Second Quarter (Q2) 2024 Insights | Nexus Mutual DAO

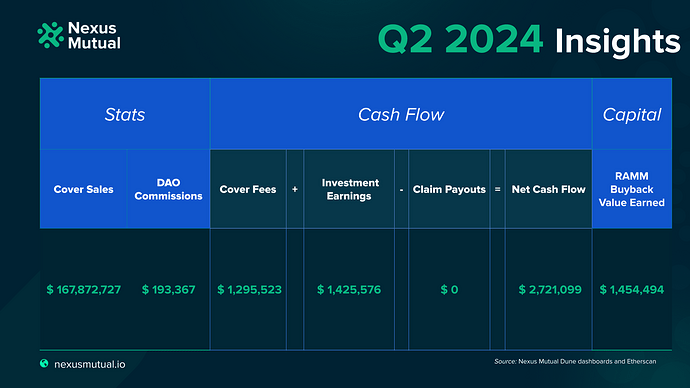

The DAO Community team presents Nexus Mutual DAO’s Q2 2024 Insights report, where we share data from the Nexus Mutual DAO Dune dashboards and highlight exciting developments from the last quarter.

Overview

In the second quarter of 2024, the Mutual sold more than $167.9M in cover, an increase of ~223% from Q1 2024.

Q2 2024 Cover Sales & Investment Earnings Breakdown

Cover Sales

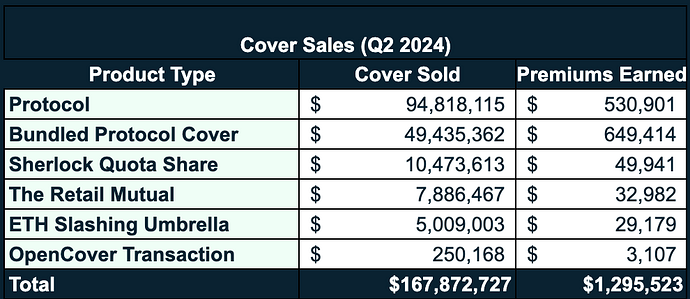

In Q2 2024, we saw substantial growth in quarter-over-quarter cover sales, with a ~223% increase in sales. Nexus Mutual members purchased $167,872,727 worth of cover. The Mutual earned more than $1.2M in cover fees in Q2, a 236% increase from Q1 2024.

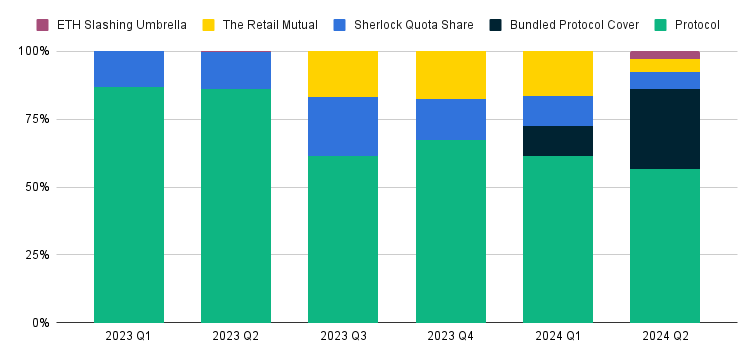

Quarterly distribution of product sales as a percentage of total cover sales throughout 2023 and 2024.

-

Substantial Growth in Protocol Cover and Bundled Protocol Cover Sales: In Q2, we saw significant growth in Protocol Cover sales, which more than doubled compared to the previous quarter ($42.4M). The introduction of Bundled Protocol Cover in late March 2024 contributed to the uptick in cover sales in both Q1 and Q2. This quarter, Bundled Protocol Cover achieved sales over 6.5 times higher than those in Q1 ($7.7M).

-

OpenCover Doubles Sales: As a distribution platform built on top of Nexus Mutual, OpenCover provides easy access to Protocol Cover on Layer 2 networks such as Base, Arbitrum, and Optimism. Through OpenCover, DeFi users can purchase Protocol Cover and Bundled Protocol Cover on L2s without needing to join the Mutual and undergo KYC procedures. In Q2 2024, OpenCover facilitated the sale of $6,318,541 worth of cover, a 211% increase in sales compared to the previous quarter ($2,994,371).

