Hi everyone,

Had a successful week in person with the engineering team ironing out the final kinks in the design.

-

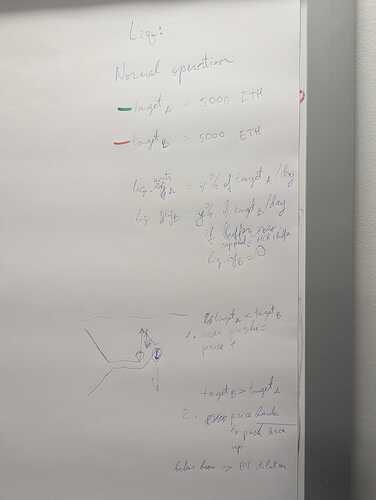

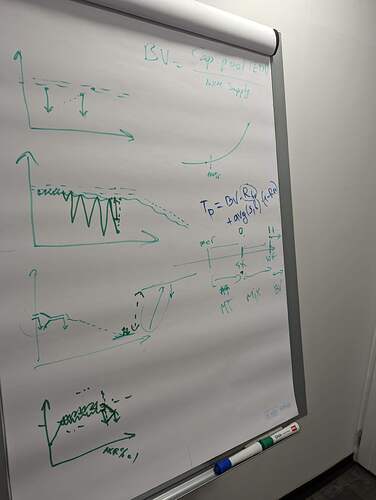

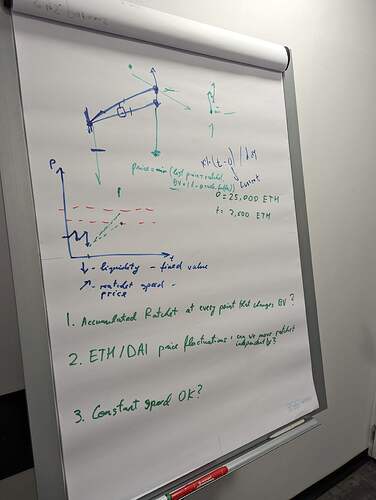

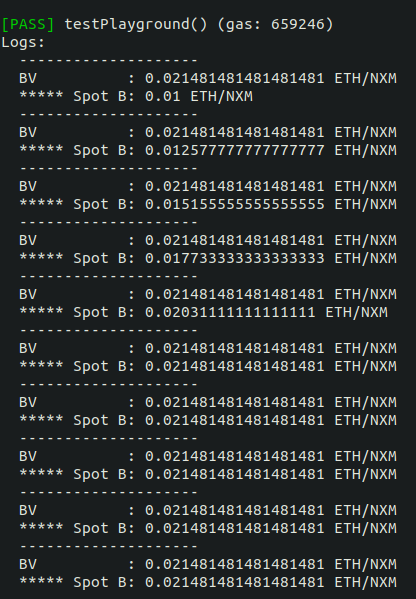

Solidity implementation details around the ratchet and liquidity mechanisms finalised.

-

We have a TWAP mechanism that we’re happy with for the internal price.

The mechanism combines separate Uniswap-style TWAPs above [price(a)] and below [price(b)] book value, then finds the final price using price(a) + price(b) - Book Value -

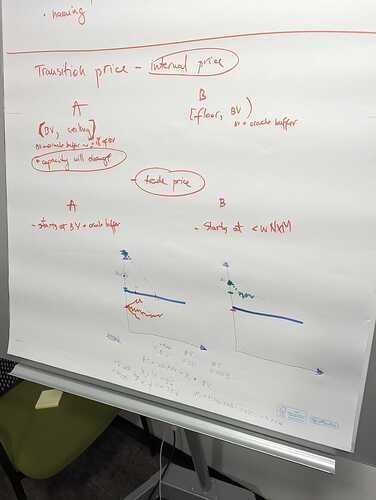

We have a solution for a smooth transition from the current bonding curve price to the new internal price by appropriately setting the initial prices of the above and below pools.

-

We have a solution for the case where the Capital Pool approaches the MCR amount to keep a market consistent price. We’re planning to allow the price ratchet target to move away from book value and letting the buy price drift below BV.

-

Examined a range of edge cases in the context of the new elements and the design as a whole

I have a bunch of simulation work to do on the new design, converting it to be closer to the required solidity implementation and testing some of the new mechanisms. Will also write up the solutions in a separate full document for public scrutiny.

Next steps for engineering are to finalise the technical specs based on the design discussed above and move towards implementation.

Generally, we’re happy with the system behavior qualitatively in pretty much all cases, now begins the work of fully battle testing it from an economic and technical perspective, including technical tests, audits and simulations.