Third Quarter (Q3) 2024 Insights | Nexus Mutual DAO

The DAO Community team presents Nexus Mutual DAO’s Q3 2024 Insights report, where we share data from the Nexus Mutual DAO Dune dashboards and highlight exciting developments from the last quarter.

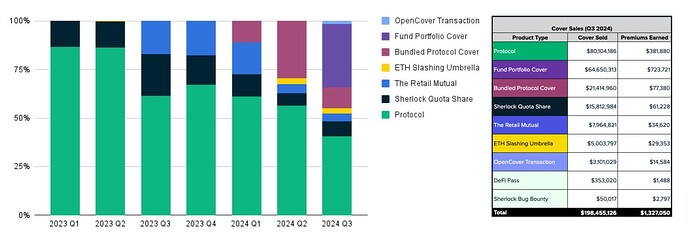

Q2 2024 Cover Sales & Investment Earnings Breakdown

In the third quarter of 2024, the Mutual sold more than $198.5M in cover, an increase of ~18% from Q2 2024. From the $198.5M cover sold, Mutual members earned more than $1.3M in cover fees in Q3.

- Investment Earnings: The Mutual’s Capital Pool generated 419.1 ETH ($ 1,097,237.78) in earnings. The pool currently holds 81,448 ETH ($213,214,574). Following NMPIP 228, idle ETH held in the Mutual’s Enzyme vault was invested with Ether.fi and Chorus One. The available funds in the Capital Pool are now fully allocated to yield-generating investments. For more details, see the Investment Committee newsletters and governance forum discussions regarding the investment allocations and updates.

- DAO Commissions: Teams that include a Point of Sale (PoS) integration in their user interface can earn a commission every time a user purchases cover through their UI. The Nexus Mutual DAO is a prominent use case, as every cover purchased through the Nexus Mutual UI generates a commission for the DAO Treasury. In Q3, the Nexus Mutual DAO generated $128,443 in commissions. Learn how to earn commissions by selling cover through your own custom-built UI in this report.

Fund Portfolio Cover and Bundled Protocol Cover, plus existing partnerships,

are driving cover sale growth while diversifying sales across cover product types.

- $5B in Total Cover Underwritten: Nexus Mutual surpassed $5B in total cover underwritten since our launch in 2019. We reached this milestone in Q3 thanks to strong partnerships built over the last five years. We’re happy to celebrate this milestone with all our partners, members and supporters. It’s a great time to learn how you can contribute to the future of onchain protection.

- Thought Leadership in Risk Management: The Mutual contributed to the creation of the Node Operator Risk Standard, which establishes benchmarks for security and operational excellence among Ethereum node operators. We’re proud to make DeFi safer for retail and institutional users.

- Support for Syndicates: Growth remains our top priority. We’re focused on helping businesses build on the Nexus Mutual protocol. If you have a risk management business—whether DeFi or real-world—we highly encourage you to explore how your business can work within the Nexus Mutual ecosystem to scale your sales and generate more revenue.

- Product Experiments: The Mutual launched Fund Portfolio Cover, Transaction Cover, DeFi Pass Cover in collaboration with OpenCover, and Sherlock Bug Bounty Cover. More products are in the development pipeline as we expand our cover product offerings and work with more industry experts like Native and Cover Re.

- Real-World Risk Coverage: Pending governance approval, we’re expanding functionality for certain product types to enable delegated claims to support our new ecosystem partner Native. Native will work to expand real-world cover as a syndicate within the Nexus Mutual ecosystem. Our first venture into real-world risk through The Retail Mutual Cover already supports more than 5,000 small UK businesses against accidental damage, fire, and theft.

Celebrating $5B in Cover Sold–Join us!

Earlier this month, we surpassed $5 billion in total cover underwritten. Since Nexus Mutual’s launch in 2019, our objective has been to create an ecosystem that offers a viable alternative to centralized insurance. Today, we’re proud to celebrate this milestone with our Nexus Mutual members and our ecosystem partners. As we continue to onboard more members and partners, we want to take the opportunity to highlight our success stories and share our plans with the community. We hope these stories and plans inspire more partners and individuals passionate about the future of risk sharing to join us.

