Tokenomics update 14/07

-

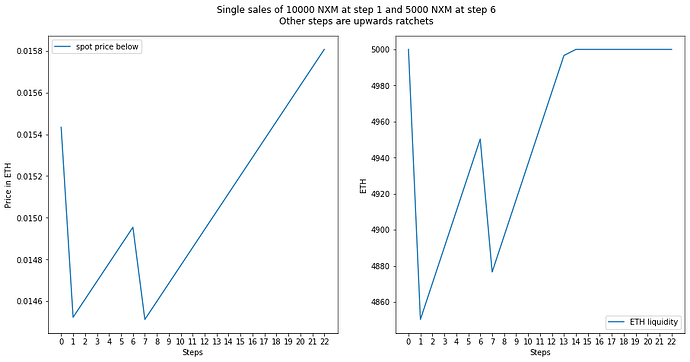

Education materials progressing well - community team writing copy supported by some simple graphs (example below), created from manually sequencing events from the simulation. Expecting to launch the education phase next week ahead of parameter discussions.

-

We’ve settled on equalising the liquidities in the above and below pools from the start - this removes any uncertainty around being able to do this later, avoids re-working the code and lets us immediately operate in the long-term state, with the added benefit of gas savings in the implementation. No impact on likely outcomes, although there may be some need for setting some separate short-term and long-term parameter values to achieve the objectives.

-

More code being written by engineering team. Implemented functions (pretty much all we need in the RAMM contract itself):

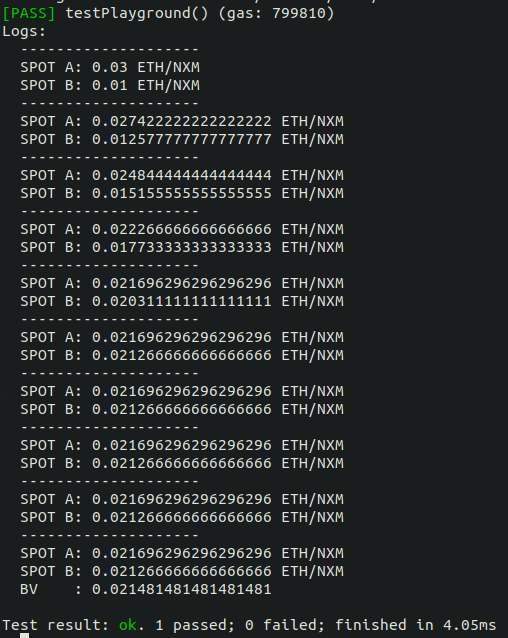

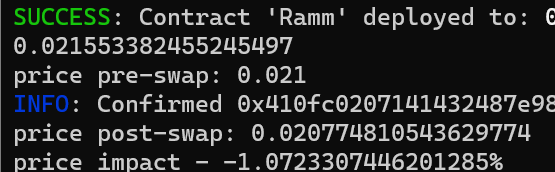

getReservesapplies the liquidity injection/extraction and the ratchetgetSpotPriceA / getSpotPriceBreturn the spot prices for the above and below poolsswap / swapEthForNxm / swapNxmForEthperform the swaps themeselves

Pictures of some ratchet spot price tests attached.

-

Most exciting for me - started working with engineering to set up an environment using Ape to enable the Python simulations to call the actual solidity functions instead of the buy/sell, ratchet and liquidity functions I’d created separately before.