RFC: Strategy to Repay Aave Loan Once ETH Reaches $4500

Overview

After members voted to approve NMPIP 212 and granted the Advisory Board the power to enter into the Cover Re deal, the Mutual deposited 9,340 ETH into Aave v3 as collateral in the Ethereum mainnet market and took out a loan against this collateral for 6,201,996.50 USDC. These funds along with other stablecoin assets from the Capital Pool were used to contribute 12M USDC into the Cover Re SP1, an investment managed by Cover Re.

At present, the Mutual has 9,442.03 ETH provided as collateral on Aave v3 and 4,818,016.48 USDC in debt. To date, the Mutual has paid 1,612,474.10 USDC off of the debt using stablecoin premiums that have accrued in the Capital Pool since the loan was taken out. Now that borrow rates on Aave v3 are increasing and the bull market is coming back in force, it’s time to discuss a strategy to repay the USDC loan on Aave v3 and remove the ETH collateral on Aave v3.

On behalf of the Product & Risk team, I’ve outlined a strategy to pay off the Aave v3 loan once ETH reaches $4500. I ask members to review this RFC proposal and share their comments, be they supportive or critical, so Mutual members can align on a repayment strategy.

If members are supportive, I will propose that members grant the Advisory Board the power to sell ETH at or above $4500 to repay the Aave v3 loan in full, remove the ETH collateral from Aave v3, and return the ETH to the Capital Pool.

Rationale

Opportunity Cost of the Aave v3 Loan

The Cover Re SP1 investment is projected to generate between 15% to 22% APY. At this time, we’re waiting on Cover Re to update the oracle that tracks the SP1 investment. While that investment is earning yield for members, the Mutual is also exposed to Aave v3 via the collateral held on the Aave v3 Ethereum mainnet market and active Aave v3 Protocol Cover.

Over the last six months, the Mutual has earned 101.18 ETH on the ETH deposited on Aave v3. This reflects an average return of 1.90% APY. Due to the borrow cost of our USDC debt, the net APY of the position on Aave v3 has been slightly positive but the debt still incurs a cost while increasing our total exposure to Aave v3 by 9,442.03 ETH.

That ETH value represents 12.24% of the Capital Pool in ETH terms. Within the Mutual, we strive to limit exposure to any one (1) listing to no more than 20% of the Capital Pool in ETH terms. Currently, the Mutual has 19,875.80 ETH of exposure to Aave v3, or 25.76% of the Capital Pool. This puts the Mutual above the acceptable concentration risk to Aave v3 given so much ETH is deposited on Aave v3 for this active loan.

The opportunity cost is quite stark. The Mutual is earning 1.90% APY based on the collateral based on the six-month average APY for ETH lenders on Aave v3. As I shared above, the net APY of the total position (interest on collateral - interest on debt) is below 0.75%. Compare this to the annualized cost of cover paid by Aave v3 Protocol Cover purchasers since the loan was first taken out.

- Median Annual Fee Paid for Aave v3 Protocol Cover: 4.59%

- Average Annual Fee Paid for Aave v3 Protocol Cover: 4.39%

If the loan were paid off in full and the ETH deposited as collateral on Aave and Aave v3 Protocol Cover were sold at the average annual cost, the Mutual could generate an additional 219 ETH in premium while staying within the 20% concentration risk limits.

ETH Price Targets for Repayment

To pay off the Aave v3 loan in full, Mutual members would need to approve selling ETH for USDC to completely pay off the debt and remove all collateral from Aave v3.

I propose selling ETH for the necessary amount of USDC to pay off the loan in full when ETH reaches $4500 per ETH.

You can compare the ETH required to complete the repayment based on the timeframes below:

| Timeframe | Debt (USDC) | ETH Required ($4500) |

|---|---|---|

| 2 Months | 4,892,098.07 | 1,087.13 |

| 3 Months | 4,933,035.89 | 1,096.23 |

| 4 Months | 4,974,316.29 | 1,105.40 |

| 5 Months | 5,015,942.12 | 1,114.65 |

| 6 Months | 5,057,916.29 | 1,123.98 |

- Debt figures are based off of USDC debt as of 5 December 2024 with average borrow rate of 10% over the repayment period

Factoring in Aave v3-related premiums alone, it would cost the Mutual 868 ETH if the loan were paid off in 2 months time or 877 ETH if the loan were paid off in 3 months time if ETH reaches $4500.

From March to November, the Mutual has earned 1279 ETH in investment returns. Using the median investment returns from August to November (118.8 ETH median earnings) and annualizing that figure, the Mutual can expect to earn 1425 ETH. This doesn’t factor in the premiums the Mutual stands to earn in the bull market or the value accrual to NXM holders via the RAMM’s automated buyback mechanism.

Reducing our overall exposure to Aave v3 would reduce the chance of a large-scale loss event impacting the Capital Pool at scale. As I’ve outlined above, it would also allow the Mutual to underwrite significantly more cover and grow premiums and active cover without being over exposed to any one protocol.

Specification

If members signalled support for this RFC, I would put forward an NMPIP outlining the following:

- The Advisory Board would have the power to sell enough ETH for USDC to pay off the loan once ETH’s price reaches $4500

- The USDC would be used to pay off the loan on Aave

- The ETH collateral would be withdrawn from Aave v3 and returned to the Capital Pool

Proposal Status

This RFC is open for comment and review for at least the next 14 days. Before moving to an NMPIP, I will put up a signalling vote on Snapshot to allow members to signal their support for or against this proposal.

I look forward to everyone’s review and comment.

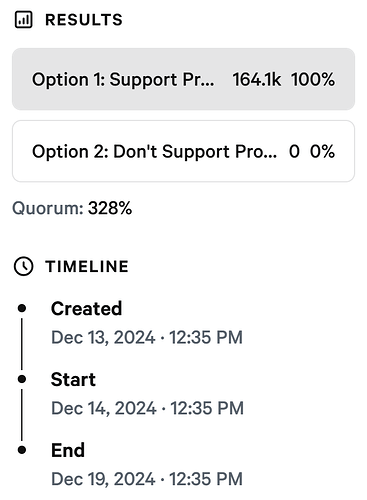

Edit: I have created the Signalling Vote on Snapshot to gauge support for this proposal. The outcome of this vote will be used to create the final NMPIP ahead of an onchain vote in January 2025.

Please review this RFC and signal support for the option that best reflects your views. Voting will be open from 14 Dec 2024 at 5:35pm UTC until 19 Dec 2024 at 5:35pm UTC.