OpenCover has been a close partner of the Mutual. Recently, the Foundation Business Development and DAO Product teams developed two new cover products with their team: Transaction Cover and DeFi Pass, currently available for the Base ecosystem. OpenCover helps distribute Nexus Mutual’s cover on Layer 2s like Base, Arbitrum, Optimism, and Polygon. Through OpenCover, users can purchase cover with lower gas fees and without the need for KYC. This quarter, OpenCover sold $9.8M worth of cover, up from $6.3M in the previous quarter, showing steady growth.

Sherlock has pioneered incentive-aligned audit competitions, which bundle smart contract audits with coverage. They offer protocols the ability to purchase up to $10M of coverage after each audit is completed. In Q3 Sherlock also announced Sherlock Shield, a new program that will provide up to $250,000 in bug bounty and exploit protection to any protocol teams that use Sherlock to audit their smart contracts. Sherlock has been a critical partner in our mission to make DeFi a safer space. We aim to continue strengthening our partnership with Sherlock and help them expand cover sales through Sherlock Shield. In Q3, we launched a new product to cover Bug Bounties organized by Sherlock to support this initiative.

The Retail Mutual, represented by InShare, has long been our partner in expanding cover capacity to over 5,000 small independent business owners in the UK who are members of The Retail Mutual. Our partnership, initiated in August 2023, has made headlines as an industry-first example of onchain capital used to cover excess losses for a traditional discretionary mutual. This partnership marks our first venture into covering real-world risk, and we’ve since expanded our real-world risk coverage through our recent partnership with Native. Stay tuned for the full public launch to learn more about our partnership with Native.

Liquid Collective provides slashing coverage for enterprises and institutions staking ETH through the Liquid Collective protocol. Since our partnership began in November 2022, we have protected Liquid Collective’s users against both network-wide events and node operator failures. In Q3, we updated Liquid Collective’s cover product to ETH Slashing Umbrella Cover, which you can find in our Dune dashboards.

We’re excited to onboard more ecosystem partners and are ready to support them through the Grants Program as well as the Accelerator Program. If you’re building the future of onchain protection, learn more about the program and apply.

At the heart of the Nexus Mutual ecosystem are our members, who work with us to truly function as a discretionary mutual by providing governance feedback, underwriting risk by staking NXM in Nexus Mutual’s staking pools, and participating as claims assessors. The DAO Community team is working to design an onboarding program for members looking to become more active within our ecosystem. Stay tuned for the program launch details.

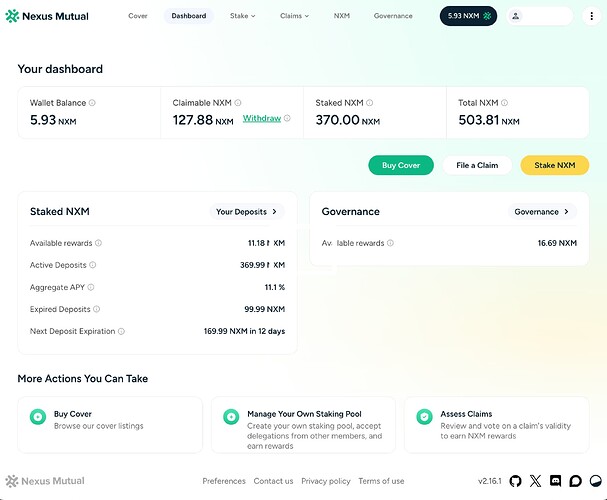

Improved Member Dashboard

As we prepare to onboard new members to the Mutual, the Foundation Engineering team has been taking an in-depth look at the member experience in the Nexus Mutual UI.

Working with Ultim Studio, they identified key areas for improvement and continue to address them one by one. This quarter, the Engineering team successfully launched the Member Dashboard, an overview page where all members can see their wallet balance, staking details, and other ways to contribute to the Mutual.

This improvement is part of a series of initiatives that kicked off earlier this year. Previously, the Cover Buy Experience was revamped. For more details on past improvements, visit the Q2 Insights Report.

If you want to provide feedback, report any issues, or share improvement ideas, please reach out to us on Discord or use the contact form on the Nexus Mutual website.