-

Strong Partnerships, Vibrant Ecosystem: Nexus Mutual’s strategic partnerships with Sherlock, The Retail Mutual, and Liquid Collective are diversifying the Mutual’s risk portfolio and playing a crucial role in building our decentralised risk marketplace. We are actively working to expand our ecosystem and welcome new partners. Find further details about our efforts to fund builders through the Nexus Mutual Grants & Accelerator Program later in this report.

-

Assets in Capital Pool on Track to Be Fully Invested: Following the vote on NMPIP 226 and the preceding member discussions on allocating the 6,575 ETH available in Nexus Mutual’s Enzyme Vault, our Capital Pool is projected to be fully allocated to investments in Q3 2024. If NMPIP 226 is approved, this strategic allocation would increase investment earnings for members.

Investment Earnings

In Q2 2024, the Mutual’s productive Capital Pool holdings generated 425.5 ETH ($1,425,576.20) in investment earnings. In total, 65% of the Capital Pool is earning ETH staking yield across Lido, RocketPool, and Kiln. At the time of this report, the Capital Pool holds a total of 85,372 ETH ($286,012,420.68).

Pending current governance discussions and an onchain vote, the Capital Pool may soon be fully allocated to investment strategies to earn returns on the float. For more information, please refer to the Investment Committee’s newsletters and the ongoing discussions about Capital Pool investments on the forum.

DAO Commissions

To incentivise the distribution of Nexus Mutual cover through third-party interfaces, teams running a distribution service via a dedicated frontend or teams integrating cover buys into their user interface can earn commissions on the cover they sell.

In Q2, the DAO highlighted the earnings potential for integrations by generating $193,367 in commissions, a 269% increase compared to Q1’s $71.5K in commissions. This is the second consecutive quarter where we have more than doubled DAO Treasury commission earnings.

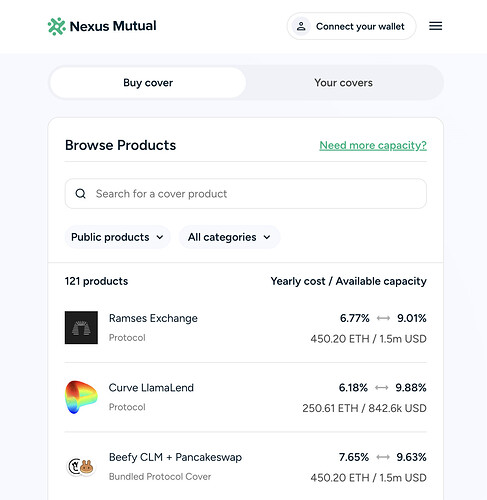

Improved Cover Buy Experience

On April 8, 2024, we introduced a significant update to the Nexus Mutual UI aimed at enhancing members’ cover buying experience. The Foundation Engineering team and Ultim Studio developed and launched this update, which provides a streamlined user journey from the landing page to the cover purchase. Key improvements include:

-

New Look and Faster Load Times: The redesigned UI offers a smoother flow through the cover buying process, reduced friction points, and improved load times.

-

Browse Products Page Enhancements: The new layout provides clearer information on pricing and capacity for each cover product. The page now displays price ranges based on staking pool managers’ pricing and available capacity in both ETH and USDC terms.

-

Improved Buy Cover Page: The updated Buy Cover page now features a clear display of maximum available capacity and an adjustable Cover Period field. A new “Request Capacity” feature allows members to request additional capacity directly through the UI if the desired capacity is unavailable.

-

Email Notifications: A new notifications system has been implemented, starting with email alerts sent three (3) days before cover expiration. Future notifications will include membership approvals, staking position expirations, and claim approvals.

-

USDC Denominated Cover: After members’ approved NMPIP 223, USDC was integrated into the Capital Pool. Members can now pay for cover with USDC and receive claim payouts in USDC. This was a highly requested feature, and we’re happy to offer our members the option to buy cover and receive payouts in USDC.

If you want to provide feedback, report any issues or share some more improvement ideas, please reach out to the DAO Community team on Discord or use the contact form on the Nexus Mutual website. For more details on the update, visit the Nexus Mutual Blog.

