Overview

Since 2019, Nexus Mutual has held two (2) assets in the Capital Pool: ETH and DAI. In the last five (5) years, more stablecoins have emerged and more members have requested the option to buy covers denominated in USDC. In order to whitelist USDC as an asset within the Capital Pool, it must first be discussed and approved by members through a formal NMPIP vote.

I am proposing that members vote to whitelist USDC as an asset within the Capital Pool to allow the Mutual to sell USDC-denominated cover.

Rationale

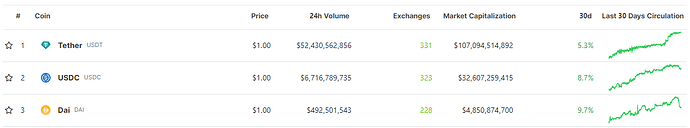

Source: CoinGecko

According to CoinGecko, Circle’s USDC has a market capitalization of 6.72x that of MakerDAO’s DAI. More members have requested the option to buy cover denominated in USDC and to pay for cover with USDC.

Adding USDC to the Capital Pool would allow the Mutual to underwrite a wider variety of risks and underwrite cover for certain listings (e.g., MakerDAO CDP, MakerDAO sDAI, and Spark Protoocl Cover) without a member worrying about DAI being impacted by one of the protocol’s in the Maker ecosystem suffering an exploit or other related loss event.

Specification

To add USDC to the Capital Pool, members would need to approve an “Add an Asset to Pool” vote that would automatically execute after the cool-down period passes and add USDC as an asset within the pool.

Proposal Status

- Open for comment

This RFC will be open for review until 23 April 2024. After this time, it will transition to an NMPIP, which will be open for review for at least 1 week (30 April 2024).

After that review period, the NMPIP can be put on chain for a full member vote.