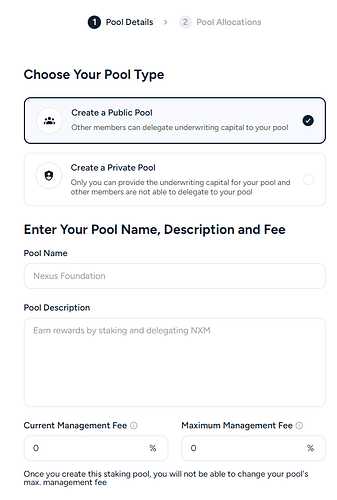

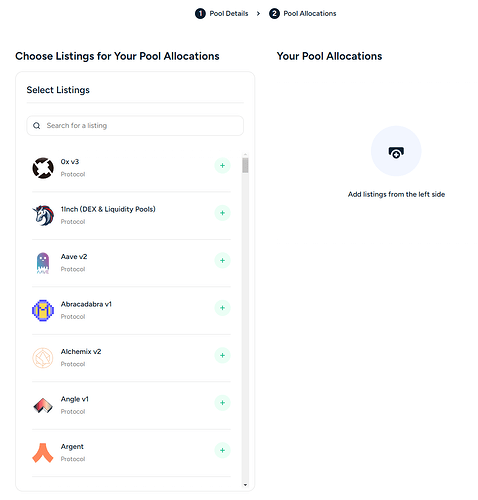

Currently, the Engineering team is working on the Staking and Claims flows within the UI. The Create Staking Pool and Pool Allocations pages are being worked on now–see the preview below. Once these flows are complete, our frontend team will work on the Your Pools and Editing Your Pools flows within the UI. Once the Staking UI changes are wrapped up, the team will move onto the updated Claims flow.

The new Staking Pool Creation page that’s being worked on as part of the broader UI updates.

The new Pool Allocations page that’s being worked on as part of the broader UI updates.

Staking Dune Dashboards

A key responsibility of the DAO R&D team is maintaining the data dashboard stack on Dune Analytics. Tomasz, our resident Dune Wizard, has been doing an exceptional job revamping our Dune dashboards. His latest contribution is the addition of the Staking Dashboard to our improved suite of dashboards. The Staking Dashboard offers valuable insights into the dynamic staking ecosystem, providing both macro and micro perspectives on rewards, staking volumes, and the number of active stakers.

Staking NXM is a cornerstone of Nexus Mutual’s business operations, as it plays a critical role in underwriting risk and supporting our ecosystem. Tomasz’s updates have made it easier than ever for members and stakeholders to understand the impact of staking on the Mutual. If you’re interested in learning more about staking NXM and how it supports Nexus Mutual, we encourage you to explore our documentation and take a look at the beautifully redesigned high-level staking dashboard as well as the pool-specific dashboards.

We’re committed to continuous improvement and always welcome feedback from our community. If you have ideas for further enhancements or want to discuss the data in more detail, don’t hesitate to reach out on Discord.

What’s Up Next

Nexus Mutual is advancing toward its mission of revolutionizing onchain protection. As we look ahead, we’re excited to introduce several key improvements and initiatives.

First, we’ll be rolling out more UI/UX enhancements, specifically focused on streamlining the NXM staking and claims assessment processes, making it even easier for members to participate and interact with the Nexus Mutual protocol. Second, our partnership with Native will bring more real-world cover products to the forefront, further expanding our coverage beyond DeFi and showcasing the versatility of onchain capital.

Finally, we’re creating more ways for members to get onboarded into our community. Whether you’re an individual, a project, or an institution, there are numerous opportunities to engage with our ecosystem and contribute to building a decentralized, community-driven insurance alternative.

Now is the perfect time to join Nexus Mutual. We look forward to your ideas—together, we’ll shape the future of onchain protection.

Let’s Stay Connected

If you want to learn more about how to contribute within our community, reach out to us on Discord, and the DAO Community team can find the best way to onboard you to the Mutual.

Our community is most active on Discord and here on the governance forum. We look forward to hearing more from you!

If you’re building in DeFi, get in touch with us through our website.

![]() Our Governance Reading Group is open to anyone interested in reading and discussing critical works about governance and coordination. Join us!

Our Governance Reading Group is open to anyone interested in reading and discussing critical works about governance and coordination. Join us!

![]() To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls on X spaces.

To get regular updates about the Mutual, subscribe to our monthly newsletter, The Hedge and follow Nexus Mutual and the Nexus Mutual DAO on X! We look forward to seeing you at our next community calls on X spaces.