Streamlining New Product Development

Growth continues to be our main objective at Nexus Mutual. We are exploring various strategies to achieve sustainable growth, and one of our focus areas is new product development.

To streamline new product development, we are proposing several organisational changes in the recent DAO Teams Funding Proposal. BraveNewDeFi, who has been serving as the Head of Community, will transition to the role of Head of Product & Risk starting in Q3 2024. Brave has already assisted all DAO and Foundation Teams, as well as members and the wider community, in matters related to risk, product, and general support. With Brave focusing on Product & Risk, the Mutual will be well-equipped to conduct user research and launch new covers and products. We have also welcomed Tomasz as a Dune Wizard into the DAO R&D team to enhance our analytics capabilities, which will further support our growth objectives.

While many of our product initiatives are currently in the research or validation phase and need further development before public announcement, some have already come to fruition.

The latest product to launch is Fund Portfolio Cover, bespoke cover for funds active in DeFi. We have other products on the verge of launch. Keep an eye on our announcements to learn more about these exciting products coming in Q3!

Nexus Mutual is Supercharging our Ecosystem with the Grants & Accelerator Program

Earlier this month, members approved the NMDP 6 and the funding of the Nexus Mutual Grants & Accelerator Program, a $3M initiative to fund one-off projects and emerging risk businesses. This program aims to contribute to the Mutual’s main objective to grow cover sales by 10x in 2024 and is managed by Dopeee who serves as the Grants & Accelerator Committee Lead.

Grants Program vs. Accelerator Program

The Grants Program has allocated $1 million in funding for the next 18 months and will focus on supporting individuals and teams with the expertise necessary to conduct in-depth research, build technical infrastructure, improve user experience, and simplify integration processes. The primary goal is to drive growth within the Nexus Mutual ecosystem by addressing specific needs in legal and regulatory aspects, technical product improvements, distribution and marketing, and composability.

The Accelerator Program is designed to create and support startups that enhance the Nexus Mutual ecosystem. It provides funding of up to $500,000 per team and targets businesses that create new cover products, distribute coverage, facilitate underwriting, or enhance risk management. The Accelerator Program aims to foster innovation and expansion within the ecosystem by backing promising new ventures.

Key Request for Proposals (RFPs)

The Grants Program has identified several high-priority RFPs:

- DeFi-Integrated Wallet Solutions: Offers up to $100,000 to integrate Nexus Mutual coverage into wallets and exchanges.

- Licensed Insurance Research: Up to $100,000 in funding to seek research on licensing for third-party syndicates to offer insurance without requiring the Mutual to move capital off-chain.

- Covered Yields Marketplace: Up to $50,000 in funding to create or modify a marketplace with native coverage options.

- Hackathon Incentives Program: Up to $50,000 in funding to sponsor hackathons to bring together talented Solidity developers.

- Incentive Distribution Contract for Staking Pools: Offering up to $15,000 to develop a smart contract that adds token incentives for staking pool managers.

- Broker Sales/Product Package: Provides up to $10,000 to create a standard package for brokers.

Learn more about the Grants and Accelerator Programs on the Nexus Mutual DAO website. Listen to BraveNewDeFi’s overview of key RFPs from our Community Call on 2 July 2024.

What’s Up Next

Nexus Mutual is making significant strides towards its growth objectives. We are pleased to see an increase in cover sales, team expansion, and growth in our ecosystem partnerships.

Throughout 2024, we’ll improve the Nexus Mutual UI, including the onboarding and staking experience. The Foundation Engineering team is also building an individual dashboard for our members to navigate through their active covers and staked NXM.

We are also excited to launch new products in collaboration with ecosystem partners. We welcome any product ideas or listing requests from our community—please share your thoughts with us through the links provided below.

Join the Mutual and get involved in our community as we continue to grow! This is the perfect time to get involved in the future of people-powered risk sharing.

Let’s Stay Connected

If you want to learn more about how to contribute within our community, reach out to us on Discord, and the DAO Community team can find the best way to onboard you to our community.

Our community is most active on Discord and here on the governance forum. We look forward to hearing more from you!

If you’re building in DeFi, get in touch with us through our website.

![]() To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls on X.

To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls on X.