us through our website.

![]() Our community is most active on Discord. We look forward to seeing you there!

Our community is most active on Discord. We look forward to seeing you there!